Asus 2012 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

191

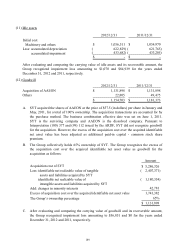

B. The fair value of non-equity convertible options, put options, call options and resetting options

embedded in bonds payable was separated from bonds payable, and was recognized in

“Financial assets or liabilities at fair value through profit or loss” in accordance with SFAS No.

34.

C. Except for some bonds which have been converted, all bonds of the Company had matured

and been redeemed on November 7, 2011.

(15) Long-term loans

A. Under long-term contracts, the Group is required to maintain certain covenants

semi-annually agreed by both sides, and the bank can inspect at any time when necessary.

B. After evaluating all of the covenants, the Group did not violate any covenant during the years

ended December 31, 2012 and 2011.

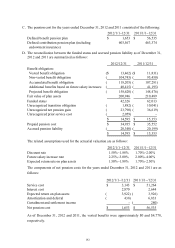

(16) Pension

A. Effective from 1995, the Company adopted SFAS No. 18, “Accounting for Pensions”. The

funding status of the pension plan as of December 31, 1995 was measured on an actuarial

basis. In accordance with SFAS No. 18, net pension cost was recognized from January 1, 1996.

Because the accrued pension liability was equal to the funding status of the pension plan, no

unrecognized transitional net assets or net obligations shall be amortized in the future. In

addition, except for a few foreign employees, the Company had settled its financial obligations

to its employees under the pension plan accounted for based on SFAS No. 18 at December 31,

2007.

B. The Company contributes 2% of the employees’ monthly salaries and wages for a few foreign

employees in accordance with the R.O.C Labor Standards Law to an independent retirement

trust fund, with the Bank of Taiwan, the trustee.

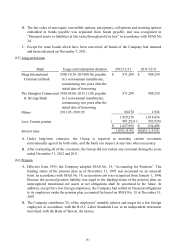

Bank Usage and redemption duration 2012/12/31 2011/12/31

Mega International 2010.10.18~2014.08.06, payable 871,200$ 908,250$

Commercial Bank in 3 semi-annual installments,

commencing two years after the

initial date of borrowing

The Shanghai Commercial

2010.04.06~2015.11.08, payable 871,200 908,250

& Savings Bank in 3 semi-annual installments,

commencing two years after the

initial date of borrowing

Others 2011.05~2019.05 86,876 1,936

1,829,276 1,818,436

Less: Current portion 801,283)( 983,938)(

1,027,993$ 834,498$

Interest rates 1.05%~8.9% 0.04%~1.815%