Singapore Airlines 2016 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.selected peer group of leading full service carriers.

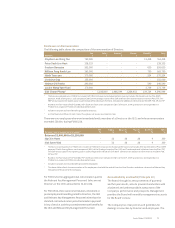

The above performance measures are selected as key

measurements of wealth creation for shareholders.

The final award will cli vest aer completion of the

performance period.

The Group has attained an achievement factor which

is reflective of outperforming / fully meeting / partially

meeting / not meeting the pre-determined target

performance level for PSP awards granted based on

the performance period from FY2013/14 to FY2015/16.

ii. The SIA Restricted Share Plan 2014 (“RSP 2014”)

The RSP 2014 is targeted at a broader base of senior

executives and enhances the Company’s ability to

recruit and retain talented senior executives, as well

as to reward for Group, Company and individual

performance. To retain key executives, an extended

vesting period of a further two years is imposed

beyond the initial two-year performance period.

Under the RSP 2014, an initial award is made in the form

of rights to shares, provided performance conditions are

met in future. Annual grants are made based on position

level and individual performance of the key executives

selected to participate in the RSP 2014. Final awards may

vary between 0-150% of the initial award, depending

on the extent to which targets based on Group and

Company EBITDAR Margin and Group and Company

Sta Productivity are met. The performance measures

are selected as they are key drivers of shareholder

value and are aligned to the Group and the Company’s

business objectives. The final award is subject to

extended vesting, with 50% of the final award paid out at

the end of the two-year performance period, and the rest

paid out equally over the next two years.

The Group has attained an achievement factor which

is reflective of outperforming / fully meeting / partially

meeting / not meeting the pre-determined target

performance level for RSP awards granted based on

the performance period from FY2014/15 to FY2015/16.

iii. The SIA Deferred Share Award (“DSA”)

As part of the SIP, the DSA is a share award established

with the objective of rewarding, motivating and

retaining Senior Management, who are responsible

for strategic initiatives. The DSA is granted as a

contingent share award under the RSP 2014. The final

award, which includes the Accumulated Dividend

Yield (based on the sum of SIA share dividend yields

declared with ex-dividend dates occurring during the

vesting period), will cli vest at the end of three years

aer the grant date, subject to meeting a three-year

service-based condition, and provided that individual

performance remains satisfactory.

Under the PSP 2014 and RSP 2014, the total number

of shares which may be delivered (whether in the

form of shares or cash in lieu of shares) is subject

to a maximum limit of 5% of the total number of

issued shares (excluding treasury shares). In addition,

the total number of shares under awards to be

granted under the PSP 2014 and RSP 2014 from the

forthcoming Annual General Meeting to the next

Annual General Meeting (the “Relevant Year”) shall

not exceed 0.5% of the total number of issued shares

(excluding treasury shares) from time to time (the

“Yearly Limit”). However, if the Yearly Limit is not

fully utilised during the Relevant Year, any unutilised

portion of the Yearly Limit can be used for grants of

awards in subsequent years.

The SIA Employee Share Option Plan (“ESOP”) expired

in 2010.

Senior Management are required to hold a portion

of the shares released to them under a share

ownership guideline which requires them to maintain

a beneficial ownership stake in the Company, thus

further aligning their interests with shareholders.

Details of the PSP 2014, RSP 2014, DSA and ESOP

can be found on pages 87 to 91 of the Directors’

Statement.

In the event of a misstatement of financial results or of

misconduct resulting in financial loss to the Company

as deemed by the BCIRC, the BCIRC may, in its absolute

discretion, reclaim unvested incentive components of

remuneration from Senior Management.

Annual Report FY2015/16 69