APS 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies

Description of Business and Basis of Presentation

Pinnacle West is a holding company that conducts business through its subsidiaries, APS and El Dorado, and formerly SunCor and APSES. APS,

our wholly-owned subsidiary, is a vertically-integrated electric utility that provides either retail or wholesale electric service to substantially all of the state of

Arizona, with the major exceptions of about one-half of the Phoenix metropolitan area, the Tucson metropolitan area and Mohave County in northwestern

Arizona. APS accounts for essentially all of our revenues and earnings, and is expected to continue to do so. SunCor was a developer of residential,

commercial and industrial real estate projects and essentially all of these assets were sold in 2009 and 2010. In February 2012, SunCor filed for protection

under the United States Bankruptcy Code to complete an orderly liquidation of its business. All activities for SunCor are reported as discontinued

operations. APSES provided energy-related projects to commercial and industrial retail customers in competitive markets in the western United States.

APSES was sold in 2011 and is reported as discontinued operations. El Dorado is an investment firm.

Pinnacle West’s Consolidated Financial Statements include the accounts of Pinnacle West and our subsidiaries: APS and El Dorado, and formerly

SunCor and APSES. APS’s consolidated financial statements include the accounts of APS and certain VIEs relating to the Palo Verde sale leaseback.

Intercompany accounts and transactions between the consolidated companies have been eliminated.

We consolidate VIEs for which we are the primary beneficiary. We determine whether we are the primary beneficiary of a VIE through a qualitative

analysis that identifies which variable interest holder has the controlling financial interest in the VIE. In performing our primary beneficiary analysis, we

consider all relevant facts and circumstances, including the design and activities of the VIE, the terms of the contracts the VIE has entered into, and which

parties participated significantly in the design or redesign of the entity. We continually evaluate our primary beneficiary conclusions to determine if changes

have occurred which would impact our primary beneficiary assessments. We have determined that APS is the primary beneficiary of certain VIE lessor trusts

relating to the Palo Verde sale leaseback, and therefore APS consolidates these entities (see Note 19).

Our consolidated financial statements reflect all adjustments (consisting only of normal recurring adjustments, except as otherwise disclosed in the

notes) that we believe are necessary for the fair presentation of our financial position, results of operations and cash flows for the periods presented.

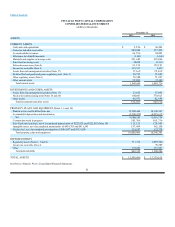

Certain line items are presented in more detail on the Consolidated Balance Sheets and Consolidated Statements of Cash Flows than was presented in

the prior years. Other line items are more condensed than the previous presentation. The prior year amounts were reclassified to conform to the current year

presentation. These reclassifications had no impact on total assets or net cash flow provided by operating activities. The following tables show the impacts of

the reclassifications of prior years (previously reported) amounts (dollars in thousands):

86