Singapore Airlines 2016 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

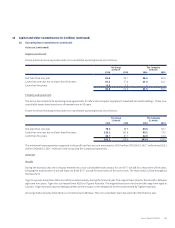

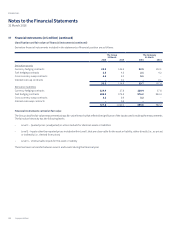

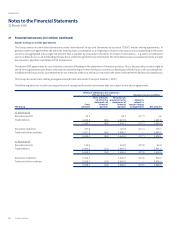

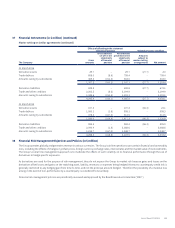

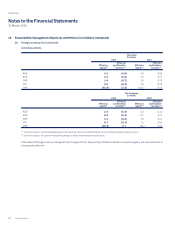

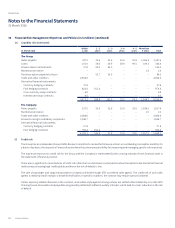

37 Financial Instruments (in $ million) (continued)

Master netting or similar agreements (continued)

Effects of offsetting in the statement

of financial position Related amounts not offset

The Company

Gross

amounts

Gross amounts

set-off in the

statements

of financial

position

Net amounts

presented in the

statements

of financial

position

Amounts

subject to

master netting

arrangements Net amount

31 March 2016

Derivative assets 29.7 – 29.7 (27.7) 2.0

Trade debtors 808.0 (8.6) 799.4 – 799.4

Amounts owing by subsidiaries 469.5 (151.5) 318.0 – 318.0

1,307.2 (160.1) 1,147.1 (27.7) 1,119.4

Derivative liabilities 699.8 – 699.8 (27.7) 672.1

Trade and other creditors 2,203.5 (8.6) 2,194.9 – 2,194.9

Amounts owing to subsidiaries 1,342.6 (151.5) 1,191.1 – 1,191.1

4,245.9 (160.1) 4,085.8 (27.7) 4,058.1

31 March 2015

Derivative assets 107.4 – 107.4 (86.3) 21.1

Trade debtors 1,000.1 (1.8) 998.3 – 998.3

Amounts owing by subsidiaries 478.5 (167.0) 311.5 – 311.5

1,586.0 (168.8) 1,417.2 (86.3) 1,330.9

Derivative liabilities 982.2 – 982.2 (86.3) 895.9

Trade and other creditors 2,090.4 (1.8) 2,088.6 – 2,088.6

Amounts owing to subsidiaries 1,215.7 (167.0) 1,048.7 – 1,048.7

4,288.3 (168.8) 4,119.5 (86.3) 4,033.2

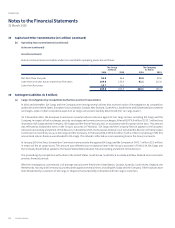

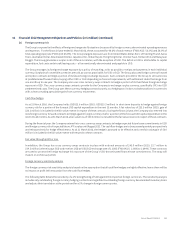

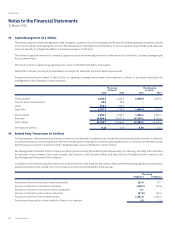

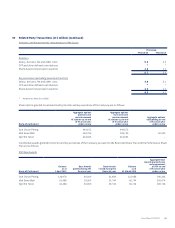

38 Financial Risk Management Objectives and Policies (in $ million)

The Group operates globally and generates revenue in various currencies. The Group’s airline operations carry certain financial and commodity

risks, including the eects of changes in jet fuel prices, foreign currency exchange rates, interest rates and the market value of its investments.

The Group’s overall risk management approach is to moderate the eects of such volatility on its financial performance through the use of

derivatives to hedge specific exposures.

As derivatives are used for the purpose of risk management, they do not expose the Group to market risk because gains and losses on the

derivatives oset losses and gains on the matching asset, liability, revenues or expenses being hedged. Moreover, counterparty credit risk is

generally restricted to any hedging gain from time to time, and not the principal amount hedged. Therefore the possibility of a material loss

arising in the event of non-performance by a counterparty is considered to be unlikely.

Financial risk management policies are periodically reviewed and approved by the Board Executive Committee (“BEC”).

Annual Report FY2015/16 199