Singapore Airlines 2016 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

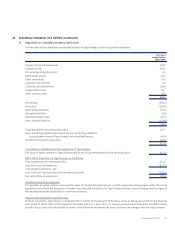

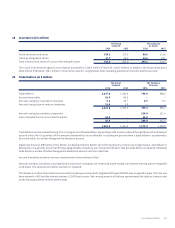

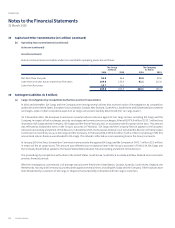

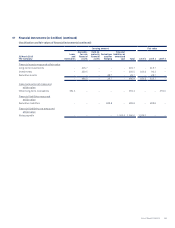

28 Inventories (in $ million)

The Group

31 March

The Company

31 March

2016 2015 2016 2015

Technical stocks and stores 154.2 173.0 88.6 111.6

Catering and general stocks 27.7 29.0 19.6 20.1

Total inventories at lower of cost and net realisable value 181.9 202.0 108.2 131.7

The cost of inventories recognised as an expense amounted to $118.4 million (FY2014/15: $106.0 million). In addition, the Group wrote down

$26.6 million (FY2014/15: $38.1 million) of inventories, which is recognised as other operating expenses in the profit and loss account.

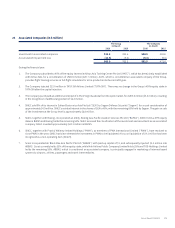

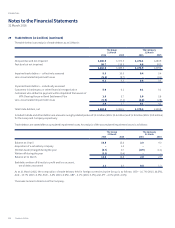

29 Trade Debtors (in $ million)

The Group

31 March

The Company

31 March

2016 2015 2016 2015

Trade debtors 1,137.8 1,380.8 798.9 998.2

Accrued receivables 61.9 86.2 – –

Amounts owing by associated companies 9.1 20.7 0.5 0.1

Amounts owing by joint venture companies 13.0 3.8 – –

1,221.8 1,491.5 799.4 998.3

Amounts owing by subsidiary companies – – 318.0 311.5

Loan receivable from an associated company 62.0 – 62.0 –

62.0 – 380.0 311.5

1,283.8 1,491.5 1,179.4 1,309.8

Trade debtors are non-interest bearing. The carrying amount of trade debtors impaired by credit losses is reduced through the use of an allowance

account unless the Group writes o the amount ascertained to be uncollectible. In subsequent periods when a trade debtor is ascertained to

be uncollectible, it is written o against the allowance account.

Significant financial diiculties of the debtor, probability that the debtor will enter bankruptcy or financial reorganisation, and default or

delinquency in payments (more than 90 days aging of debtor balances) are considered indicators that the trade debtor is impaired. Individual

trade debtor is written o when Management deems the amount not to be collectible.

Accrued receivables pertain to services rendered which have not been billed.

Amounts owing by subsidiary, associated and joint venture companies are unsecured, trade-related, non-interest bearing and are repayable

on demand. The amounts are neither overdue nor impaired.

The interest on a short-term loan to an associated company was computed using Bank Bill Swap Bid Rate plus an agreed margin. The loan was

denominated in AUD and the interest rate was 10.345% per annum. Net carrying amount of the loan approximates fair value as interest rates

on the loan approximate market interest rates.

Annual Report FY2015/16 183