Singapore Airlines 2016 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Summary of Significant Accounting Policies (continued)

(c) Standards issued but not yet eective

The Accounting Standards Council announced on 29 May 2014 that Singapore-incorporated companies listed on the Singapore Exchange

(“SGX”) will apply a new financial reporting framework identical to the International Financial Reporting Standards (“IFRS”)from the

financial year ending 31 December 2018 onwards. Singapore-incorporated companies listed on SGX will have to assess the impact of

IFRS 1: First-time adoption of IFRS when transitioning to the new reporting framework. The Group is currently assessing the impact of

transitioning to the new reporting framework on its financial statements.

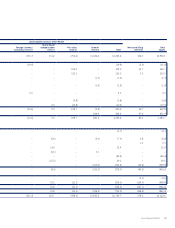

Description Effective from

FRS 114 Regulatory Deferral Accounts 1 April 2016

Amendments to FRS 1: Disclosure Initiative 1 April 2016

Amendments to FRS 16 Property, Plant and Equipment and FRS 41: Agriculture: Bearer Plants 1 April 2016

Amendments to FRS 27: Equity Method in Separate Financial Statements 1 April 2016

Amendments to FRS 16 and FRS 38: Clarification of Acceptable Methods of Depreciation and Amortisation 1 April 2016

Amendments to FRS 111: Accounting for Acquisitions of Interest in Joint Operations 1 April 2016

Amendments to FRS 110 and FRS 28: Sale or Contribution of Assets between an Investor and its Associate or

Joint Venture To be determined

Improvements to FRS (November 2014) 1 April 2016

Amendments to FRS 7: Amendment relating to disclosure of changes in liabilities arising from financing activities 1 April 2017

Amendments to FRS 12: Recognition of Deferred Tax Assets for Unrealised Losses 1 April 2017

FRS 115 Revenue from Contracts with Customers 1 April 2018

FRS 109 Financial Instruments 1 April 2018

Except for FRS 115 and FRS 109, the Management expects that the adoption of the other standards and interpretations above will have

no material impact on the financial statements in the period of initial application. The nature of the impending changes in accounting

policy on adoption of FRS 115 and FRS 109 are described below:

FRS 115 Revenue from Contracts with Customers

FRS 115 was issued in November 2014 and establishes a new five-step model that will apply to revenue arising from contracts with

customers. Under FRS 115, revenue is recognised at an amount that reflects the consideration to which an entity expects to be entitled

in exchange for transferring goods or services to a customer. The principles in FRS 115 provide a more structured approach to measuring

and recognising revenue. The new revenue standard is applicable to all entities and will supersede all current revenue recognition

requirements under FRS. Either a full or modified retrospective application is required when the Group is required to adopt it on 1 April

2018; early adoption is permitted. The Group is currently assessing the impact of FRS 115.

Annual Report FY2015/16 115