Singapore Airlines 2016 Annual Report Download

Download and view the complete annual report

Please find the complete 2016 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STRENGTHENING

A POSITION OF

LEADERSHIP

Annual Report FY2015/16

MCI (P) 100/05/2016

Table of contents

-

Page 1

MCI (P) 100/05/2016 STRENGTHENING A POSITION OF LEADERSHIP Annual Report FY2015/16 -

Page 2

Mission Statement Singapore Airlines is a global company dedicated to providing air transportation services of the highest quality and to maximising returns for the benefit of its shareholders and employees. On the Cover The Group is well positioned to compete in the challenging operating ... -

Page 3

... and Services 32 People Development 34 Environment 35 Community Engagement 36 Subsidiaries 44 Financial Review 60 Awards GOVERNANCE 62 Statement on Risk Management 63 Corporate Governance Report 75 Membership and Attendance of Singapore Airlines Limited 76 Further Information on Board of Directors... -

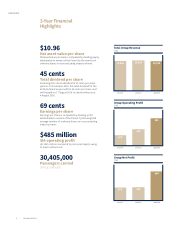

Page 4

... share paid on 27 November 2015, the total dividend for the 2015/16 financial year will be 45 cents per share, and will be paid on 17 August 2016 to shareholders as at 4 August 2016. 2013/14 2014/15 2015/16 69 cents Earnings per share Earnings per share is computed by dividing profit attributable... -

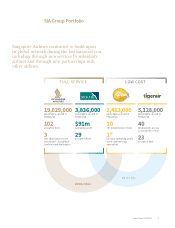

Page 5

SIA Group Portfolio Singapore Airlines continued to build upon its global network during the last financial year, including through new services by subsidiary airlines and through new partnerships with other airlines. FULL SERVICE LOW COST ,836,000 2,412,000 19,029,000 3 5,128,000 passengers ... -

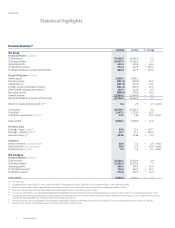

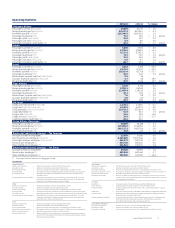

Page 6

... : equity ratio (times) R3 Value added Per Share Data Earnings - basic (cents) R4 Earnings - diluted (cents) R5 Net asset value ($) R6 Dividends Interim dividend (cents per share) Final dividend (cents per share) Dividend cover (times) R7 The Company Financial Results ($ million) Total revenue Total... -

Page 7

.../ltk) Cargo unit cost (cents/ctk) Cargo breakeven load factor (%) Group Airlines (Passenger) Passengers carried (thousand) Revenue passenger-km (million) Available seat-km (million) Passenger load factor (%) Employee Productivity (Average) - The Company Average number of employees Seat capacity per... -

Page 8

...the world's largest passenger aircraft, the Airbus A380, on the Airline's first-ever charity flight 29 September KrisFlyer programme expands to allow members to earn and redeem miles on Scoot and Tigerair 25 June Singapore Airlines serves iconic Peranakan dishes specially developed with Ms Shermay... -

Page 9

... first A350-900 from the Airbus Delivery Centre in Toulouse Singapore Airlines announces launch of 'Companion App' - the first-of-itskind mobile application that offers customers greater control of their inflight entertainment experience even before boarding the aircraft Annual Report FY2015/16 7 -

Page 10

Configuring a Multi-Hub Strategy Complementing our strong Singapore Hub, our multi-hub strategy provides access to the large and growing markets of India and Thailand. This adds new engines of growth to our business. 8 Singapore Airlines -

Page 11

EQUITY HOLDING 49% 49% OF VISTARA OF NOKSCOOT The SIA Group has a direct presence in India through Vistara, a full-service carrier based in New Delhi. NokScoot is owned by Singapore Airlines' subsidiary Scoot and Thai carrier Nok Air. Annual Report FY2015/16 9 -

Page 12

... Premium Positioning Offering best-in-class products and services across a wide global network, we continue to further develop Singapore Airlines' positioning as a premium full-service airline. Our constant investment in customer service, new cabin products, upgraded lounges and the new Premium... -

Page 13

... and travel. US$ PREMIUM ECONOMY CLASS PRODUCTS 80m A350 INNOVATIVE NEW FLEET With the inaugural long-haul flight to Amsterdam on 9 May 2016, and the re-start of non-stop flights to the United States in 2018. Annual Report FY2015/16 11 Entered service in August 2015 after a two-year development... -

