Singapore Airlines 2016 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2016

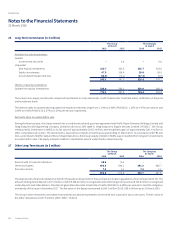

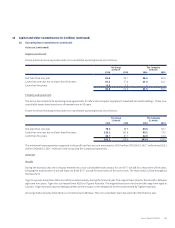

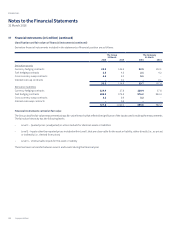

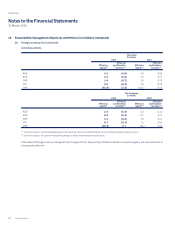

37 Financial Instruments (in $ million)

Classification and fair values of financial instruments

Financial assets and financial liabilities are measured on an ongoing basis either at fair value or at amortised cost. The principal accounting

policies in Note 2 describe how the classes of financial instruments are measured, and how revenue and expenses, including fair value gains

and losses, are recognised.

The carrying amounts and fair values of financial assets and financial liabilities, including their levels in the fair value hierarchy are as follows.

It does not include fair value information for financial assets and financial liabilities not measured at fair value if the carrying amount is a

reasonable approximation of fair value.

The classifications of financial assets that are not measured at fair value and have carrying amounts which are a reasonable approximation of

fair value, are as follows:

• Loanreceivablefromanassociatedcompany,tradedebtors,amountsowingbysubsidiarycompanies,depositsandotherdebtors,and

cash and bank balances are classified as loans and receivables financial assets; and

• Quotednon-equityinvestmentsareclassifiedasheld-to-maturityfinancialassets.

All financial liabilities that are not measured at fair value and have carrying amounts which are a reasonable approximation of fair value are

classified as financial liabilities at amortised cost.

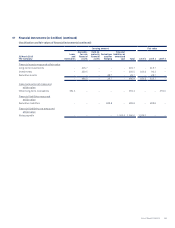

Carrying amount Fair value

31 March 2016

The Group

Loans

and

receivables

Available-

for-sale

financial

assets

Held-to-

maturity

financial

assets

Derivatives

used for

hedging

Financial

liabilities at

amortised

cost Total Level 1 Level 2 Level 3

Financial assets measured at fair value

Long-term investments – 215.7 – – – 215.7 – 215.7 –

Investments – 316.7 – – – 316.7 226.4 90.3 –

Derivative assets – – – 32.3 – 32.3 – 32.3 –

Assets held for sale – 156.5 – – – 156.5 – 156.5 –

– 688.9 – 32.3 – 721.2 226.4 494.8 –

Financial assets not measured

at fair value

Deposit with a financial institution 79.4 – – – – 79.4 – – 84.1

Other long-term receivables 460.8 – – – – 460.8 – – 457.9

540.2 – – – – 540.2 – – 542.0

Financial liabilities measured

at fair value

Derivative liabilities – – – 727.8 – 727.8 – 727.8 –

Financial liabilities not measured

at fair value

Notes payable – – – – 1,000.0 1,000.0 1,036.3 – –

Loans – – – – 303.1 303.1 – – 320.5

Finance lease commitments – – – – 44.4 44.4 – – 44.4

Purchase option price payable – – – – 79.4 79.4 – – 83.8

– – – – 1,426.9 1,426.9 1,036.3 – 448.7

Singapore Airlines192

FINANCIAL