Asus 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

90

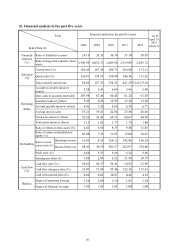

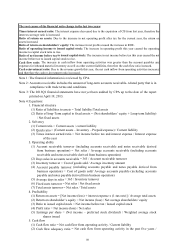

(Capital expenditure + Inventory increase + Cash dividend) in the past five years

(3) Cash reinvestment ratio = (Net cash flow from operating activity – Cash dividend) / (Fixed

assets + Long-term investment + Other assets + Working capital)

6. Balance:

(1) Degree of operating leverage = (Net operating income – Variable operating cost and expense)

/ Operating income

(2) Degree of financial leverage = Operating income / (Operating income – interest expense)

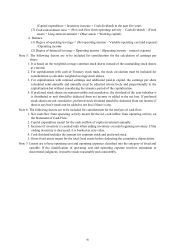

Note 5: The following factors are to be included for consideration for the calculation of earnings per

share:

1. It is based on the weighted average common stock shares instead of the outstanding stock shares

at yearend.

2. For capitalization with cash or Treasury stock trade, the stock circulation must be included for

consideration to calculate weighted average stock shares.

3. For capitalization with retained earnings and additional paid-in capital, the earnings per share

calculated semi-annually and annually must be adjusted retroactively and proportionally to the

capitalization but without considering the issuance period of the capitalization.

4. If preferred stock shares are nonconvertible and cumulative, the dividend of the year (whether it

is distributed or not) should be deducted from net income or added to the net loss. If preferred

stock shares are not cumulative, preferred stock dividend should be deducted from net income if

there is any but it needs not be added to net loss if there is any.

Note 6: The following factors are to be included for consideration for the analysis of cash flow:

1. Net cash flow from operating activity meant for the net cash inflow from operating activity on

the Statement of Cash Flow.

2. Capital expenditure meant for the cash outflow of capita investment annually.

3. Increase of inventory is counted only when ending inventory exceeds beginning inventory. If the

ending inventory is decreased, it is booked as zero value.

4. Cash dividend includes the amount for common stock and preferred stock.

5. Gross fixed assets meant for the total fixed assets before deducting the cumulative depreciation.

Note 7: Issuers are to have operating cost and operating expenses classified into the category of fixed and

variable. If the classification of operating cost and operating expense involves estimation or

discretional judgment, it must be made reasonably and consistently.