Page 14

Developing New Opportunities Singapore Airlines has expanded beyond the traditional focus on ticket revenues by driving top-line growth through new revenue and new business initiatives. Such initiatives include the training of pilots through a joint venture with Airbus. 12 Singapore Airlines -

Page 15

...TRAINEES TO BE TRAINED AT THE AIRBUS ASIA TRAINING CENTRE EACH YEAR A joint venture owned by Airbus and Singapore Airlines, when fully operational, will be Airbus' largest flight crew training facility with eight full-flight simulators and extensive classroom facilities. Annual Report FY2015/16 13 -

Page 16

STRATEGY Our Strategy for the Future The SIA Group fleet and network are expanding in support of the development of our portfolio strategy, in which we have investments in both full-service and low-cost airline operations. Our portfolio of airlines serving short-, mediumand long-haul markets gives... -

Page 17

...-hub strategy to set up hubs outside of Singapore and to create new engines of growth in key markets. 03 Strengthening Premium Positioning SIA is committed to the constant enhancement of the three main pillars of our brand promise. SERVICE EXCELLENCE The CEM (Customer Experience Management) System... -

Page 18

... low-cost segments of the market; adding new hubs through joint venture airlines in other parts of the world; developing adjacent businesses to introduce new streams of revenue; and strengthening our premium positioning through continued investment in our products, services and network. Development... -

Page 19

... Airline Company Singapore Airlines continued to invest heavily in its premium products and services during the financial year. Premium Economy Class was launched in August and has been well received by customers to date, more lounges were revamped with a new design concept that has won much public... -

Page 20

... Between December 2001 and December 2004, Mr Seah served as President & CEO of Singapore Technologies Pte Ltd. Mr Seah was awarded the Distinguished Service Order in 2012 and the Public Service Star (Bintang Bakti Masyarakat) in 1999, and made a Justice of the Peace in 2003. 18 Singapore Airlines -

Page 21

...owns and manages Scoot and Tigerair, Director of SIA Engineering Company Limited, Member of the National University of Singapore Board of Trustees and Chairman-elect of the Board of Governors of the International Air Transport Association, of which he is a Member of the Strategy and Policy Committee... -

Page 22

STRATEGY Board of Directors (continued) William Fung Kwok Lun Director Dr Fung is the Group Chairman of Li & Fung Limited, a multinational group of companies headquartered in Hong Kong. Dr Fung has held key positions in major trade and business associations. He was the Chairman of the Hong Kong ... -

Page 23

...over 30 years of experience in the practice of law, specialising in banking, corporate and financial services work. He is also the Chairman of the Maritime and Port Authority of Singapore and Chairman of the Board of Directors of the Singapore International Arbitration Centre. Mr Wong is a member of... -

Page 24

PERFORMANCE Operating Review The Year in Review The year in review saw Singapore Airlines continuing to seek targeted growth opportunities, while matching capacity to demand in the current landscape. 1. 2. 3. 22 Singapore Airlines -

Page 25

...-hub strategy, the pursuit of adjacent business opportunities, and ongoing enhancement of premium products and services. The Board of Directors recommends a final dividend of 35 cents per share for FY2015/16. Including the interim dividend of 10 cents per share paid on 27 November 2015, the total... -

Page 26

...financial year. The year in review saw Singapore Airlines continuing to seek targeted growth opportunities, while matching capacity to demand in the current landscape. Following a period of modest growth in the South West Pacific region, flight frequency to Sydney was increased to 31 weekly services... -

Page 27

...with an average age of four years and 10 months. The airline has 39 A320neos on firm order and another 11 on purchase options. Deliveries will commence from 2018. Los Angeles Houston ATLANTIC OCEAN PACIFIC OCEAN SOUTH AMERICA To Barcelona Sao Paulo Auckland Christchurch Annual Report FY2015/16... -

Page 28

PERFORMANCE Operating Review continued Products and Services The Airline continued to introduce new products and services, both on the ground and in the air. 1. 2. 3. 26 Singapore Airlines -

Page 29

... partners and brands. Throughout the year, members benefitted from a series of global redemption promotions, local offers and partner privileges in the area of financial services, retail, telecommunications and travel. Recent enhancements were also made to the Singapore Airlines website, mobile... -

Page 30

.... Exclusive to Singapore Airlines, the specially designed serviceware features an embossed decoration complete with a platinum band. Ergonomic improvements have also been incorporated into the design for added convenience, further enhancing our customers' onboard culinary experience. Made with... -

