APS 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

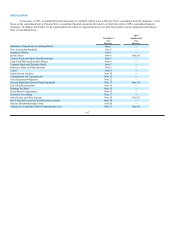

Table of Contents

ARIZONA PUBLIC SERVICE COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

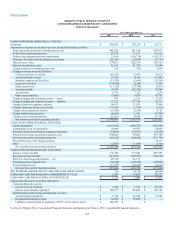

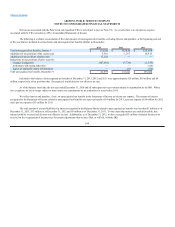

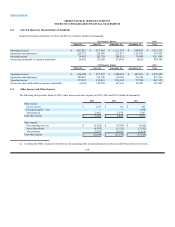

S-1. Income Taxes

APS is included in Pinnacle West’s consolidated tax return. However, when Pinnacle West allocates income taxes to APS, it is done based upon

APS’s taxable income computed on a stand-alone basis, in accordance with the tax sharing agreement.

Certain assets and liabilities are reported differently for income tax purposes than they are for financial statements purposes. The tax effect of these

differences is recorded as deferred taxes. We calculate deferred taxes using currently enacted tax rates.

APS has recorded regulatory assets and regulatory liabilities related to income taxes on its Balance Sheets in accordance with accounting guidance for

regulated operations. The regulatory assets are for certain temporary differences, primarily the allowance for equity funds used during construction and

pension and other postretirement benefits. The regulatory liabilities primarily relate to deferred taxes resulting from ITCs and the change in income tax rates.

In accordance with regulatory requirements, APS ITCs are deferred and are amortized over the life of the related property, with such amortization

applied as a credit to reduce current income tax expense in the statement of income.

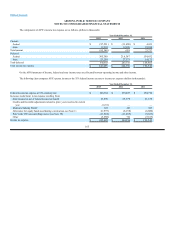

The $71 million long-term income tax receivable on APS’s Consolidated Balance Sheets as of December 31, 2012 represented the anticipated refund

related to an APS tax accounting method change approved by the IRS in the third quarter of 2009. On July 9, 2013, IRS guidance was released which

provided clarification regarding the timing and amount of this cash receipt. As a result of this guidance, uncertain tax positions decreased $67 million during

the third quarter. This decrease in uncertain tax positions resulted in a corresponding increase to the total anticipated refund due from the IRS and an offsetting

increase in long-term deferred tax liabilities. Additionally, as a result of this IRS guidance, the $138 million anticipated refund was reclassified to current

income tax receivable.

During the year ended December 31, 2013, the IRS finalized the examination of tax returns for the years ended December 31, 2008 and 2009, and the

$138 million anticipated refund was reduced by approximately $2 million to reflect the outcome of this examination. On December 17, 2013, the Joint

Committee on Taxation approved the anticipated refund. Cash related to this refund was received in the first quarter of 2014.

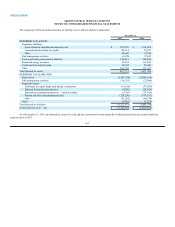

On September 13, 2013, the U.S. Treasury Department released final income tax regulations on the deduction and capitalization of expenditures

related to tangible property. These final regulations apply to tax years beginning on or after January 1, 2014. Several of the provisions within the regulations

will require a tax accounting method change to be filed with the IRS resulting in a cumulative effect adjustment. To account for the adoption of these

regulations plant-related long-term deferred tax liabilities decreased by $84 million, with the offsetting decrease to current deferred income tax assets. Prior to

the issuance of these regulations, this $84 million would have been repaid over 20 years through lower tax depreciation deductions.

163