Singapore Airlines 2016 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2016

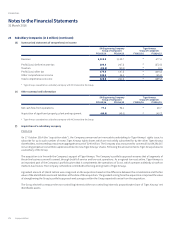

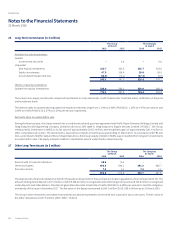

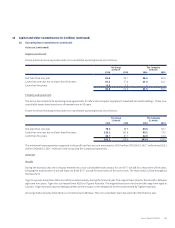

26 Long-Term Investments (in $ million)

The Group

31 March

The Company

31 March

2016 2015 2016 2015

Available-for-sale investments

Quoted

Government securities – 0.6 – 0.6

Unquoted

Non-equity investments 215.7 303.6 215.7 303.6

Equity investments 47.9 116.4 28.0 28.0

Accumulated impairment loss (18.5) (73.1) (17.3) (9.5)

245.1 347.5 226.4 322.7

Held-to-maturity investments

Quoted non-equity investments 528.0 580.1 528.0 580.1

773.1 927.6 754.4 902.8

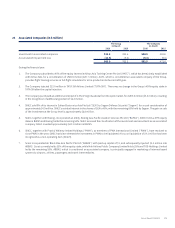

The Group’s non-equity investments comprised investments in corporate bonds, credit-linked notes, fixed-rate notes, certificates of deposits

and investment funds.

The interest rates for quoted and unquoted non-equity investments range from 1.30% to 3.96% (FY2014/15: 1.30% to 4.47%) per annum and

1.00% to 4.08% (FY2014/15: 2.57% to 5.31%) per annum respectively.

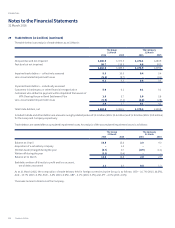

Reclassification to assets held for sale

During the financial year, the Group entered into a conditional sale and purchase agreement with Rolls-Royce Overseas Holdings Limited and

Hong Kong Aircra Engineering Company Limited to divest its 10% stake in Hong Kong Aero Engine Services Limited (“HAESL”). The Group

remeasured its investment in HAESL to its fair value of approximately $156.5 million, and recognised a gain of approximately $141.9 million in

other comprehensive income. The divestment is expected to complete in the financial year ending 31 March 2017. In accordance with FRS 105

Non-current Assets Held for Sale and Discontinued Operations, the Group’s equity interest in HAESL was reclassified from long-term investments

to assets held for sale. The equity interest in HAESL is classified as Level 2 under the fair value hierarchy.

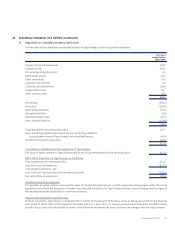

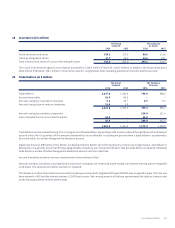

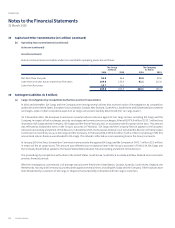

27 Other Long-Term Assets (in $ million)

The Group

31 March

The Company

31 March

2016 2015 2016 2015

Deposit with a financial institution 28.6 76.6 – –

Other receivables 460.8 496.1 391.3 426.7

Derivative assets 7.4 1.1 7.4 1.1

496.8 573.8 398.7 427.8

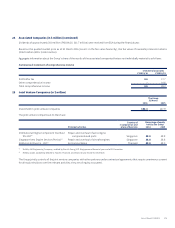

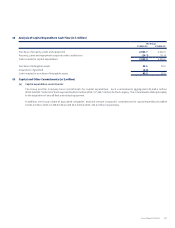

The deposit with a financial institution is held for the purpose of payment for the purchase price option payable on a finance lease (Note 19). The

amount relating to the deposit is $79.4 million, of which $28.6 million is recognised under other long-term assets and $50.8 million is recognised

under deposits and other debtors. The deposit generates interest at a fixed rate of 5.68% (FY2014/15: 5.68%) per annum to meet the obligation

at maturity of the lease in December 2017. The fair value of the deposit amounted to $84.1 million (2015: $86.0 million) as at 31 March 2016.

The Group’s other receivables are stated at amortised cost and are expected to be received over a period of two to ten years. The fair value of

the other receivables is $457.9 million (2015: $492.7 million).

Singapore Airlines182

FINANCIAL