Page 31

... and Hong Kong for customers in Suites and First Class. Blending the seasonality of fresh ingredients at the peak of taste and nutrition, this nourishing nine-course meal prepared with traditional cooking methods was created by award-winning Chinese chef Zhu Jun, a member of our International... -

Page 32

... and Peranakan Hokkien Mee Soup were offered as main courses to customers travelling in Suites, First Class and Business Class on selected flights. Selected main courses were also made available for pre-order through Singapore Airlines' 'Book the Cook' service. 1. 2. 3. 30 Singapore Airlines -

Page 33

..., a specially-designed collector's edition amenity kit, and the award-winning KrisWorld inflight entertainment system. In addition to three main courses to choose from on board, the section of meals can be made prior to travel by opting for the Premium Economy Book the Cook service. Customers are... -

Page 34

PERFORMANCE Operating Review continued People Development Singapore Airlines' learning curriculum will be reviewed and refreshed continuously to ensure its relevance in driving high performance. 2. 1. 3 4. 32 Singapore Airlines -

Page 35

...for general support staff. Other TOP initiatives, such as improved merit awards and redemption vouchers under the Workplace Innovation and Improvement Scheme (WINS), have been well received by unions and employees. Under TOP, a Job Analysis Framework (JAF) was also introduced to assist line managers... -

Page 36

...waste minimisation. More information on the Airline's environmental activities and programmes are available in the Singapore Airlines Sustainability Report FY2015/16. Maintaining a modern and fuel-efficient fleet of 102 aircraft at an average age of seven years and five months © Burung Indonesia... -

Page 37

... offices work with charities in support of various initiatives and causes. SilkAir embarked on several community projects during the year in review. With a memorandum of understanding signed in 2015 with Child's Dream Foundation, SilkAir is providing air tickets to Child's Dream staff travelling... -

Page 38

... seven countries. With Changi Airport as a hub for full-service and low-cost carriers, coupled with the increasing number of flights operating in Singapore, SIA Engineering Company pursues improvements in its services, enhancing engineering reliability and operating efficiencies of customer airlines... -

Page 39

... Moog's products on new-generation aircraft. The Singapore-based joint venture will be the Centre of Excellence in Asia Pacific for Moog's flight control components on the 787 and A350 aircraft. The company's Fleet Management business covers engineering and maintenance support activities, including... -

Page 40

PERFORMANCE Subsidiaries continued SIA Cargo SIA Cargo's aircraft fleet expanded to nine Boeing 747-400 freighters in October 2015 after the return of one freighter from the lessee at the end of the agreed lease period. 38 Singapore Airlines -

Page 41

... to 9 Boeing 747-400 freighter aircraft Air cargo demand grew at a slower pace in FY2015/16 compared to the previous year, partly due to the economic and trade slowdown in China and other emerging Asian economies. Despite these challenges, certain market segments that continued to see good growth... -

Page 42

PERFORMANCE Subsidiaries continued SilkAir SilkAir was ranked 3rd in the Top 10 Airlines by Passenger Carriage in the Changi Airline Awards 2014, presented by Changi Airport Group. 40 Singapore Airlines -

Page 43

... Carriage in the Changi Airline Awards 2014, presented by Changi Airport Group. New Destinations Added 2 During the financial year in review, SilkAir continued to grow its network, with the addition of two new destinations - Cairns and Male. On 30 May 2015, SilkAir started thrice-weekly services... -

Page 44

... systems, with joint ground handling planned at the airlines' Singapore home base. Scoot and Tigerair are important elements of SIA's portfolio strategy in which it has investments in both full-service and budget aspects of the airline business. Following a voluntary general offer, Tigerair recently... -

Page 45

... their respective websites began in April 2015. The recent merger of both airlines' computer reservation systems will also result in more seamless transactions for customers and cost efficiencies in the near future. During the year in review, SIA launched a voluntary general offer for the shares of... -

Page 46

PERFORMANCE Financial Review Highlights of the Group's Performance Revenue $ Million 20,000 $15,228M (-$338 million, -2.2%) 16,000 14,858 12,000 15,098 15,244 15,566 15,228 8,000 4,000 0 2011/12 2012/13 2013/14 2014/15 2015/16 Operating Profit $ Million 800 $681M (+$271 million, +... -

Page 47

Performance of the Group Key Financial Highlights 2015/16 2014/15 % Change Earnings For The Year ($ million) Revenue Expenditure Operating profit Profit attributable to owners of the Parent Per Share Data (cents) Earnings per share - basic Ordinary dividend per share Ratios (%) Return on equity ... -

