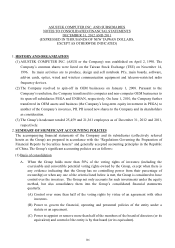

Asus 2012 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

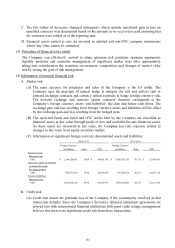

C. The fair values of derivative financial instruments which include unrealized gain or loss on

unsettled contracts were determined based on the amounts to be received or paid assuming that

the contracts were settled as of the reporting date.

D. Financial assets carried at cost are invested in unlisted and non-OTC company instruments

whose fair value cannot be estimated.

(3) Procedure of financial risk control

The Company can effectively control to attain optimum risk positions, maintain appropriate

liquidity positions and centralize management of significant market risks after appropriately

taking into consideration the economic environment, competition, and changes of market value

risk by setting the goal of risk management.

(4) Information of material financial risk

A. Market risk

(A) The main currency for purchases and sales of the Company is the US dollar. The

Company uses the principle of natural hedge to mitigate the risk and utilizes spot or

forward exchange contracts and currency option contracts to hedge foreign currency risk.

The forward exchange and currency option contracts’ duration corresponds to the

Company’s foreign currency assets’ and liabilities’ due date and future cash flows. The

exchange gain and loss resulting from foreign currency assets and liabilities will be offset

by the exchange gain and loss resulting from the hedged item.

(B) The open-end funds and listed and OTC stocks held by the Company are classified as

financial assets at fair value through profit or loss and available-for-sale financial assets.

As these assets are measured at fair value, the Company has risk exposure related to

changes in fair value in an equity securities market.

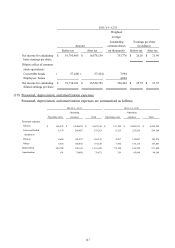

(C) Information on significant foreign currency denominated assets and liabilities:

B. Credit risk

(A) Credit risk means the potential loss of the Company if the counterparty involved in that

transaction defaults. Since the Company’s derivative financial instrument agreements are

entered into with international financial institutions with good credit ratings, management

believes that there is no significant credit risk from these transactions.

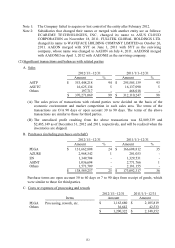

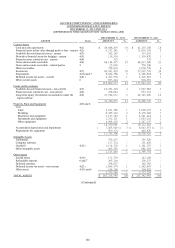

Foreign Currency Foreign Currency

(in dollars) Rate NTD (in dollars) Rate NTD

Financial assets

Monetary item

USD 2,344,550,492$ 29.04 68,085,746$ 2,069,185,553$ 30.275 62,644,593$

Long-term equity investments

accounted for under

the equity method

USD 860,573,539 29.04 24,991,056 663,488,476 30.275 20,087,114

Financial liabilities

Monetary item

USD 2,247,038,314 29.04 65,253,993 1,692,874,003 30.275 51,251,760

2012/12/31

2011/12/31