Singapore Airlines 2016 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Accounting for aircra related assets and carrying values

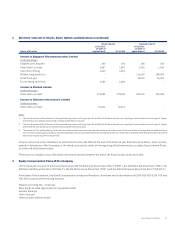

Refer to note 2(h) ‘Property, plant and equipment’, note 2(i) ‘Depreciation of property, plant and equipment’, note 3(a) ‘Impairment of property, plant and

equipment – aircra fleet’ and note 3(b) ‘Depreciation of property, plant and equipment – aircra fleet’ for the relevant accounting policy and a discussion

of significant accounting estimates.

The key audit matter How the matter was addressed in our audit

The accounting for aircra has a material impact on Singapore Airlines due

to the cumulative value of the aircra and long lived nature of these assets.

The key aspects requiring judgement include:

• Thedeterminationoftheusefullivesandresidualvaluesofthe

aircra. This takes into account physical, economic and commercial

considerations;

• Thedeterminationofcomponentsofaircra;and

• Reviewingofcarryingvaluesofaircraallocatedtodierentparts

of the business that use the aircra (cash generating units (CGUs)).

When it is necessary to test whether the asset values are impaired,

the carrying value of all assets in the CGU are compared to an

estimate of the amount that can be recovered from each CGU, based

on discounted future cash flows. This requires an estimate to be

made of future revenues, operating costs, capital expenditure and

discount rates for each CGU.

The assessment of these judgements is a key focus area of our audit.

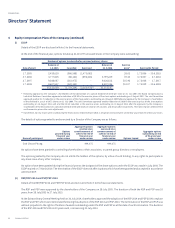

We compared the estimates of useful lives and residual values to the

Singapore Airlines’ fleet plan, recent aircra transactions and contractual

rights. We assessed the determination of the significant components of

aircra assets against our understanding of significant components of

aircra as identified across the aviation industry.

We assessed the determination of the dierent CGUs that make up Singapore

Airlines, based on our understanding of the nature of Singapore Airlines’

business and the economic environment in which its segments operate.

We reviewed the potential indicators of impairment that would require

impairment testing of CGUs. Where a CGU required testing, we challenged

the forecast future revenues, operating costs, capital expenditure and

discount rates based on our knowledge of the business and the aviation

industry. We assessed the accuracy of the discounted cash flow models

by re-performing the mathematical calculations.

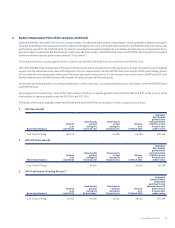

Findings

We found that the estimates of useful lives and residual values were balanced and residual values are adjusted appropriately to reflect Singapore

Airlines’ fleet plans. Upon acquisition, components of aircra are aggregated. Major inspection events are capitalised upon occurrence as components

and they are depreciated over an appropriate useful life.

Where CGU testing was required to be conducted, cash flow forecasting was found to be in accordance with approved plans and to be balanced overall.

Annual Report FY2015/16 97