Page 48

... aircraft maintenance and overhaul costs, staff costs, and expenditure arising from SilkAir's and Scoot's capacity growth. Consequently, the Group's operating profit improved $271 million (+66.4 per cent) to $681 million for the financial year ended 31 March 2016. Except for Singapore Airlines Cargo... -

Page 49

... Equity Holders' Funds ($ Million) R2 0 2012 2013 2014 2015 2016 Net Liquid Assets ($ Million) 0 Total Assets ($ Million) Net liquid assets is defined as the sum of cash and bank balances, and short-term investments, net of finance lease commitments, loans and bonds issued. Annual Report FY2015... -

Page 50

...Financial Review Performance of the Group (continued) Dividends For the financial year ended 31 March 2016, the Board recommends a final dividend of 35 cents per share. Including the interim dividend of 10 cents per share paid on 27 November 2015, the total dividend for the 2015/16 financial year... -

Page 51

...,574 13,920 6,198 1,452 882 604 840 230 24,126 + 0.9 - 0.3 + 8.3 + 0.5 + 48.2 - 1.8 - 25.2 + 1.9 Average staff productivity was as follows: 2015/16 2014/15 % Change Revenue per employee ($) Value added per employee ($) 625,400 206,986 649,564 183,483 - 3.7 + 12.8 Annual Report FY2015/16 49 -

Page 52

... in the business for future capital requirements. 2015/16 $ million 2014/15 $ million Total revenue Less: Purchase of goods and services Add: Interest income Surplus on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of profits of... -

Page 53

...). Passenger carriage was almost flat against last year (+0.1 per cent). The Company launched the new Premium Economy class on its Singapore-Sydney route on 9 August 2015, and has since progressively added the new cabin class on flights to 16 other destinations. Available Seat Capacity, Passenger... -

Page 54

... 2.6 1.1 Earnings 2015/16 $ million 2014/15 $ million % Change Revenue Expenditure Operating profit Finance charges Interest income Surplus on disposal of aircraft, spares and spare engines Dividends from subsidiary and associated companies Dividends from long-term investments Other non-operating... -

Page 55

... A breakdown of passenger revenue by route region and area of original sale is shown below: By Route Region ($ million) 2015/16 2014/15 % Change 99.2 78.9 By Area of Original SaleR5 ($ million) 2015/16 2014/15 % Change East Asia Americas Europe South West Pacific West Asia and Africa Systemwide... -

Page 56

...2014/15 % % Change Fuel costs Staff costs Depreciation R6 Handling charges Aircraft maintenance and overhaul costs Rentals on leased aircraft Inflight meals and other passenger costs Airport and overflying charges Sales costs R7 Communication and information technology costs R8 Other costs R9 Total... -

Page 57

... pertained mainly to impairment losses on the Company's investment in Singapore Flying College Pte Ltd ($43 million), and two grounded 777-200 aircraft ($22 million). A change in fuel productivity (passenger aircraft) of 1.0 per cent would impact the Company's annual fuel cost by about $26 million... -

Page 58

...147 13,920 0.9 1.2 0.5 0.3 4.3 7.5 0.9 The Company's average staff productivity ratios R10 are shown below: 2015/16 2014/15 % Change Seat capacity per employee (seat-km) Passenger load carried per employee (tonne-km) Revenue per employee ($) Value added per employee ($) 8,465,029 626,572 835... -

Page 59

... Subsidiary Companies The major subsidiary companies are SIAEC, SIA Cargo, SilkAir, Scoot, and Tiger Airways. The following performance review includes intra-group transactions. SIAEC 2015/16 $ million 2014/15 $ million % Change Total revenue Total expenditure Operating profit Net profit Revenue... -

Page 60

... Financial Review Performance of the Company (continued) Performance of the Subsidiary Companies (continued) SIA Cargo 2015/16 $ million 2014/15 $ million % Change Total revenue Total expenditure Operating loss Exceptional items Profit/(Loss) after taxation SIA Cargo's full year operating loss... -

Page 61

... fuel prices and a more fuel-efficient 787 fleet. As a result, the operating loss in the prior year was reversed, and it achieved an operating profit of $28 million this financial year (+$95 million). Yield was flat against last year, while unit cost fell significantly by 19.0 per cent to 4.7¢/ask... -

Page 62

... Class Best Airline Economy Class Best Airline Inflight Catering Best Airline in the World (10th year) Best Airline First Class Best Airline Business Class DEC 2015 Global Traveler (USA) Best Overall Airline in the World 2015 (11th time) Best Airline for Business Class 60 Singapore Airlines -

