Avon 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

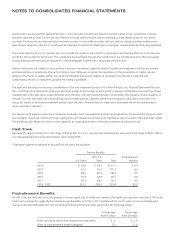

Global and other expenses include, among other things, costs related to our executive and administrative offices, information technology,

research and development, marketing and professional and related fees associated with the Foreign Corrupt Practices Act (“FCPA”)

investigations and compliance reviews. We allocate certain planned global expenses to our business segments primarily based on planned

revenue. The unallocated costs remain as Global and other expenses. We do not allocate to our segments costs of implementing

restructuring initiatives related to our global functions or professional and related fees associated with the FCPA investigations and

compliance reviews. Costs of implementing restructuring initiatives related to a specific segment are recorded within that segment.

The accounting policies of the segments are the same as those described in Note 1, Description of the Business and Summary of Significant

Accounting Policies. We evaluate the performance of our segments based on revenues and operating profits or losses. Segment revenues

primarily reflect direct sales of products to Representatives based on the Representative’s geographic location. Intersegment sales and

transfers are not significant. Each segment records direct expenses related to its employees and its operations.

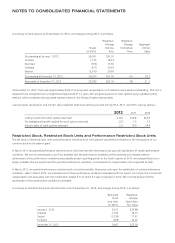

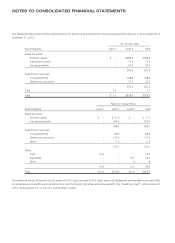

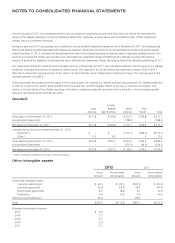

Summarized financial information concerning our reportable segments as of December 31 is shown in the following tables:

Total Revenue & Operating Profit (Loss)

2012 2011 2010

Total

Revenue

Operating

Profit (Loss)

Total

Revenue

Operating

Profit (Loss)

Total

Revenue

Operating

Profit

Latin America $ 4,993.7 $ 443.9 $ 5,161.8 $ 634.0 $ 4,640.0 $ 613.3

Europe, Middle East & Africa 2,914.2 312.8 3,122.8 478.9 3,047.9 474.3

North America 1,906.8 (214.9) 2,064.6 (188.0) 2,193.5 147.3

Asia Pacific 902.4 5.1 942.4 81.4 981.4 82.6

Total from operations 10,717.1 546.9 11,291.6 1,006.3 10,862.8 1,317.5

Global and other – (232.1) – (151.7) – (244.4)

Total $10,717.1 $ 314.8 $11,291.6 $ 854.6 $10,862.8 $1,073.1

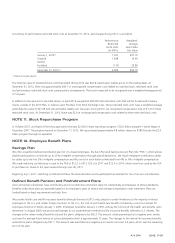

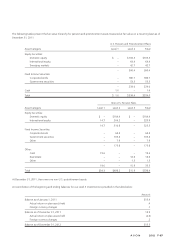

Total Assets

2012 2011 2010

Latin America $2,713.3 $2,766.4 $2,778.6

Europe, Middle East & Africa 1,380.2 1,516.2 1,601.2

North America 969.4 1,185.7 1,457.0

Asia Pacific 537.7 628.8 630.6

Total from operations 5,600.6 6,097.1 6,467.4

Global and other 1,781.9 1,637.9 1,406.3

Total assets $7,382.5 $7,735.0 $7,873.7

Capital Expenditures

2012 2011 2010

Latin America $ 99.0 $117.1 $200.5

Europe, Middle East & Africa 27.1 51.2 54.6

North America 8.9 12.5 18.5

Asia Pacific 4.6 16.0 18.9

Total from operations 139.6 196.8 292.5

Global and other 89.2 79.9 38.7

Total capital expenditures $ 228.8 $276.7 $331.2