Singapore Airlines 2016 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Financial Statements

31 March 2016

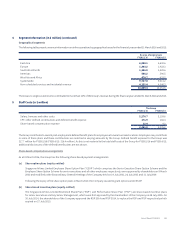

2 Summary of Significant Accounting Policies (continued)

(ah) Derivative financial instruments and hedging (continued)

Derivatives are classified as fair value through profit or loss unless they qualify for hedge accounting. Hedges which meet the criteria for

hedge accounting are accounted for as cash flow hedges.

For cash flow hedges, the eective portion of the gain or loss on the hedging instrument is recognised directly in the fair value reserve

Note 16(d), while the ineective portion is recognised in the profit and loss account.

Amounts taken to the fair value reserve are transferred to the profit and loss account when the hedged transaction aects profit or loss,

such as when a forecast sale or purchase occurs. If the hedged item is a non-financial asset or liability, the amounts taken to the fair value

reserve are transferred to the initial carrying amount of the non-financial asset or liability.

If the hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, is terminated or exercised, or the designation

is revoked, hedge accounting is discontinued prospectively. If the forecast transaction is no longer expected to occur, the balance in equity

is reclassified to profit or loss.

(ai) Non-current assets held for sale

Non-current assets classified as held for sale are measured at the lower of their carrying amount and fair value less costs to sell. Non-

current assets are classified as held for sale if their carrying amounts will be recovered principally through a sale transaction rather than

continuing use. Property, plant and equipment, once classified as held for sale, are not depreciated or amortised.

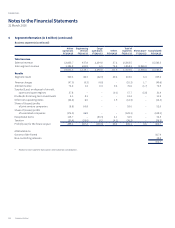

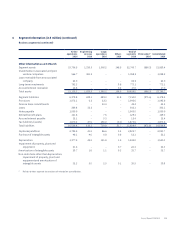

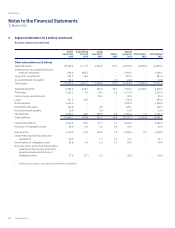

(aj) Segment reporting

(i) Business segment

For management purposes, the Group is organised into operating segments based on the nature of the services provided which are

independently managed by the respective segment managers responsible for the performance of the respective segments under

their charge. The segment managers report directly to corporate management who regularly review the segment results in order to

allocate resources to the segments and to assess the segment performance. Additional disclosures on each of these segments are

shown in Note 4, including the factors used to identify the reportable segments and the measurement basis of segment information.

The significant business segments of the Group are airline operations, engineering services and cargo operations.

(ii) Geographical segment

The analysis of revenue by area of original sale from airline operations is derived by allocating revenue to the area in which the

sale was made. Revenue from other operations, which consist principally of engineering services and cargo operations, is derived

in East Asia and is therefore, not shown.

Assets, which consist principally of flight and ground equipment, support the entire worldwide transportation system, and are

mainly located in Singapore. An analysis of assets and capital expenditure of the Group by geographical distribution has therefore

not been included.

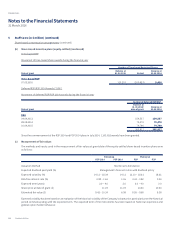

(ak) Exceptional items

Exceptional items are separate items of income and expense of such size, nature or incidence that their separate disclosure is relevant to

explain the performance of the Group for the year.

Singapore Airlines134

FINANCIAL