Avon 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

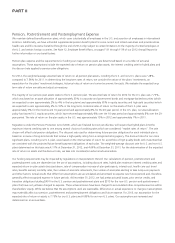

Pension, Postretirement and Postemployment Expense

We maintain defined benefit pension plans, which cover substantially all employees in the U.S. and a portion of employees in international

locations. Additionally, we have unfunded supplemental pension benefit plans for some current and retired executives and provide retiree

health care and life insurance benefits (through the end of 2012 only) subject to certain limitations to the majority of retired employees in

the U.S. and certain foreign countries. See Note 12, Employee Benefit Plans, on pages F-31 through F-39 of our 2012 Annual Report for

further information on our benefit plans.

Pension plan expense and the requirements for funding our major pension plans are determined based on a number of actuarial

assumptions. These assumptions include the expected rate of return on pension plan assets, the interest crediting rate for hybrid plans and

the discount rate applied to pension plan obligations.

For 2012, the weighted average assumed rate of return on all pension plan assets, including the U.S. and non-U.S. plans was 7.28%,

compared to 7.54% for 2011. In determining the long-term rates of return, we consider the nature of the plans’ investments, an

expectation for the plans’ investment strategies, historical rates of return and current economic forecasts. We evaluate the expected long-

term rate of return annually and adjust as necessary.

The majority of our pension plan assets relate to the U.S. pension plan. The assumed rate of return for 2012 for the U.S. plan was 7.75%,

which was based on an asset allocation of approximately 35% in corporate and government bonds and mortgage-backed securities (which

are expected to earn approximately 2% to 4% in the long term) and approximately 65% in equity securities and high yield securities (which

are expected to earn approximately 6% to 10% in the long term). Historical rates of return on the assets of the U.S. plan were

approximately 9% for the most recent 10-year period and approximately 8% for the 20-year period. In the U.S. plan, our asset allocation

policy has favored U.S. equity securities, which have returned approximately 8% over the 10-year period and approximately 8% over the 20-

year period. The rate of return on the plan assets in the U.S. was approximately 15% in 2012 and approximately 7% in 2011.

Regulations under the Pension Protection Act of 2006, which are finalized but not yet effective, will require that hybrid plans limit the

maximum interest crediting rate to one among several choices of crediting rates which are considered “market rates of return”. The rate

chosen will affect total pension obligations. The discount rate used for determining future pension obligations for each individual plan is

based on a review of long-term bonds that receive a high-quality rating from a recognized rating agency. The discount rates for our more

significant plans, including our U.S. plan, were based on the internal rates of return for a portfolio of high quality bonds with maturities that

are consistent with the projected future benefit payment obligations of each plan. The weighted-average discount rate for U.S. and non-U.S.

plans determined on this basis was 4.11% at December 31, 2012, and 4.69% at December 31, 2011. For the determination of the expected

rate of return on assets and the discount rate, we take into consideration external actuarial advice.

Our funding requirements may be impacted by regulations or interpretations thereof. Our calculations of pension, postretirement and

postemployment costs are dependent on the use of assumptions, including discount rates, hybrid plan maximum interest crediting rates and

expected return on plan assets discussed above, rate of compensation increase of plan participants, interest cost, health care cost trend

rates, benefits earned, mortality rates, the number of associate retirements, the number of associates electing to take lump-sum payments

and other factors. Actual results that differ from assumptions are accumulated and amortized to expense over future periods and, therefore,

generally affect recognized expense in future periods. At December 31, 2012, we had pretax actuarial losses, prior service credits, and

transition obligations totaling $491 for the U.S. pension and postretirement plans and $313 for the non-U.S. pension and postretirement

plans that have not yet been charged to expense. These actuarial losses have been charged to accumulated other comprehensive loss within

shareholders’ equity. While we believe that the assumptions used are reasonable, differences in actual experience or changes in assumptions

may materially affect our pension, postretirement and postemployment obligations and future expense. For 2013, our assumption for the

expected rate of return on assets is 7.75% for our U.S. plans and 6.85% for our non-U.S. plans. Our assumptions are reviewed and

determined on an annual basis.