Asus 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

D. Long-term investments in foreign investees, which are accounted for under the equity method,

are stated on the basis of stockholders’ equity in the foreign-currency financial statements of

investees. Translation gain or loss from long-term investments is recognized as cumulative

translation adjustment in stockholders’ equity.

(2) Classification of current and non-current assets and liabilities

A. Assets that meet one of the following criteria are classified as current assets; otherwise, they

are classified as non-current assets:

(A) Assets arising from operating activities that are expected to be realized or consumed, or

are intended to be sold within the normal operating cycle;

(B) Assets held mainly for trading purposes;

(C) Assets that are expected to be realized within twelve months from the balance sheet date;

(D) Cash and cash equivalents, excluding restricted cash and cash equivalents and those that

are to be exchanged or used to pay off liabilities more than twelve months after the

balance sheet date.

B. Liabilities that meet one of the following criteria are classified as current liabilities; otherwise,

they are classified as non-current liabilities:

(A) Liabilities arising from operating activities that are expected to be paid off within the

normal operating cycle;

(B) Liabilities arising mainly from trading activities;

(C) Liabilities that are to be paid off within twelve months from the balance sheet date;

(D) Liabilities for which the repayment date cannot be extended unconditionally to more than

twelve months after the balance sheet date.

(3) Financial instruments

A. In accordance with SFAS No. 34, “Financial Instruments: Recognition and Measurement” and

the “Regulations Governing the Preparation of Financial Reports by Securities Issuers”,

financial assets are classified as financial assets at fair value through profit or loss, financial

assets carried at cost, or available-for-sale financial assets, as appropriate. Financial liabilities

are classified either as financial liabilities at fair value through profit or loss, or as financial

liabilities at cost.

B. The Company accounts for purchases and sales of financial assets on the trade date, or the date

when the Company commits to purchase or sell the asset. At initial recognition, financial

assets are recognized at fair value plus, in the case of investments that are not reported at fair

value through profit or loss, directly attributable transaction costs.

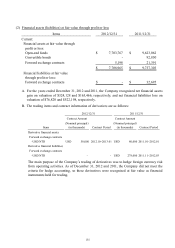

(A) Financial assets measured at fair value through profit or loss

These financial assets are subsequently measured at fair value with changes in fair value

recognized in profit or loss. Stocks of listed and OTC companies, convertible bonds and

closed-end funds are measured at closing prices at the balance sheet date. Open-end funds

are measured at the unit price of the net assets at the balance sheet date.