Asus 2012 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

196

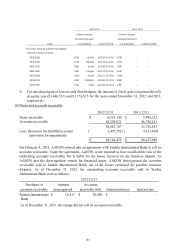

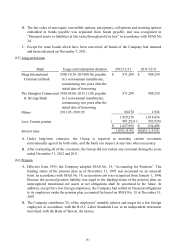

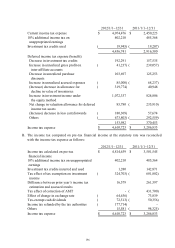

B. The income tax computed on pre-tax financial income at the statutory rate was reconciled

with the income tax expense as follows:

2012/1/1~12/31 2011/1/1~12/31

Current income tax expense 4,074,476$ 2,450,223$

10% additional income tax on 402,210 485,364

unappropriated earnings

Investment tax credits used 19,945)( 19,207)(

4,456,741 2,916,380

Deferred income tax expense (benefit):

Decrease in investment tax credits 192,291 157,535

Increase in unrealized gross profit on

inter-affiliate accounts

41,237)( 239,057)(

Decrease in unrealized purchase

discounts

103,697 125,253

Increase in unrealized accrued expenses 85,000)( 68,237)(

(Increase) decrease in allowance for

decline in value of inventories

319,774)( 40,948

Increase in investment income under

the equity method

1,072,337 824,806

Net change in valuation allowance for deferred

income tax assets

85,780 235,910)(

(Increase) decrease in loss carryforwards 180,309)( 57,674

Others 673,803)( 292,559)(

153,982 370,453

Income tax expense 4,610,723$ 3,286,833$

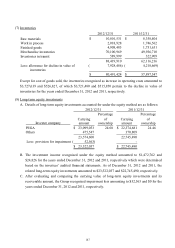

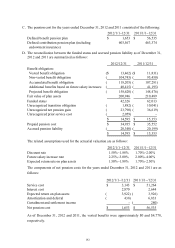

2012/1/1~12/31 2011/1/1~12/31

Income tax calculated on pre-tax

financial income

4,814,639$ 3,501,545$

10% additional income tax on unappropriated

earnings

402,210 485,364

Investment tax credits incurred and used 1,280 142,871

Tax effect of tax exemption on investment

income

324,703)( 601,802)(

Difference between prior year’s income tax

estimation and assessed results

16,579 261,397

Tax effect of correction of AMT - 431,700)(

Effect of change in exchange rate 64,636)( 73,839

Tax-exempt cash dividends 72,513)( 50,356)(

Income tax refunded by the tax authorities 177,714)( -

Others 15,581 94,325)(

Income tax expense 4,610,723$ 3,286,833$