Asus 2012 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

193

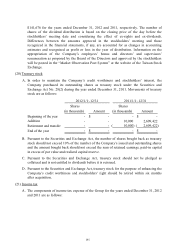

(17) Common stock

A. As of December 31, 2012, the Company’s authorized capital was $47,500,000, consisting of

4,750,000,000 shares of common stock (including 50,000,000 shares which were reserved

for employee stock options), and the outstanding capital was $7,527,603 with a par value of

$10 (in dollars) per share.

B. As of December 31, 2012, the Company issued Global Depositary Receipts (GDRs), of

which 6,280,000 units of the GDRs are now listed on the London Stock Exchange. Per unit

of GDR represents 5 shares of the Company’s common stock and total GDRs represent

31,398,000 shares of the Company’s common stock. The terms of GDR are as follows:

(A) Voting rights

GDR holders may, pursuant to the Depositary Agreement and the relevant laws and

regulations of the R.O.C., exercise the voting rights pertaining to the underlying common

shares represented by the GDRs.

(B) Dividends, stock warrants and other rights

GDR holders and common shareholders are all entitled to receive dividends. The

Depositary may issue new GDRs in proportion to GDRs holding ratios or raise the

number of shares of common stock represented by each unit of GDR or sell stock

dividends on behalf of GDR holders and distribute proceeds to them in proportion to their

GDRs holding ratios.

C. The Board of Directors authorized to transfer its GDRs from the London Stock Exchange to

the Bourse de Luxembourg on January 30, 2013, and the change will take effect in late March

2013.

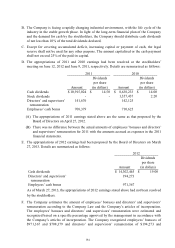

(18) Additional paid-in capital

The Company Act requires that capital reserve arising from paid-in capital in excess of par value

on issuance of common stock and donations can be used to cover accumulated deficit, or to

increase capital or payment of cash in proportion to ownership percentage provided the Company

has no accumulated deficit. Besides, the Securities and Exchange Act requires that the capital

reserve can be capitalized once a year and the amount shall not exceed 10% of the paid-in capital.

Capital reserve should not be used to cover accumulated deficit unless the legal reserve is

insufficient.

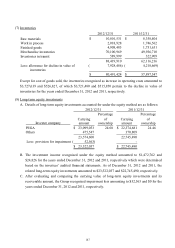

(19) Retained earnings

A. According to the Company’s articles of incorporation, annual net income shall first be used to

pay all taxes and after covering prior years’ losses, if any, should be distributed as follows:

10% as legal reserve, an appropriate amount as special reserve according to relevant

regulation or as required by the government, 10% of capital stock as capital interest, no less

than 1% as employees’ bonuses, and no more than 1% as directors’ and supervisors’ bonuses.

When the employees’ bonuses are distributed in stock, the recipients may include the

employees of subsidiaries. After the distribution of earnings, the remaining earnings, if any,

may be appropriated according to a resolution adopted in the stockholders’ meeting.