Asus 2012 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

205

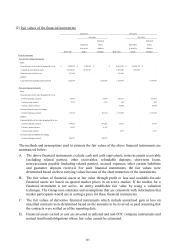

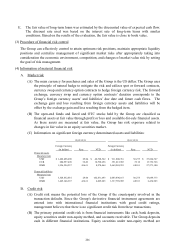

(2) Fair values of the financial instruments

The methods and assumptions used to estimate the fair values of the above financial instruments are

summarized below:

A. The above financial instruments exclude cash and cash equivalents, notes/accounts receivable

(including related parties), other receivables, refundable deposits, short-term loans,

notes/accounts payable (including related parties), accrued expenses, other current liabilities

and guarantee deposits received. For such financial instruments, the fair values were

determined based on their carrying values because of the short maturities of the instruments.

B. The fair values of financial assets at fair value through profit or loss and available-for-sale

financial assets are based on quoted market prices in an active market. If the market for a

financial instrument is not active, an entity establishes fair value by using a valuation

technique. The Group uses estimates and assumptions that are consistent with information that

market participants would use in setting a price for these financial instruments.

C. The fair values of derivative financial instruments which include unrealized gain or loss on

unsettled contracts were determined based on the amounts to be received or paid assuming that

the contracts were settled as of the reporting date.

D. Financial assets carried at cost are invested in unlisted and non-OTC company instruments and

mutual fund bond obligations whose fair value cannot be estimated.

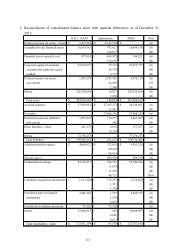

Estimated Estimated

Quotations using a Quotations using a

in an active valuation in an active valuation

Book value market technique Book value market technique

Financial instruments

Non-derivative financial instruments

Assets

Financial assets at fair value through profit or loss 9,202,568$ 9,202,568$ -$ 10,884,188$ 10,884,188$ -$

Available-for-sale financial assets 10,634,361 10,634,361 - 7,421,606 7,421,606 -

Financial assets carried at cost 477,014 - - 653,544 - -

Liabilities -

Long-term loans (including current portion) 1,829,276 - 1,829,276 1,818,436 - 1,818,436

Derivative financial instruments

Assets

Financial assets at fair value through profit or loss

Forward exchange contracts 66,497 - 66,497 686,335 - 686,335

Currency swap contracts 2,176 - 2,176 884 - 884

Currency option contracts - - - 38,788 - 38,788

Derivative financial assets for hedging

Forward exchange contracts 116,334 - 116,334 1,354,470 - 1,354,470

Liabilities

Financial liabilities at fair value through profit or loss

Forward exchange contracts 580,526 - 580,526 35,595 - 35,595

Currency option contracts 31,567 - 31,567 - - -

Currency swap contracts - - - 1,457 - 1,457

Derivative financial liabilities for hedging

Forward exchange contracts 408,375 - 408,375 - - -

2012/12/31

2011/12/31

Fair value

Fair value