Avon 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

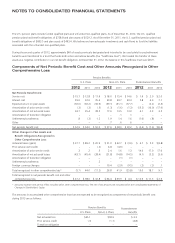

Of the total costs to implement, $71.2 was recorded in selling, general and administrative expenses and $9.5 was recorded in cost of sales

for 2010.

Restructuring Charges – 2011

During 2011, we recorded total costs to implement of $40.0 associated with previously approved initiatives that are part of our 2005 and

2009 Restructuring Programs, and the costs consisted of the following:

• net charge of $3.4 primarily for employee-related costs, including severance and pension benefits;

• implementation costs of $27.2 for professional service fees, primarily associated with our initiatives to outsource certain finance processes and

realign certain distribution operations, realign certain support functions to a more regional basis and realign certain manufacturing facilities;and

• accelerated depreciation of $14.6 associated with our initiatives to realign certain distribution operations and close certain manufacturing

operations, offset by a net gain of $5.2 primarily due to the sale of a facility in Germany.

Of the total costs to implement, $28.8 was recorded in selling, general and administrative expenses and $11.2 was recorded in cost of sales

for 2011.

Restructuring Charges – 2012

During 2012, we recorded total costs to implement of $.1 associated with previously approved initiatives that are part of our 2005 and 2009

Restructuring Programs, and the costs consisted of the following:

• net benefit of $12.1 as a result of adjustments to the reserve, partially offset by employee-related costs;

• implementation costs of $8.9 for professional service fees, primarily associated with our initiatives to outsource certain finance processes

and realign certain distribution operations; and

• accelerated depreciation of $4.7 associated with our initiatives to realign certain distribution operations and close certain manufacturing

operations, offset by a net gain of $1.4 due to the sale of machinery and equipment in Germany.

Of the total cost to implement, a net benefit of $3.0 was recorded in selling, general and administrative expenses and total costs to

implement of $3.1 were recorded in cost of sales for 2012.

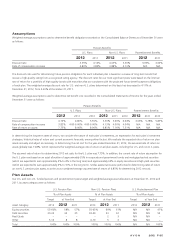

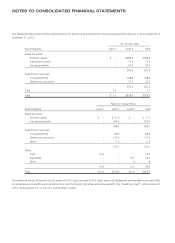

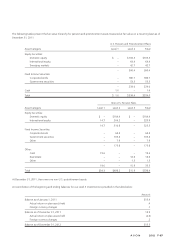

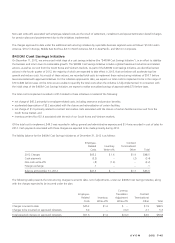

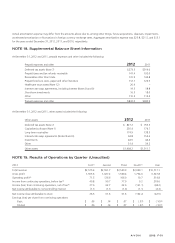

The liability balances, which primarily consist of employee-related costs, for the initiatives under the 2005 and 2009 Restructuring Programs

are shown below:

Total

Balance December 31, 2009 $149.0

2010 Charges 64.6

Adjustments (23.3)

Cash payments (49.2)

Non-cash write-offs (1.7)

Foreign exchange (3.5)

Balance December 31, 2010 $135.9

2011 Charges 25.6

Adjustments (22.2)

Cash payments (64.1)

Non-cash write-offs .3

Foreign exchange (1.6)

Balance December 31, 2011 $ 73.9

2012 Charges 2.3

Adjustments (14.4)

Cash payments (41.5)

Non-cash write-offs 1.0

Foreign exchange (.3)

Balance December 31, 2012 $ 21.0

Non-cash write-offs associated with employee-related costs are the result of settlement, curtailment and special termination benefit charges

for pension plans and postretirement due to the initiatives implemented.

A V O N 2012 F-43