Asus 2012 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.212

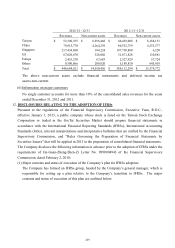

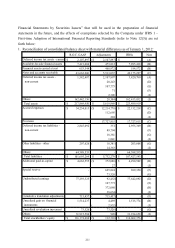

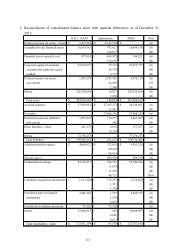

Notes to the reconciliation of the material differences:

A. In accordance with current accounting standards in R.O.C., a deferred tax asset or liability

should, according to the classification of its related asset or liability, be classified as current or

noncurrent. However, a deferred tax asset or liability that is not related to an asset or liability

for financial reporting, should be classified as current or noncurrent according to the expected

period to realize or settle a deferred tax asset or liability. However, under IAS 1, “Presentation

of Financial Statements”, an entity should not classify a deferred tax asset or liability as current.

The amount reclassified was $2,107,897.

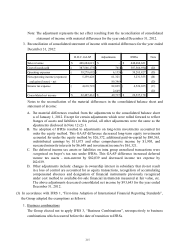

B. In accordance with the amended “Rules Governing the Preparation of Financial Statements by

Securities Issuers”, dated July 7, 2011, unlisted and non-OTC stocks held by the Group should

be measured at cost and recognized in “Financial assets carried at cost”. However, in

accordance with IAS 39, “Financial Instruments: Recognition and Measurement”, investments

in equity instruments without an active market but with reliable fair value measurement (i.e.

the variability of the estimation interval of reasonable fair values of such equity instruments is

insignificant, or the probability for these estimates can be made reliably) should be measured at

fair value. This GAAP difference will increase other comprehensive income of $4,489 due to

reclassification of unlisted stocks and emerging stocks from “Financial assets carried at cost”

to “Available-for-sale financial assets” in accordance with the amended “Rules Governing the

Preparation of Financial Statements by Securities Issuers”, dated December 22, 2011.

C. The classification of some accounts is different between current accounting policies and IFRSs

and “Rules Governing the Preparation of Financial Statements by Securities Issuers” that will

be used in the future. These reclassifications increased notes and accounts receivable by

$5,513,037, decreased accrued expenses by $12,214,778 and increased provision by

$17,727,815.

D. The current accounting standards in R.O.C. do not specify the rules on the cost recognition for

accumulating compensated absences. The Group recognizes such costs as expenses upon

actual payment. However, IAS 19, “Employee Benefits” requires that the costs of

accumulating compensated absences should be accrued as expenses at the end of the reporting

period. This GAAP difference increased accrued expenses and deferred income tax assets -

non-current by $112,695 and $20,243, respectively, and decreased undistributed earnings by

$92,452.

E. The current accounting standards in R.O.C do not specify the rules on the tax rate that shall

apply to the deferred tax assets or liabilities associated with unrealized gain or loss arising

from transactions between parent company and subsidiaries. The Company adopts the

seller’s tax rate to recognize such deferred tax. However, under IAS 12, “Income Taxes”,

temporary differences in the consolidated financial statements are determined by comparing

the carrying amounts of assets and liabilities in the financial statements and applicable taxation

basis. As the Company’s tax base is determined by reference to the Group entities’ income