Asus 2012 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

197

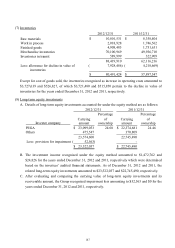

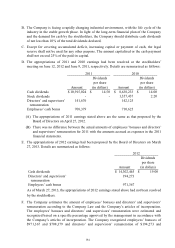

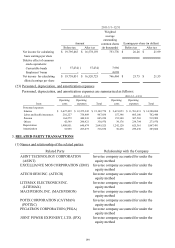

C. The components of deferred income tax assets (liabilities) are as follows:

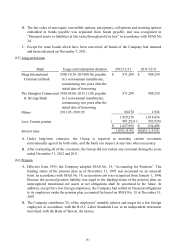

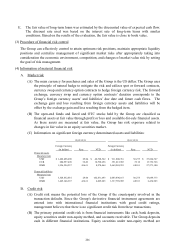

D. The Tax Authority has examined the Company’s income tax returns through 2010. In 2012,

the Company finally settled its disagreement with the Tax Authority’s assessment of

additional tax on its 1996 and 1998 income tax returns. As agreed with the Tax Authority, the

original assessment was reduced by $177,714 which was recognized as an adjustment to

current income tax expense.

E. Imputation credit account and creditable ratio

2012/12/31 2011/12/31

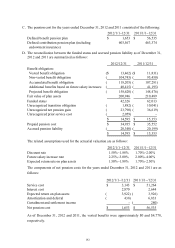

Deferred income tax assets:

Unrealized gross profit 541,222$ 511,528$

Unrealized purchase discounts 229,592 333,289

Unrealized sales discounts 466,180 390,553

Allowance for decline in value of inventories 1,406,727 685,966

Unrealized accrued expenses 1,967,888 1,639,395

Tax benefit of unused loss carryforwards 645,532 444,102

Unused investment tax credits 227,173 379,126

Others 221,001 273,259

5,705,315 4,657,218

Valuation allowance - deferred income tax 930,481)( 728,483)(

assets

4,774,834 3,928,735

Deferred income tax liabilities:

Investment income from foreign investees 3,875,085)( 2,797,522)(

Others 594,620)( 285,933)(

4,469,705)( 3,083,455)(

305,129$ 845,280$

2012/12/31 2011/12/31

Deferred income tax assets - current 2,417,530$ 2,107,897$

Deferred income tax assets - non-current 1,845,574 1,582,487

Deferred income tax liabilities - current 1)( 12)(

Deferred income tax liabilities - non-current 3,957,974)( 2,845,092)(

305,129$ 845,280$

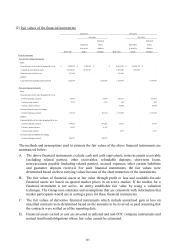

2012/12/31 2011/12/31

ICA balance 12,345,070$ 12,143,365$

2011 (Actual) 2010 (Actual)

Creditable ratio for earnings distribution 17.43% 18.05%