APS 2013 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

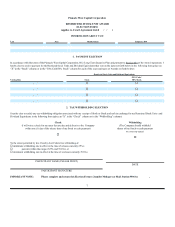

Performance Periods and in the lowest quartile in the other Performance Period, the average of these quartiles would be 3 (the average

of 4, 4, and 1) and the Average Performance Metric would be the 75 percentile (3 /4). The calculations in this Subsection

6(a)(7) will be verified by the Company’s internal auditors.

(8) If either EEI or SNL discontinues providing the data specified above, the Committee shall select a data source that, in the

Committee’s judgment, will provide data most comparable to the data provided by EEI or SNL, as the case may be. If the JD Power

Residential National Large Segment Survey for investor-owned utilities (or a successor JD Power survey) is not available during

each of the years of the Performance Period, the Performance Metric associated with the JD Power Residential Survey ( Subsection

6(a)(1)) will be disregarded and not included in the Company’s Average Performance for purposes of determining any Base Grant

adjustments pursuant to Subsection 5(b).

(b) Total Shareholder Return. “Total Shareholder Return” for the Performance Period is the measure of a company’s stock price

appreciation plus any dividends paid during the Performance Period. Only those companies that were included in the Growth Index in each

of the years of the Performance Period will be considered. Total Shareholder Return for the Company and the companies in the Growth

Index will be determined using the Daily Comparative Return as calculated by Bloomberg (or other independent third party data system). If

the Growth Index is discontinued, the Committee shall select the most comparable index then in use for the sector comparison. In addition,

if the sector comparison is no longer representative of the Company’s industry or business, the Committee shall replace the Growth Index

with the most representative index then in use. Once the Total Shareholder Returns of the Company and all relevant companies in the

Growth Index have been determined, the member companies will be ranked from greatest to least. Percentiles will be calculated (interpolated

from 0% to 100%) based on a company’s relative ranking. Percentiles will be carried out to one (1) decimal place. If the Company is not in

the Growth Index, then its percentile will be interpolated between the companies listed in the relative ranking. These calculations will be

verified by the Company’s internal auditors.

7. Termination of Award. This Award Agreement will terminate and be of no further force or effect on the date that Employee is no longer employed

by the Company or any of its Subsidiaries, whether due to voluntary or involuntary termination, death, retirement, disability, or otherwise, except as

specifically set forth in Section 4 above or in Article 15 of the Plan. Employee will, however, be entitled to receive any Stock and Dividend

Equivalents payable under Section 4 of this Award Agreement if Employee’s employment terminates after the end of the Performance Period but before

Employee’s receipt of such Stock and Dividend Equivalents.

8. Section 409A Compliance. If the Company concludes, in the exercise of its discretion, that this Award is subject to Section 409A of the Code, the

Plan and this Award Agreement shall be administered in compliance with Section 409A and each provision of this Award Agreement and the Plan

shall be interpreted to comply with Section 409A. If the Company concludes, in the exercise of its discretion, that this Award is not subject to

Section 409A, but, instead, is eligible for the short-term deferral exception to the requirements of Section 409A, the Plan and this Award Agreement

shall be administered to comply with the requirements of the short-term deferral exception to the requirements of Section 409A and each provision of

this Award Agreement and the Plan shall be interpreted to comply with the requirements of such exception. In either event, Employee does not have

any right to make any election regarding the time or form of any payment due under this Award Agreement other than the tax withholding election

described in Section 9.

9. Tax Withholding. Employee is responsible for any and all federal, state, and local income, payroll or other tax obligations or withholdings

(collectively, the “Taxes”) arising out of this Award. Employee shall pay any and all Taxes due in connection with a payout of Stock hereunder by

check or by having the Company withhold shares of Stock from such payout. No later than April 30, , Employee must elect, on the election

form attached hereto, how Employee will satisfy the tax

5

th