APS 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

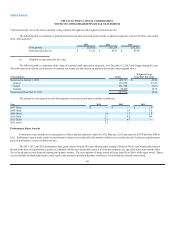

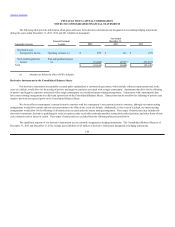

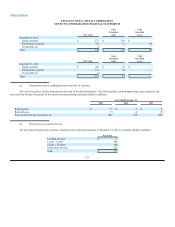

Our Consolidated Balance Sheets at December 31, 2013 and December 31, 2012 include the following amounts relating to the VIEs (in millions):

December 31,

2013

December 31,

2012

Palo Verde sale leaseback property plant and equipment, net of accumulated

depreciation $125 $129

Current maturities of long-term debt 26 27

Long-term debt excluding current maturities 13 39

Equity-Noncontrolling interests 146 129

Assets of the VIEs are restricted and may only be used to settle the VIEs’ debt obligations and for payment to the noncontrolling interest holders.

Other than the VIEs’ assets reported on our consolidated financial statements, the creditors of the VIEs have no other recourse to the assets of APS or Pinnacle

West, except in certain circumstances, such as a default by APS under the lease.

APS is exposed to losses relating to these VIEs upon the occurrence of certain events that APS does not consider reasonably likely to occur. Under

certain circumstances (for example, the NRC issuing specified violation orders with respect to Palo Verde or the occurrence of specified nuclear events), APS

would be required to make specified payments to the VIEs’ noncontrolling equity participants, assume the VIEs’ debt, and take title to the leased Palo Verde

Unit 2 interests which, if appropriate, may be required to be written down in value. If such an event had occurred as of December 31, 2013, APS would have

been required to pay the noncontrolling equity participants approximately $133 million and assume $39 million of debt. Since APS consolidates these VIEs,

the debt APS would be required to assume is already reflected in our Consolidated Balance Sheets.

For regulatory ratemaking purposes, the leases continue to be treated as operating leases and, as a result, we have recorded a regulatory asset relating

to the arrangements.

20. Nuclear Decommissioning Trusts

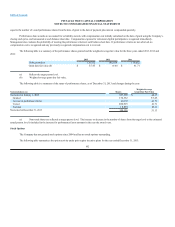

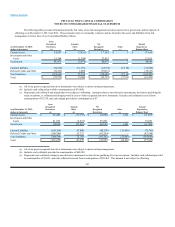

To fund the costs APS expects to incur to decommission Palo Verde, APS established external decommissioning trusts in accordance with NRC

regulations. Third-party investment managers are authorized to buy and sell securities per stated investment guidelines. The trust funds are invested in fixed

income securities and equity securities. APS classifies investments in decommissioning trust funds as available for sale. As a result, we record the

decommissioning trust funds at their fair value on our Consolidated Balance Sheets. See Note 14 for a discussion of how fair value is determined and the

classification of the nuclear decommissioning trust investments within the fair value hierarchy. Because of the ability of APS to recover decommissioning

costs in rates and in accordance with the regulatory treatment for decommissioning trust funds, we have deferred realized and unrealized gains and losses

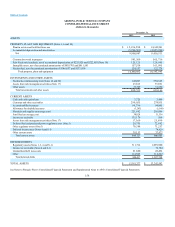

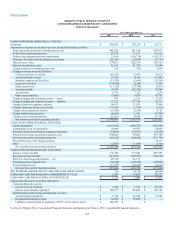

(including other-than-temporary impairments on investment securities) in other regulatory liabilities . The following table includes the unrealized gains and

losses based on the original cost of the investment and summarizes the fair value of APS’s nuclear decommissioning trust fund assets at December 31, 2013

and December 31, 2012 (dollars in millions):

150