Asus 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

92

92

!

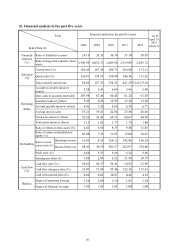

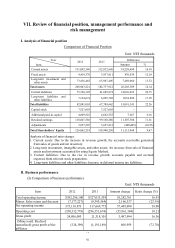

VII. Review of financial position, management performance and

risk management

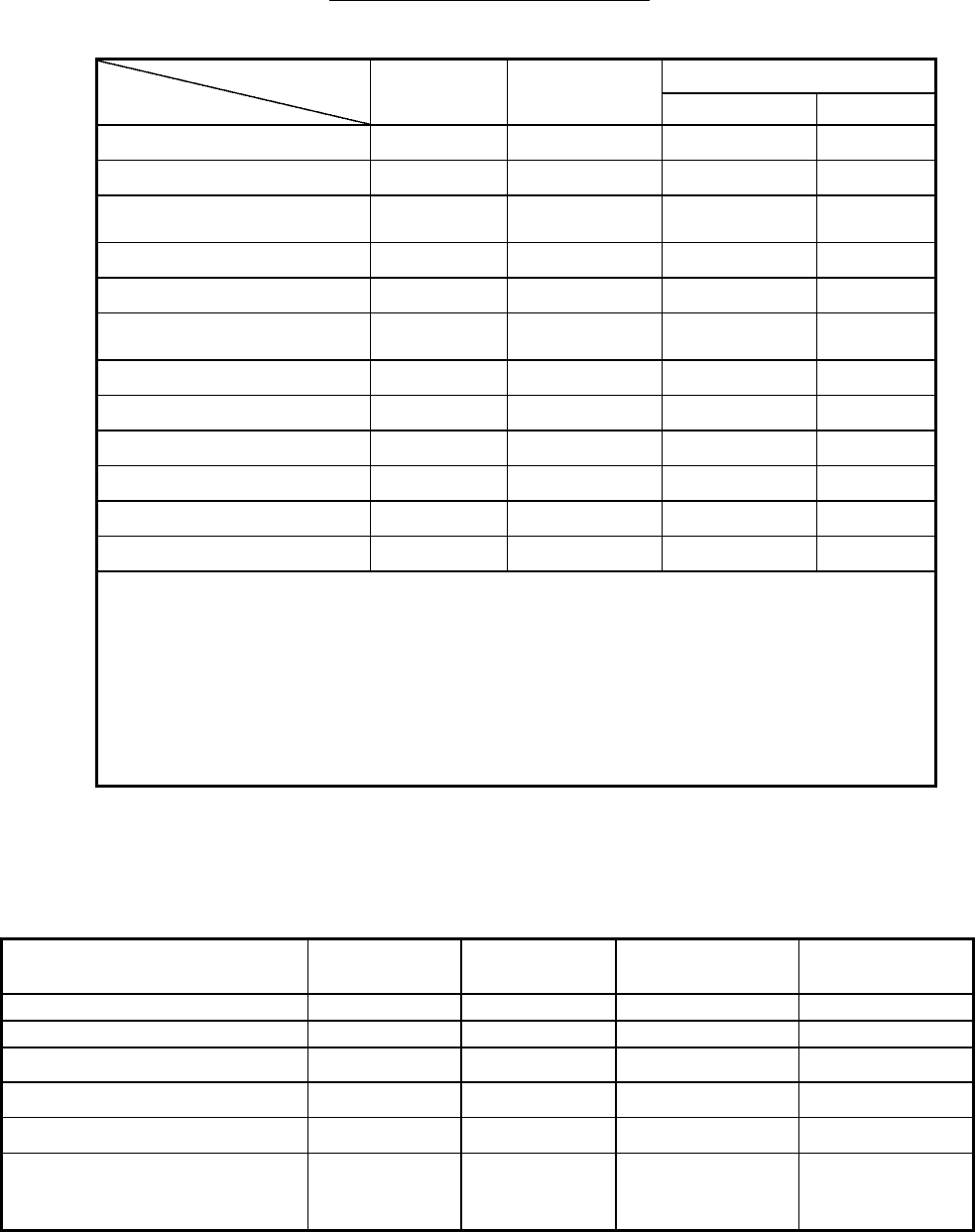

I. Analysis of financial position

Comparison of Financial Position

Unit: NT$ thousands

Year

Item

2012 2011 Difference

Amount %

Current assets 131,092,386 112,832,696 18,259,690 16.18

Fixed assets 4,414,370 3,937,811 476,559 12.10

Long-term investment and

other assets 73,436,465 65,967,405 7,469,060 11.32

Total assets 208,943,221 182,737,912 26,205,309 14.34

Current liabilities 75,726,329 61,689,874 14,036,455 22.75

Long-term liabilities and

other liabilities 7,154,674 6,099,788 1,054,886 17.29

Total liabilities 82,881,003 67,789,662 15,091,341 22.26

Capital stock 7,527,603 7,527,603 - -

Additional paid-in capital 4,669,822 4,662,555 7,267 0.16

Retained earnings 110,607,586 99,100,280 11,507,306 11.61

Adjustments 3,257,207 3,657,812 (400,605) (10.95)

Total Shareholders’ Equity 126,062,218 114,948,250 11,113,968 9.67

Analysis of financial ratio change:

1. Current assets: Due to the increase in revenue growth, the accounts receivable generated

from sales of goods and net inventory.

2. Long-term investment, intangible assets, and other assets: An increase from sale of financial

assets and investment accounted for using Equity Method.

3. Current liabilities: Due to the rise in revenue growth, accounts payable and accrued

expenses from relevant stock preparation.

4.!Long-term liabilities and other liabilities: Increase in deferred income tax liabilities.

II. Business performance

(I) Comparison of business performance

Unit: NT$ thousands

Item 2012 2011 Amount change Ratio change (%)

Total operating income $382,296,100 $327,013,339 55,282,761 16.91

Minus: Sales return and discount (7,177,227) (9,343,564) 2,166,337 (23.19)

Net operating income 375,118,873 317,669,775 57,449,098 18.08

Operating cost (350,312,778) (296,351,674) (53,961,104) 18.21

Gross profit 24,806,095 21,318,101 3,487,994 16.36

(Minus) add: Realized

(unrealized) gross profit of the

affiliates

(324,190) (1,191,149) 866,959 (72.78)