Singapore Airlines 2016 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

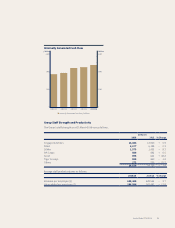

Total Assets ($ Million) NAV Per Share ($)

Equity Holders' Funds ($ Million)

Group Equity Holders' Funds, Total Assets and

Net Asset Value (NAV) per Share

30,000

25,000

20,000

15,000

10,000

5,000

0

14

12

10

8

6

4

2

0

Dollars$ Million

2012 2013 2014 2015 2016

Group Net Liquid Assets

5,000

4,000

3,000

2,000

1,000

0

5,000

4,000

3,000

2,000

1,000

0

$ Million $ Million

2012 2013 2014 2015 2016

Net Liquid Assets ($ Million)

R2 Net liquid assets is defined as the sum of cash and bank balances, and short-term investments, net of finance lease commitments, loans and

bonds issued.

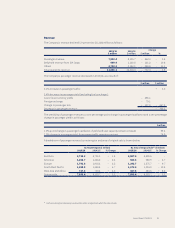

As at 31 March 2016, equity attributable to owners of

the Parent increased by $291 million or 2.3 per cent to

$12,755 million, largely due to profit for the financial

year (+$804 million), and fair value movements on

cash flow hedges (+$121 million) and available-for-sale

financial assets (+$109 million). These were partially

oset by acquisition of a non-controlling interest in Tiger

Airways (-$335 million), payment of dividends (-$315

million) and purchase of treasury shares (-$85 million).

The fair value change on cash flow hedges was primarily

attributable to fair value changes on fuel hedges, while

the movement on available-for-sale financial assets

was mainly due to a fair value adjustment for SIA

Engineering Company Limited’s (“SIAEC”) interest in

Hong Kong Aero Engine Services Ltd (“HAESL”) arising

from the proposed divestment of its 10 per cent stake

in HAESL to Rolls-Royce Overseas Holdings Limited and

Hong Kong Aircra Engineering Company Limited. The

completion of this transaction is conditional upon the

approval of relevant national competition authorities.

Total Group assets decreased by $152 million or 0.6

per cent to $23,770 million as at 31 March 2016, mainly

attributable to a decrease in cash balances (-$1,070

million) and trade debtors (-$270 million), partially

oset by increase in property, plant and equipment

(+$620 million), investments (+$345 million) and a loan

to an associated company (+$62 million). The decrease

in cash balances largely arose from capital expenditure

(-$2,909 million), additional investment in Tiger

Airways in the Voluntary General Oer (-$458 million),

redemption of the five-year retail bonds (-$300 million),

and payment of dividends (-$315 million), partially

funded by operational cash inflows (+$3,005 million).

Net asset value per share increased 2.8 per cent to $10.96.

Total Group liabilities decreased by $355 million or 3.2 per

cent to $10,637 million as at 31 March 2016. The decrease

was attributable to the repayment of the retail bonds

(-$300 million) and reduction in derivative liabilities

(-$292 million), partially oset by an increase in sales in

advance of carriage (+$162 million), deferred account

(+$84 million) and deferred taxation (+$82 million).

The Group’s net liquid assetsR2 decreased by $179 million

to $3,293 million as at 31 March 2016, attributable to a

reduction in cash and bank balances (-$1,070 million),

partially oset by higher short-term investments

(+$499 million), and reduction in total debt (+$392

million) arising primarily from the redemption of the

$300 million retail bonds. Total debt to equity ratio

decreased by 0.03 times to 0.11 times as at 31 March 2016.

Financial Position

Annual Report FY2015/16 47