Singapore Airlines 2016 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

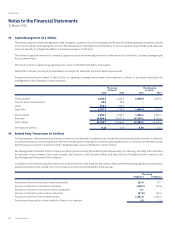

Notes to the Financial Statements

31 March 2016

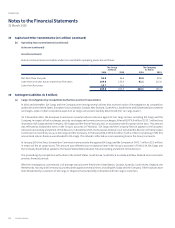

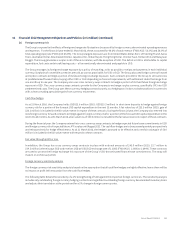

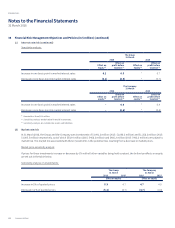

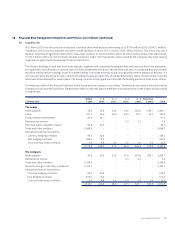

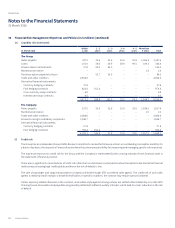

38 Financial Risk Management Objectives and Policies (in $ million) (continued)

(a) Jet fuel price risk

The Group’s earnings are aected by changes in the price of jet fuel. The Group’s strategy for managing the risk on fuel price, as defined by

BEC, aims to provide the Group with protection against sudden and significant increases in jet fuel prices. In meeting these objectives, the

fuel risk management programme allows for the judicious use of approved instruments such as swaps, options and collars with approved

counterparties and within approved credit limits.

Cash flow hedges

The Group manages this fuel price risk by using swap, option and collar contracts and hedging up to eight quarters forward using jet fuel

swap, option and collar, ICE Brent swap and Brent-MOPS crack swap contracts.

The Group has applied cash flow hedge accounting to these derivatives as they are considered to be highly eective hedging instruments.

A net fair value loss before tax of $610.7 million (2015: loss before tax of $952.9 million), with a related deferred tax credit of $103.8 million

(2015: deferred tax credit of $162.0 million), is included in the fair value reserve in respect of these contracts.

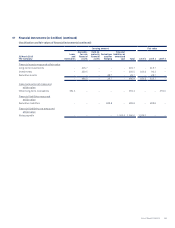

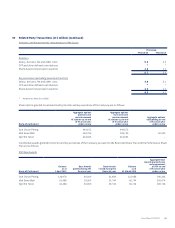

Jet fuel price sensitivity analysis

The jet fuel price risk sensitivity analysis is based on the assumption that all other factors, such as fuel surcharge and uplied fuel volume,

remain constant. Under this assumption, and excluding the eects of hedging, an increase in price of one USD per barrel of jet fuel aects

the Group’s and the Company’s annual fuel costs by $52.4 million and $41.3 million (FY2014/15: $50.0 million and $41.8 million) respectively.

The fuel hedging sensitivity analysis is based on contracts that are still outstanding as at the end of the reporting period and assumes that

all jet fuel, Brent and crack hedges are highly eective. Under these assumptions, with an increase or decrease in jet fuel prices, each by

one USD per barrel, the before tax eects on equity are set out in the table below.

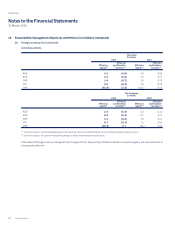

Sensitivity analysis on outstanding fuel hedging contracts:

The Group

31 March

The Company

31 March

2016 2015 2016 2015

Effect on equity Effect on equity

Increase in one USD per barrel 25.4 35.1 20.7 28.8

Decrease in one USD per barrel (25.4) (35.1) (20.7) (28.8)

Singapore Airlines200

FINANCIAL