Singapore Airlines 2016 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LTK/BBL

Finance Charges

Finance charges were $2 million or 4.5 per cent lower,

mainly due to repayment of the $300 million five-year

retail bond during the financial year.

Interest Income

Interest income was $8 million or 9.8 per cent higher,

mainly due to higher interest from deposits, bonds, fixed

rate notes, investment funds, and loans extended to

Virgin Australia and Scoot.

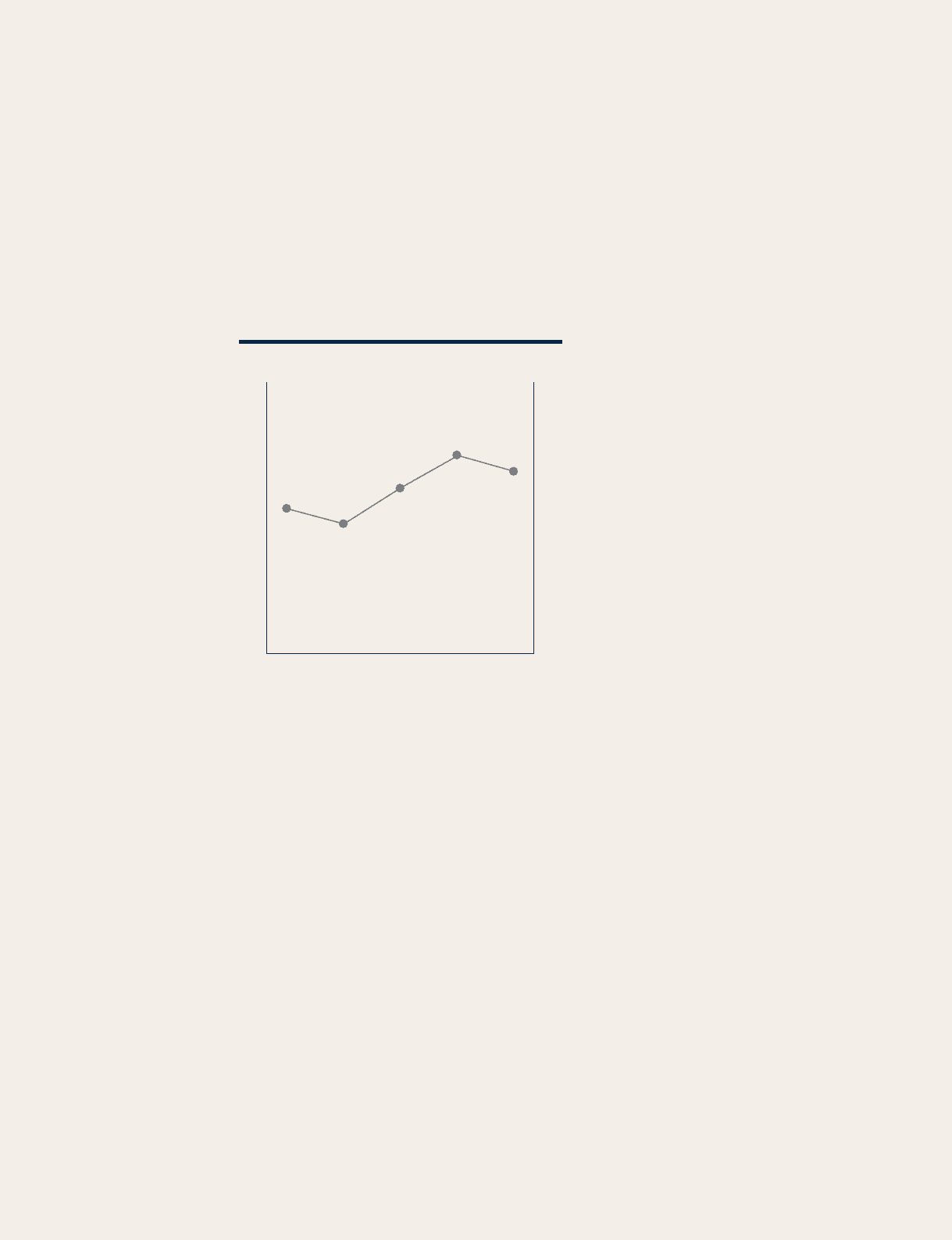

Fuel Productivity of Passenger Fleet

440

430

420

410

400

440

430

420

410

400

LTK/BBL

2011/12 2012/13 2013/14 2014/15 2015/16

Fuel Productivity and Sensitivity Analysis

Fuel productivity as measured by load tonne-km

per barrel (ltk/BBL) decreased marginally over the

preceding year to 427ltk/BBL. This was mainly due to

lower bellyhold load factor.

Surplus on Disposal of Aircra, Spares and

Spare Engines

The $4 million gain on disposal of aircra, spares and

spare engines pertained mainly to gain from sale of

buyer furnished equipment and spares. Last year’s

$37 million gain arose mainly from the sale and

leaseback of three 777-300ERs and sale of one

777-200 aircra.

Dividends from Subsidiary and

Associated Companies

Dividends from subsidiary and associated companies

were $80 million lower, mainly due to absence of special

dividend declared by SIAEC in the prior year.

Dividends from Long-Term Investments

Dividends from long-term investments were $90 million

higher, primarily attributable to special dividend

declared by Everest Investment Holdings Limited,

formerly known as Abacus International Holdings

Limited, following sale of its 65.0 per cent investment

in Abacus International Pte Ltd to Sabre Technology

Enterprises II Ltd.

Other Non-operating Items

Other non-operating items in 2015/16 comprised

mainly gain on sale of flight simulators to Airbus Asia

Training Centre (“AATC”) ($13 million), and surplus

on divestment of Abacus Travel Systems ($5 million),

partially oset by additional impairment on two

grounded 777-200 aircra ($9 million), and impairment

loss on a long-term investment ($8 million). Last year’s

non-operating items pertained mainly to impairment

losses on the Company’s investment in Singapore

Flying College Pte Ltd ($43 million), and two grounded

777-200 aircra ($22 million).

Taxation

There was a net tax expense of $94 million, comprising

current tax charge of $104 million and deferred tax

credit of $10 million.

As at 31 March 2016, the Company’s deferred taxation

account stood at $1,347 million.

A change in fuel productivity (passenger aircra)

of 1.0 per cent would impact the Company’s annual

fuel cost by about $26 million, before accounting for

changes in fuel price, US dollar exchange rate and

flying operations.

A change in the price of fuel of one US dollar per barrel

aects the Company’s annual fuel cost by about $41

million, before accounting for US dollar exchange rate

movements, and changes in volume of fuel consumed.

Annual Report FY2015/16 55