Asus 2012 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.213

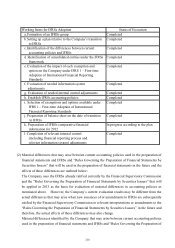

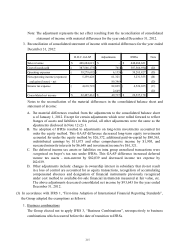

tax returns, the buyer’s tax rate shall apply to the deferred tax associated with unrealized gain

or loss arising from transactions between parent company and subsidiaries. This GAAP

difference increased both deferred income tax assets - non-current and undistributed earnings

by $107,773.

F. The Group elected to use the exemption on cumulative translation differences for all foreign

operations. Cumulative translation differences that existed at the date of transition to IFRSs are

deemed to be zero and reclassified to undistributed earnings in the amount of $625,824 after

considering the tax effects, and reversed the same amount to special reserve at the same time in

accordance with Jin-Guan-Zheng-Shen-Zi Order No. 1010012865 of the Financial Supervisory

Commission, dated April 6, 2012.

G. In accordance with current accounting standards, the Group revalued its property, plant and

equipment. In transition to IFRSs, the Group elected to use the current revaluation of property,

plant and equipment at the date of transition to IFRSs as deemed cost at the date of the

revaluation and accordingly, reclassified the capital surplus from asset revaluation to retained

earnings. This GAAP difference decreased other liabilities - others and unrealized revaluation

increment by $18,381 and $73,526, respectively, and increased deferred income tax liabilities -

non-current and undistributed earnings by $18,381 and $73,526, respectively, and the amount

of $73,526 was then reclassified to special reserve in accordance with Jin-Guan-Zheng-

Shen-Zi Order No.1010012865 of the Financial Supervisory Commission, dated April 6, 2012.

H. In accordance with the IFRSs Frequently Asked Questions (FAQ) issued by the Taiwan Stock

Exchange dated April 9, 2012, the capital surplus recognized from a change in the holding

percentage of an investee company accounted for under equity method is reclassified to

undistributed earnings in the amount of $372,080.

I. Other adjustment items include adoption of IFRSs resulting to adjustment on long-term

investments accounted for under the equity method, election to recognize all cumulative

actuarial gains and losses at the date of transition to IFRS, recognition of lease payments as an

expense on a straight-line basis over the lease term, and recognition of long-term employee

benefits expense over the service period other than pension expense. The above adjustments

decreased undistributed earnings by $38,634 on the date of transition to IFRSs.