Asus 2012 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

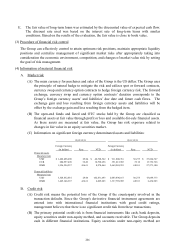

215

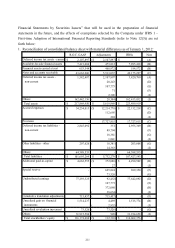

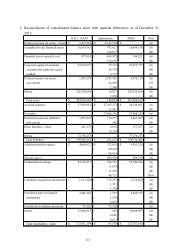

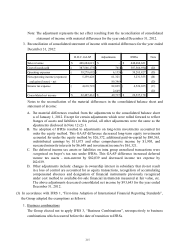

Note: The adjustment represents the net effect resulting from the reconciliation of consolidated

statement of income with material differences for the year ended December 31, 2012.

3. Reconciliation of consolidated statement of income with material differences for the year ended

December 31, 2012:

Notes to the reconciliation of the material differences in the consolidated balance sheet and

statement of income:

A.

The material differences resulted from the adjustments to the consolidated balance sheet

as of January 1, 2012. Except for certain adjustments which were rolled forward to reflect

changes of assets and liabilities in this period, all other adjustments were the same as the

adjustments disclosed in Note 12 (2) 1.

B.

The adoption of IFRSs resulted to adjustments on long-term investments accounted for

under the equity method. This GAAP difference decreased long-term equity investments

accounted for under the equity method by $26,372, additional paid-in-capital by $80,563,

undistributed earnings by $11,873 and other comprehensive income by $1,905, and

increased minority interests by $6,648 and investment income by $61,321.

C.

The deferred income tax assets or liabilities on intra group unrealized transactions were

recognized on buyer’s tax rate under IFRSs. This GAAP difference increased deferred

income tax assets - non-current by $82,039 and decreased income tax expense by

$82,039.

D.

Other adjustments include: changes in ownership interest in subsidiary that do not result

in a loss of control are accounted for as equity transactions, recognition of accumulating

compensated absences and designation of financial instruments previously recognized

under cost method to available-for-sale financial instruments measured at fair value, etc.

The above adjustments decreased consolidated net income by $93,643 for the year ended

December 31, 2012.

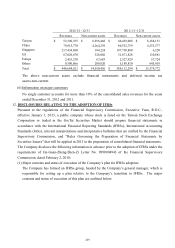

(3) In accordance with IFRS 1, “First-time Adoption of International Financial Reporting Standards”,

the Group adopted the exemptions as follows:

1. Business combinations

The Group elected not to apply IFRS 3, “Business Combinations”, retrospectively to business

combinations which occurred before the date of transition to IFRSs.

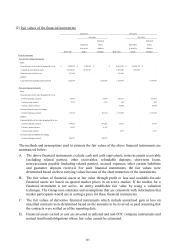

R.O.C. GAAP

Adjustments IFRSs Note

Sales revenue 448,684,621$ -$ 448,684,621$

Cost of goods sold 387,566,173)( 761)( 387,566,934)( (D)

Operating expenses 39,279,692)( 6,135)( 39,285,827)( (D)

Non-operating income (expenses) 5,259,428 61,321 5,231,353 (B)

and gains (losses) - net 89,396)( (D)

Income tax expense 4,610,723)( 82,039 4,526,035)( (C)

2,649 (D)

Consolidated net income 22,487,461$ 49,717$ 22,537,178$