APS 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

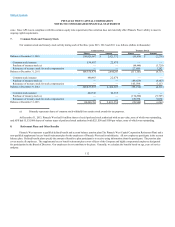

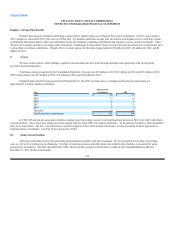

The investment strategies for these plans include external management of plan assets, and prohibition of investments in Pinnacle West securities.

The overall strategy of the pension plan’s IPS is to achieve an adequate level of trust assets relative to the benefit obligations. To achieve this

objective, the plan’s investment policy provides for mixes of investments including long-term fixed income assets and return-generating assets. The target

allocation between return-generating and long-term fixed income assets is defined in the IPS and is a function of the plan’s funded status. The plan’s funded

status is reviewed on at least a monthly basis.

Long-term fixed income assets, also known as liability-hedging assets, are designed to offset changes in the benefit obligations due to changes in

interest rates. Long-term fixed income assets consist primarily of fixed income debt securities issued by the U.S. Treasury, other government agencies, and

corporations. Long-term fixed income assets may also include interest rate swaps, U.S. Treasury futures and other instruments.

Return-generating assets are intended to provide a reasonable long-term rate of investment return with a prudent level of volatility. Return-generating

assets are composed of U.S. equities, international equities, and alternative investments. International equities include investments in both developed and

emerging markets. Alternative investments include investments in real estate, private equity and various other strategies. The plan may hold investments in

return-generating assets by holding securities in common and collective trusts.

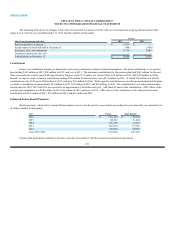

Based on the IPS, and given the pension plan’s funded status at year-end 2013, the long-term fixed income assets had a target allocation of 58% with

a permissible range of 55% to 61% and the return-generating assets had a target allocation of 42% with a permissible range of 45% to 39%. The return-

generating assets have additional target allocations, as a percent of total plan assets, of 22% equities in U.S. and other developed markets, 6% equities in

emerging markets, and 14% in alternative investments. The pension plan IPS does not provide for a specific mix of long-term fixed income assets, but does

expect the average credit quality of such assets to be investment grade. As of December 31, 2013, long-term fixed income assets represented 55% of total

pension plan assets, and return-generating assets represented 45% of total pension plan assets.

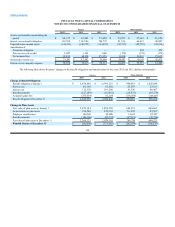

The asset allocation for other postretirement benefit plan assets is governed by the IPS for those plans, which provides for an asset allocation target

mix of generally 25% of fixed income assets and 75% of non-fixed income assets. This asset allocation target mix does not vary with the plan’s funded

status. As of December 31, 2013, investment in fixed income assets represented 38% of the other postretirement benefit plan total assets, and non-fixed income

assets represented 62% of the other postretirement benefit plan’s assets. Fixed income assets are primarily invested in corporate bonds of investment-grade

U.S. issuers, and U.S. Treasuries. Non-fixed income assets are primarily invested in large cap U.S. equities in diverse industries, and international equities

in both emerging and developed markets.

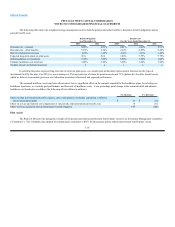

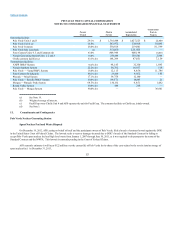

See Note 14 for a discussion on the fair value hierarchy and how fair value methodologies are applied. The plans invest directly in fixed income and

equity securities, in addition to investing indirectly in fixed income securities, equity securities and real estate through the use of common and collective

trusts. Equity securities held directly by the plans are valued using quoted active market prices from the published exchange on which the equity security

trades, and are classified as Level 1. Fixed income securities issued by the U.S. Treasury held directly by the plans are valued using quoted

117