Asus 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

93

!

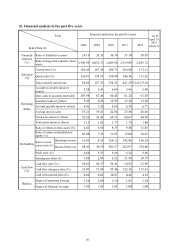

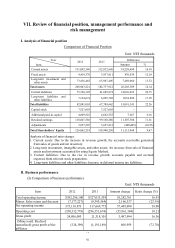

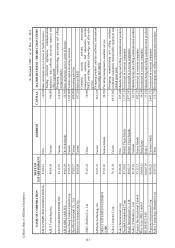

Item 2012 2011 Amount change Ratio change (%)

Realized gross profit 24,481,905 20,126,952 4,354,953 21.64

Operating expense (9,709,439) (9,403,496) (305,943) 3.25

Operating income 14,772,466 10,723,456 4,049,010 37.76

Non-operating income and gain

Interest income 196,463 160,270 36,193 22.58

Investment income (Equity

Method) 9,489,163 7,274,803 2,214,360 30.44

Dividend income 422,661 292,051 130,610 44.72

Gain from exchange 1,445,006 1,645,648 (200,642) (12.19)

Gain from financial asset

valuation 324,128 163,66 160,662 98.28

Other income 267,996 225,311 42,685 18.94

Total non-operating income

and gain 12,145,417 9,761,549 2,383,868 24.42

Non-operating expense and loss

Interest expense 5 47,099 (47,094) (99.99)

Gain on valuation of

financial liabilities, loss 76,820 522,198 (445,378) (85.29)

Other loss 127,426 120,243 7,183 5.97

Total Non-operating

expense and loss 204,251 689,540 (485,289) (70.38)

Net income before tax 26,713,632 19,795,465 6,918,167 34.95

Minus: Estimated income tax (4,291,302) (3,217,306) (1,073,996) 33.38

Net income $22,422,330 $16,578,159 5,844,171 35.25

Analysis of financial ratio change:

1. Operating income and operating cost: Both revenue and operating costs increased due to the expansion o

f

new market and launch of new products this year.

2. Non-operating income and gain: Investment earnings with equity method had increased from the year

before.

3. Other Expenses and Loss: The result was a reduction in loss on valuation of financial liability compared

with last year.

4. Estimated income tax expense: The result was an increase in income tax payable.

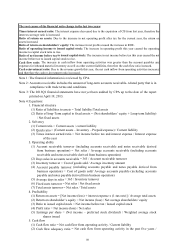

(II) Analysis of gross profit

Unit: NT$ Thousands

Change amount

Root cause

Difference of price Difference of sales

combination

Difference of

quantity

Gross profit 3,487,994 12,198,694 (9,568,006) 857,306

Remark The increase of gross profit of 2012 is from the favorable difference of price and

quantity.