Asus 2012 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

207

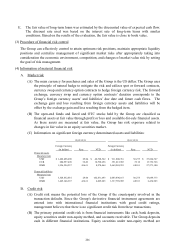

funds and listed and OTC stocks issued by companies with good credit ratings. The

Group manages credit risk exposure related to each financial institution and believes that

there is no significant concentration of credit risk of cash and equity securities. The

customers of the Group have good credit and profit records. The Group evaluates the

financial condition of these customers in order to reduce credit risk of accounts

receivable.

C. Liquidity risk

(A) The Group adjusts its funding mainly through corporate bonds, cash and bank deposits.

The Group maintains funding sufficient to fulfill all contract obligations, and thereby

expects no liquidity risk would arise from lack of funding.

(B) The Group invests in funds and listed and OTC stocks, which are traded in active

markets and are expected to be readily convertible into certain amount of cash

approximate to their fair values in the markets. The Group has lower funding risk for

forward exchange contracts because sufficient working capital is maintained to fulfill

contract obligations, and lower cash flow risk due to the exchange rate of those contracts

was known.

(C) The Group is expected to have liquidity risk since there are no active market for

investment equity instruments carried at cost.

(D) The derivative financial instruments for hedging are intended mainly to hedge the

exchange rate risk from future cash flows. The forward exchange contracts’ duration

corresponds to the Group’s foreign currency future cash flows. The Group will settle the

foreign currency liabilities at expiration of the contracts. Thus, management believes that

the cash flow risk is not significant.

D. Cash flow risk due to changes in interest rates

The Group’s long-term loans are issued at floating interest rates. Accordingly, the future cash

flow will fluctuate with the yield rate of these debt instruments.

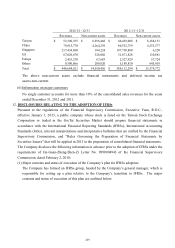

11. OPERATING SEGMENT INFORMATION

(1) General information

The businesses of the Group are mainly divided into two parts: 3C brand business, and others.

3C brand business focuses on the sales of 3C products, and others focus on strategic investments

in businesses other than 3C brand business.

(2) Measurement basis

The Group uses the operating profit as the measurement for operating segment profit and the basis

of performance assessment. The accounting policies of the operating segments and the accounting

policies described in Note 2 of the consolidated financial statements are the same.