APS 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

Table of Contents

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

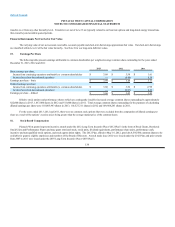

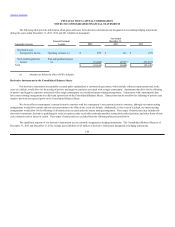

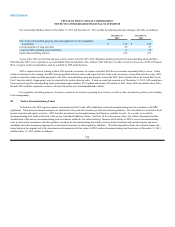

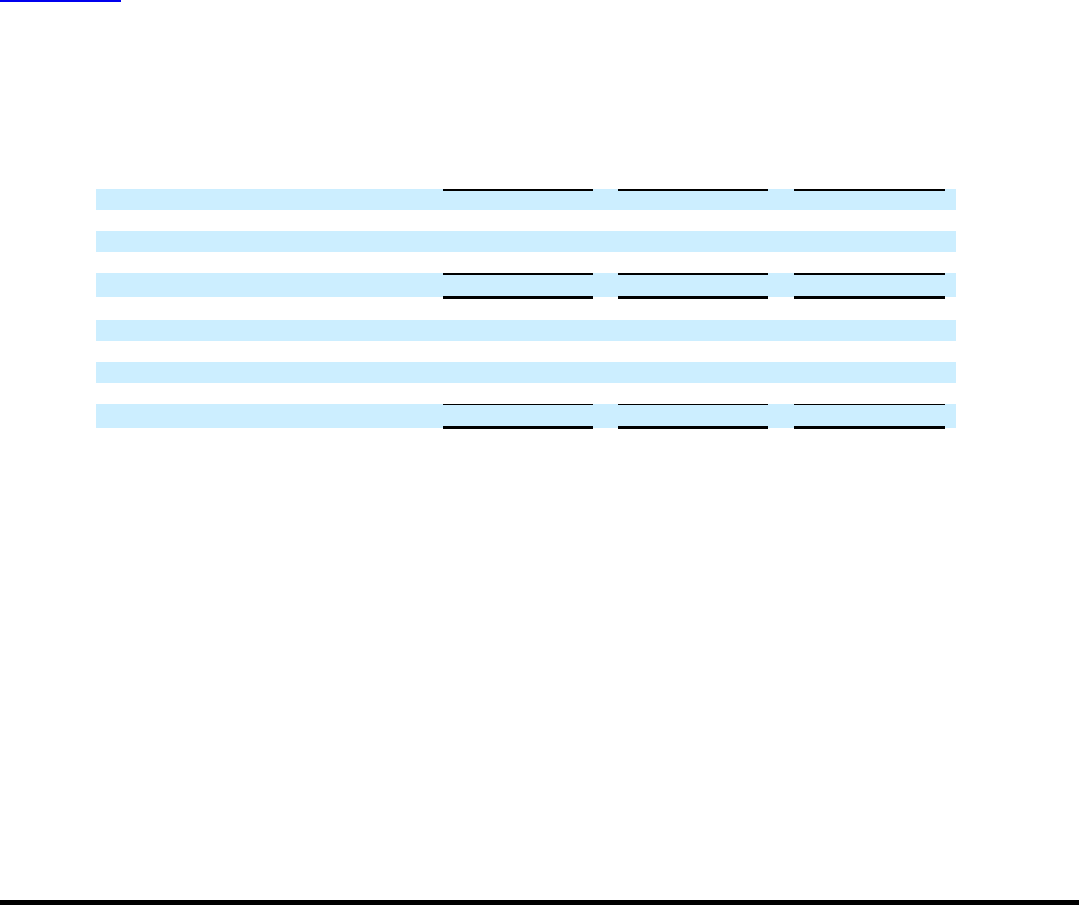

18. Other Income and Other Expense

The following table provides detail of other income and other expense for 2013, 2012 and 2011 (dollars in thousands):

2013 2012 2011

Other income:

Interest income $1,629 $1,239 $1,850

Investment gains — net — — 1,165

Miscellaneous 75 367 96

Total other income $1,704 $1,606 $3,111

Other expense:

Non-operating costs $(8,207) $ (7,777) $ (7,037)

Investment loss — net (3,711)(2,453) —

Miscellaneous (4,106)(9,612)(3,414)

Total other expense $(16,024)$ (19,842)$(10,451)

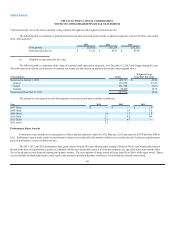

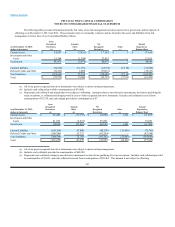

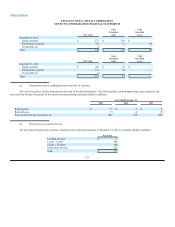

19. Palo Verde Sale Leaseback Variable Interest Entities

In 1986, APS entered into agreements with three separate VIE lessor trusts in order to sell and lease back interests in Palo Verde Unit 2 and related

common facilities. APS will pay approximately $49 million per year during 2014 and 2015 related to these leases. The lease agreements include fixed rate

renewal periods which give APS the ability to utilize the asset for a significant portion of the asset’s economic life, and therefore provide APS with the power to

direct activities of the VIEs that most significantly impact the VIEs’ economic performance. Predominately due to the fixed rate renewal periods, APS has been

deemed the primary beneficiary of these VIEs and therefore consolidates the VIEs.

On December 31, 2012, APS notified the lessor trust entities that APS will retain the assets beyond 2015 by either exercising the fixed rate lease

renewals or by purchasing the assets. If APS elects to purchase the assets, the purchase price will be based on the fair market value of the assets at the end of

2015. If APS elects to extend the leases, we will be required to make payments beginning in 2016 of approximately $23 million annually. The length of the

lease extensions is unknown at this time, as it must be determined through an appraisal process. APS must give notice to the lessor trusts by June 30, 2014

notifying them which of these two options (lease renewal or purchasing the assets) it will exercise. The December 31, 2012 notification does not impact APS’s

consolidation of the VIEs, as APS continues to be deemed the primary beneficiary of the VIEs.

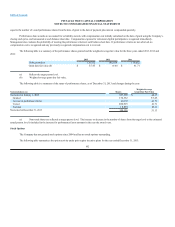

As a result of consolidation, we eliminate rent expense and recognize depreciation and interest expense, resulting in an increase in net income for

2013, 2012 and 2011 of $34 million, $32 million and $28 million, respectively, entirely attributable to the noncontrolling interests. Income attributable to

Pinnacle West shareholders remains the same. Consolidation of these VIEs also results in changes to our Consolidated Statements of Cash Flows, but does

not impact net cash flows.

149