Asus 2012 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

179

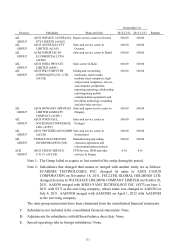

E. If the bondholder is eligible to exercise the put option within one year, the bonds payable are

reclassified as current liability. When the put option expires, those bonds payable are

reclassified as long-term liability if the liability meets the definition of long-term liability.

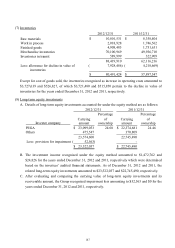

(13) Accrued product warranty liability

When a warranty clause is attached to the sale of a product, a warranty liability is accrued based

on historical return rates and repair costs, failure rates and warranty periods. Service warranty

expense is included in the current year’s operating expenses.

(14) Pension

A. Under the defined benefit pension plan, net periodic pension costs are recognized in

accordance with the actuarial calculations. Net periodic pension costs include service cost,

interest cost, expected return on plan assets, and amortization of unrecognized net transition

obligation and gains or losses on plan assets. Unrecognized net transition obligation is

amortized on a straight-line basis over the employees’ remaining service period.

B. Under the defined contribution pension plan, net periodic pension costs are recognized as

incurred.

(15) Income tax

A. Income tax is calculated on the basis of accounting income. The differences between the tax

bases and the book values of assets and liabilities are recorded as deferred tax using the

enacted tax rates for the periods in which the deferred tax is expected to be reversed. The tax

effects from taxable temporary differences are recognized as deferred tax liabilities, while the

deductible temporary differences and investment tax credits are accounted for as deferred tax

assets, which are assessed for a valuation allowance based on future realization.

B. Deferred income tax assets or liabilities are classified as current or non-current based on the

classification of items that resulted in the deferred item or based on the timing of the expected

reversal, for certain transactions not directly related to an asset or liability. When a change in

the tax laws is enacted, the deferred tax liability or asset is recomputed accordingly in the

period of change. The difference between the new amount and the original amount, that is, the

effect of changes in the deferred tax liability or asset, is recognized as an adjustment to current

income tax expense (benefit).

C. Over or under provision of prior years’ income tax liabilities is included in current year’s

income tax.

D. For the Company and domestic subsidiaries, the 10% additional income tax on unappropriated

earnings is recorded as current income tax expense when the shareholders resolve not to

distribute the earnings.

E. For the Company and domestic subsidiaries, current income tax is the higher of current income

tax payable or the Alternative Minimum Tax (AMT) calculated by applying the Income Basic

Tax Act (IBTA). The Group has taken into consideration the impact of the AMT in the

determination of its current income tax expense and its future impact when estimating the

realizable value of the deferred tax assets.

F. The income tax for each consolidated entity is reported on an individual basis with the relevant

country and is not reported on a consolidated basis. The consolidated income tax expense is

the total of income tax expense for all consolidated entities.