APS 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

Table of Contents

Taxes other than income taxes. Taxes other than income taxes increased $11 million for the year ended December 31, 2012 compared with the

prior year, primarily because of higher property tax rates in the current year.

Other income (expenses), net. Other income (expenses), net, decreased $10 million for the year ended December 31, 2012 compared with the prior

year, primarily because of higher investment losses of approximately $2 million and other non-operating expenses of approximately $8 million in the current

year.

Interest charges, net of allowance for borrowed funds used during construction. Interest charges, net of allowance for borrowed funds used

during construction, decreased $24 million for the year ended December 31, 2012 compared with the prior year, primarily because of lower debt balances and

lower interest rates in the current year.

Income taxes. Income taxes were $53 million higher for the year ended December 31, 2012 compared with the prior year, primarily due to higher

pre-tax income in the current year and a lower effective tax rate in 2011.

Discontinued Operations

Results from discontinued operations decreased $17 million, primarily due to a contribution Pinnacle West made to SunCor’s estate as part of a

negotiated resolution to the bankruptcy (see Note 1) and absence of a gain related to the sale of our investment in APSES in 2011.

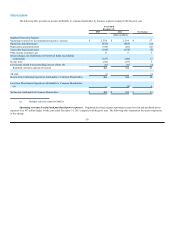

LIQUIDITY AND CAPITAL RESOURCES

Overview

Pinnacle West’s primary cash needs are for dividends to our shareholders and principal and interest payments on our indebtedness. The level of our

common stock dividends and future dividend growth will be dependent on declaration by our Board of Directors and based on a number of factors, including

our financial condition, payout ratio, free cash flow and other factors.

Our primary sources of cash are dividends from APS and external debt and equity issuances. An ACC order requires APS to maintain a common

equity ratio of at least 40%. As defined in the ACC order, the common equity ratio is total shareholder equity divided by the sum of total shareholder equity

and long-term debt, including current maturities of long-term debt. At December 31, 2013, APS’s common equity ratio, as defined, was 58%. Its total

shareholder equity was approximately $4.3 billion, and total capitalization was approximately $7.5 billion. Under this order, APS would be prohibited from

paying dividends if such payment would reduce its total shareholder equity below approximately $3.0 billion, assuming APS’s total capitalization remains the

same. This restriction does not materially affect Pinnacle West’s ability to meet its ongoing cash needs or ability to pay dividends to shareholders.

APS’s capital requirements consist primarily of capital expenditures and maturities of long-term debt. APS funds its capital requirements with cash

from operations and, to the extent necessary, external debt financing and equity infusions from Pinnacle West.

61