Asus 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

94

94

!

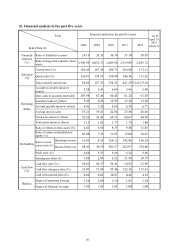

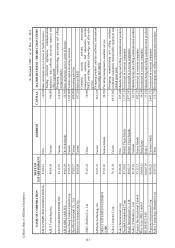

III. Analysis of cash flow

(I) Liquidity analysis of the last two years

Year

Item

2012 2011 Financial ratio change

Current ratio 21.89ʘ 14.83ʘ 47.61ʘ

Cash adequacy ratio 115.61ʘ 122.16ʘ (5.36)ʘ

Cash reinvestment ratio 4.19ʘ 0.42ʘ 897.62ʘ

Analysis of financial ratio change:

1. Decrease of cash flow ratio this year:

The increase of cash inflow for this year’s operating activities is greater than the

accounts payable and expenses for inbound material inventory as well as other

current liabilities, therefore the cash flow ratio increased.

2. Increase of cash reinvestment ratio this year:

Due to the revenue growth this year, the net cash inflow from operating activities

increased, therefore the cash reinvestment ratio increased.

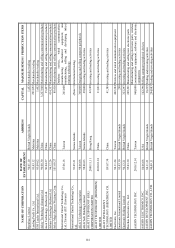

(II) Analysis of cash liquidity in one year

Unit: NT$100 million

Beginning cash

balancec

Expected net

cash flow from

operating activity

of the yeard

Expected

cash outflow

of the yeare

Expected cash

surplus

(deficit)

cɠdɡe

Remedial measures for the

expected insufficient cash

Investing

activity

Financing

activity

217.2 182.3 118.3 281.2 - -

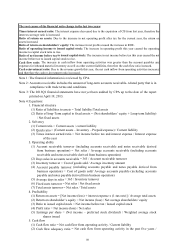

1. Analysis of cash flow change:

(1)Operating activity: Net cash inflow from operating activity for an amount o

f

NT$18.23 billion

(2)Investing activity: Net cash outflow from investing activity including long-term

investment for an amount of NT$3.64 billion

(3)Financing activity: Net cash outflow from financing activity including dividend

distribution for an amount of NT$15.47 billion

2. Remedial measures for the expected insufficient cash and liquidity analysis: N/A

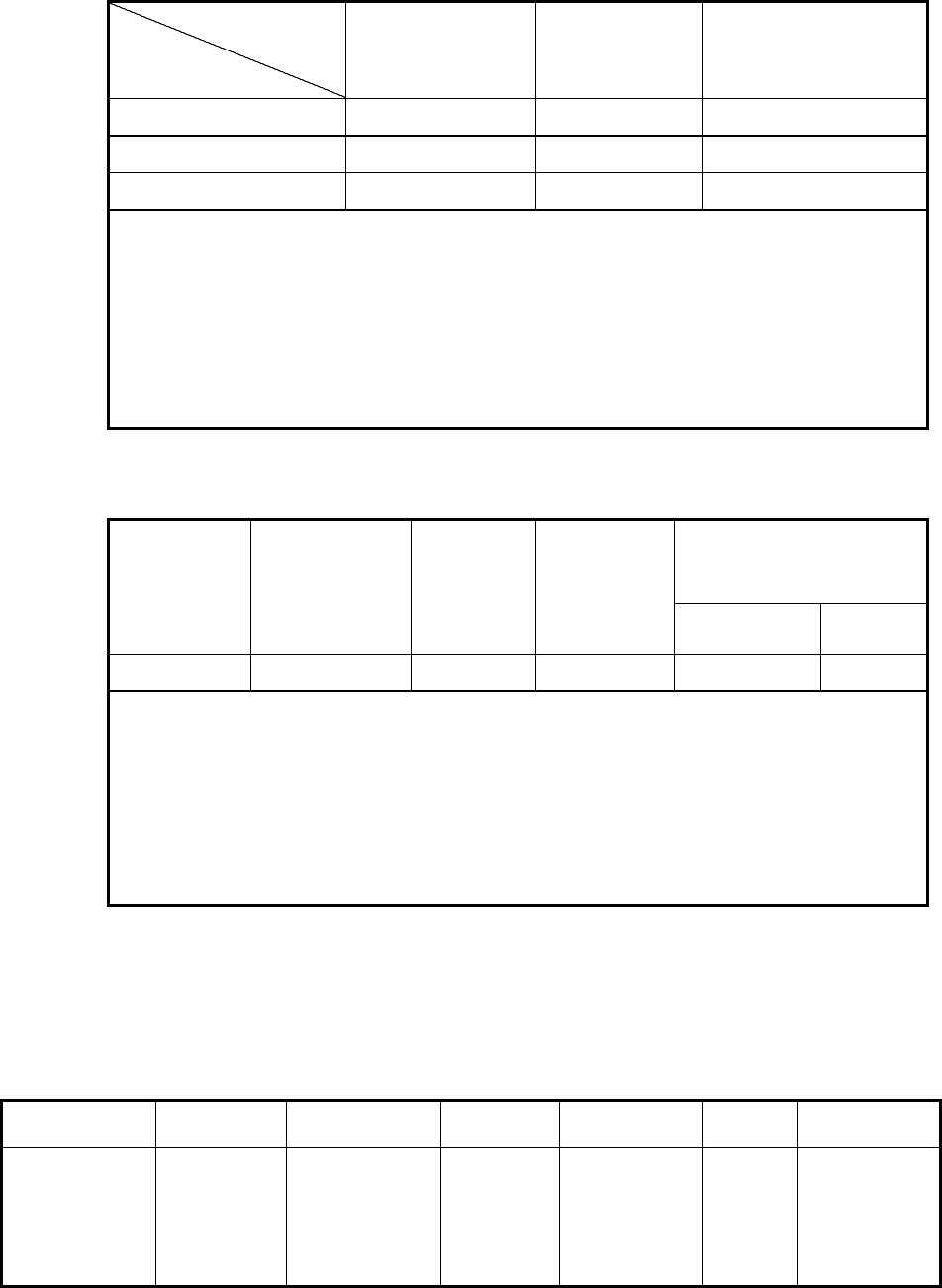

IV. The impact of significant capital expenditure on finance in recent years:

Significant capital expenditure and the source of fund: N/A

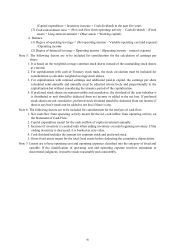

V. Reinvestment in recent years:

Unit: NT$ thousands

Item

(Note)!Amount!Policy Gain or Loss

in 2012!

Root cause of

profit or loss!

Corrective

action Investment Plans

Own brand

business!-!

Develop brand

business to

improve

competitiveness

and operating

performance

8,129,034

Focus on brand

marketing and

business

development

.! .!