APS 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Four Corners

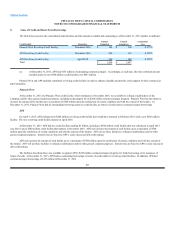

On December 30, 2013, APS purchased SCE’s 48% ownership interest in each of Units 4 and 5 of Four Corners. As a result of this purchase, APS

now owns 63% of Units 4 and 5. APS has a total entitlement from Four Corners of 970 MW. The final purchase price for the interest was approximately

$182 million. APS acquired assets and assumed certain of SCE’s decommissioning and mine reclamation obligations. We have recognized plant-in-service,

net of accumulated depreciation, of $316 million, which includes an acquisition adjustment of $255 million. In addition, we have recognized a liability of

$34 million for the decommissioning obligations, $93 million for the mine reclamation obligations, $18 million of other various liabilities, and $11 million of

construction work in progress relating to this purchase. These amounts are subject to revision during the measurement period, not to exceed one year, to the

extent additional information is obtained about the facts and circumstances that existed as of the acquisition date. While we expect the ACC to approve the

recovery of the acquisition adjustment, should recovery be disallowed, it will be reclassified from plant-in-service to goodwill, subject to impairment testing.

The decommissioning and mine reclamation obligations were recognized at their fair value. Because APS’s rates are regulated, APS expects to recover the costs

of the acquired plant assets, including a return on its investment based on its cost of capital. APS believes this return is consistent with what a market

participant would consider to be fair value in APS’s regulatory environment. Accordingly, APS believes the cost of the plant assets approximate their fair

value.

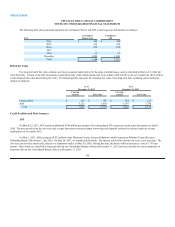

The 2012 Settlement Agreement includes a procedure to allow APS to request rate adjustments prior to its next general rate case related to APS’s

acquisition of additional interests in Units 4 and 5 and the related closure of Units 1-3 of Four Corners. APS made its filing under this provision on

December 30, 2013. This includes deferral for future recovery of all non-fuel operating cost for the acquired SCE interest in Four Corners, net of the non-fuel

operating costs savings resulting from the closure of Four Corners Units 1-3. The 2012 Settlement Agreement also provides for deferral for future recovery of

all unrecovered costs incurred in connection with the closure of Four Corners Units 1-3. The deferral balance related to the acquisition of SCE’s interest in

Units 4 and 5 and the closure of Four Corners Units 1-3 was $37 million as of December 31, 2013.

As part of APS’s acquisition of SCE’s interest in Units 4 and 5 of Four Corners, APS and SCE agreed, via a “Transmission Termination

Agreement,” that upon closing of the acquisition, the companies would terminate an existing transmission agreement (“Transmission Agreement”) between the

parties that provides transmission capacity on a system (the “Arizona Transmission System”) for SCE to transmit its portion of the output from Four

Corners to California. APS previously submitted a request to FERC related to this termination, which resulted in a FERC order denying rate recovery of $40

million that APS agreed to pay SCE associated with the termination. APS and SCE negotiated an alternate arrangement under which SCE will assign its

1,555 MW capacity rights over the Arizona Transmission System to third-parties, including 300 MW to APS’s marketing and trading group for

transmission of the additional power received from Four Corners. This arrangement becomes effective upon FERC approval and will remain in effect until the

net payments received by SCE in connection with the assignments reach $40 million, at which time the arrangement and the Transmission Agreement will

terminate. APS believes that FERC will approve the alternate arrangement as filed but, if not approved, SCE and APS will again be subject to the terms of the

Transmission Termination Agreement. As we previously disclosed, APS believes that the original denial by FERC of rate recovery under the Transmission

Termination Agreement constitutes the failure of a condition that relieves APS of its obligations under that agreement. If APS and SCE were unable to

determine a resolution through negotiation, the Transmission Termination Agreement requires that disputes be resolved through arbitration. APS is unable to

predict the outcome of this matter if it proceeds to arbitration.

100