Asus 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

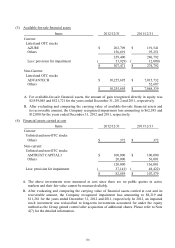

(B) Available-for-sale financial assets

Available-for-sale financial assets are those non-derivative financial assets that are

designated as available for sale or not classified as financial assets at fair value through

profit or loss, held-to-maturity financial assets, or loans and receivables. These assets are

then measured at fair value. The difference adjustments arising from change in fair value,

excluding impairment loss and exchange gain or loss from the translation of monetary

financial assets denominated in foreign currencies which are recognized in current profit

or loss, are recognized in a separate component of stockholders’ equity until such

investment is reclassified or disposed of, upon which the cumulative separate component

of stockholders’ equity is transferred to current profit or loss.

(C) Financial assets carried at cost

Equity investments without reliable market prices, including emerging and other unlisted

and non-OTC stocks, are measured at cost. If objective evidence of impairment exists, the

Company recognizes impairment loss, which is not reversed in subsequent periods.

C. Subsequent to initial recognition, the Company measures all financial liabilities at amortized

cost except for financial liabilities at fair value through profit or loss, which are measured at

fair value.

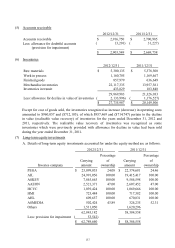

(4) Notes and accounts receivable and other receivables

A. Notes and accounts receivable are claims resulting from the sale of goods or services. Other

receivables are those arising from transactions other than the sale of goods or services.

B. Notes and accounts receivable and other receivables are recognized initially at fair value and

subsequently measured at amortized cost using the effective interest method, less provision for

accumulated impairment. A provision for impairment is established when there is objective

evidence that the receivables are impaired. The amount of the provision is the difference

between the asset’s carrying amount and the present value of estimated future cash flows,

discounted at the original effective interest rate. When the fair value of the asset subsequently

increases and the increase can be objectively related to an event occurring after the impairment

loss was recognized in profit or loss, the impairment loss shall be reversed to the extent of the

loss previously recognized in profit or loss. Such recovery of impairment loss shall not make

the asset’s carrying amount more than its amortized cost where no accumulated impairment

loss was recognized. Subsequent recoveries of amounts previously written off are recognized

in profit.

(5) Inventories

The costs of inventories consist of those necessary expenditures incurred in bringing each item of

inventory to its usable condition and location. Cost is calculated on a weighted-average basis.

Inventories are valued at the lower of cost or net realizable value. Net realizable value by item is

determined based on the estimated selling price in the ordinary course of business, less estimated

costs to complete and to sell.