Asus 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

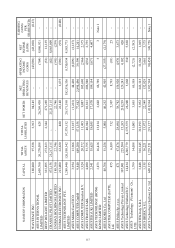

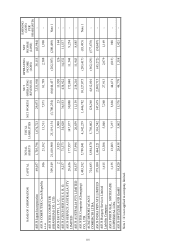

127

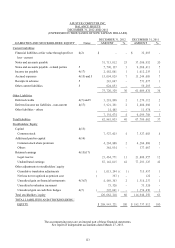

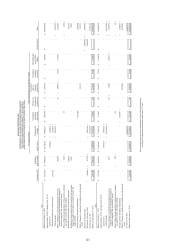

ASUSTEK COMPUTER INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2012 AND 2011

(EXPRESSED IN THOUSANDS OF NEW TAIWAN DOLLARS,

EXCEPT AS OTHERWISE INDICATED)

1. HISTORY AND ORGANIZATION

(1) ASUSTEK COMPUTER INC. (ASUS or the Company) was established on April 2, 1990. The

Company’s common shares were listed on the Taiwan Stock Exchange (TWSE) on November 14,

1996. Its main activities are to produce, design and sell notebook PCs, main boards, software,

add-on cards, optics, wired and wireless communication equipment and telecom-restricted radio

frequency devices.

(2) The Company resolved to spin-off its OEM businesses on January 1, 2008. Pursuant to the

Company’s resolution, the Company transferred its computer and non-computer OEM businesses

to its spun-off subsidiaries, PEGA and UNIHAN, respectively. On June 1, 2010, however, the

Company transferred further its OEM assets and business (the Company’s long-term equity

investment in PEGA) to the Company’s another investee, PII. PII issued new shares to the

Company and its shareholders as consideration.

(3) The Company’s headcount totaled 4,682 and 4,061 employees as of December 31, 2012 and 2011,

respectively.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The financial statements are prepared in accordance with the “Regulations Governing the Preparation

of Financial Reports by Securities Issuers” and generally accepted accounting principles in the

Republic of China. The Company’s significant accounting policies are as follows:

(1) Foreign currency transactions and translation of financial statements in foreign currencies

A. Transactions involving non-derivative financial instruments denominated in foreign currencies

are recorded in New Taiwan dollars at the rates of exchange in effect when the transactions

occurred. Translation gain or loss arising from the settlement of assets and liabilities

denominated in foreign currencies are included in profit or loss in the year of actual

settlement.

B. Monetary assets and liabilities denominated in foreign currencies are remeasured at the

balance sheet date using the exchange rates in effect on that date, with related exchange gain

and loss included in the statement of income.

C. Non-monetary assets and liabilities denominated in foreign currencies that are measured at fair

value through stockholders’ equity are remeasured at the exchange rate prevailing at the

balance sheet date, with related exchange gain or loss recorded as cumulative translation

adjustment in stockholders’ equity. Non-monetary assets and liabilities denominated in foreign

currencies that are measured at fair value through profit or loss are remeasured at the exchange

rate prevailing at the balance sheet date, with related exchange gain or loss recorded in the

statement of income. Non-monetary assets and liabilities denominated in foreign currencies

that are measured at cost are remeasured at the historical exchange rate.