Page 63

... consecutive year) Best Airline for Premium Class Travel Best Airline for Economy Class Best In-flight Entertainment Best Frequent Flier Programme - KrisFlyer Hall of Fame Award MAR 2016 Guardian/Observer Readers' Travel Awards 2016 (UK) Best Long Haul Airline Most recommended brand Annual Report... -

Page 64

..., and data privacy laws. (d) Risk Review Activities The Group carried out the risk management review exercises on a half-yearly basis, including a review of strategic risks. Risks that impact the performance and objectives of the strategic investments undertaken by the Company were also evaluated by... -

Page 65

... Board oversees the business performance and affairs of the Company and provides general guidance to Management. Its principal functions include charting the Group's strategic direction, reviewing and approving annual budgets, financial plans and monitoring the Group's performance; approving major... -

Page 66

...financial year. The Board holds separate Strategy Sessions to assist Management in developing its plans and strategies for the future. The non-executive Directors also set aside time to meet without the presence of Management to review the latter's performance in meeting goals and objectives. Board... -

Page 67

... for another term(s). Their re-nominations are subject to the recommendations of the Chairman of the Board and the NC. The Company's Articles of Association provide that at each Annual General Meeting ("AGM") of the Company, one-third of the Directors for the time being, or, if their number is not... -

Page 68

... for each Director and Relevant Key Management Personnel and administers the Company's Profit Sharing Bonus, EVA-based Incentive Plan, Strategic Initiatives Incentive Plan, Transformational Initiatives Incentive Plan, Performance Share Plan and Access to Information (Principle 6) The Directors are... -

Page 69

... Economic Value Added ("EVA")-based Incentive Plan ("EBIP"): The EBIP rewards for sustainable shareholder value creation over the medium term achieved by growing profits, deploying capital efficiently and managing the risk profile and risk time horizon of an airline business. A portion of the annual... -

Page 70

... the initial award, depends on stretched value-aligned performance targets. They are based on absolute and relative Total Shareholder Return ("TSR"), meeting targets over the performance period of three financial years. The absolute TSR is based on outperformance against Cost of Equity. The relative... -

Page 71

... to which targets based on Group and Company EBITDAR Margin and Group and Company Staff Productivity are met. The performance measures are selected as they are key drivers of shareholder value and are aligned to the Group and the Company's business objectives. The final award is subject to extended... -

Page 72

... reviews of the compensation related risks in future. The performance targets as determined by the BCIRC are set at realistic yet stretched levels each year to motivate a high degree of business performance with emphasis on both short- and long-term quantifiable objectives. A pay-for-performance... -

Page 73

... of FY2014/15 Group and individual performance and includes EVA-based Incentive Plan (EBIP) payment, Profit-Sharing Bonus, cash component [50%] of the Strategic Incentive Plan (SIP) and Transformational Initiatives Incentive Plan (TIP). The EBIP amount paid in the reporting year is a percentage of... -

Page 74

... obtained at the last Annual General Meeting. Risk Management and Internal Controls (Principle 11) A dedicated Risk Management Department looks into and manages the Group's risk management policies. The Statement of Risk Management can be found on page 62. Annually, a report is submitted by the... -

Page 75

.... The department assists the Committee and the Board by performing regular evaluations on the Group's internal controls, financial and accounting matters, compliance, business and financial risk management policies and procedures, and ensuring that internal controls are adequate to meet the Group... -

Page 76

.... Quarterly results announcements, news releases, presentation slides, monthly operating statistics, annual reports, sustainability reports and other key facts and figures about the Company are available on the Investor Relations website. The Investor Relations Department meets with analysts and... -

Page 77

Membership and Attendance of Singapore Airlines Limited Board of Directors and Board Committee Members For the Period 1 April 2015 to 31 March 2016 Board No. of Meetings held No. of Meetings attended Board Executive Committee No. of Meetings held No. of Meetings attended Board Audit Committee No.... -

Page 78

... Organisation/Company Title 1. 2. 3. 4. 5. Temasek International Advisors Pte Ltd Singapore National Employers Federation COFCO Corporation, China SLF Strategic Advisers Private Limited National Wages Council Senior International Advisor President Director Director Member 76 Singapore Airlines -

Page 79

... Director Director Other Principal Commitments Organisation/Company Title 1. 2. 3. 4. 5. 6. 7. 8. DBS Bank Ltd DBS Bank (Hong Kong) Limited LaSalle College of the Arts Limited Singapore Health Services Pte Ltd STT Communications Ltd Fullerton Financial Holdings Pte Ltd Asia Mobile Holdings Pte... -

Page 80

... Limited Director Other Principal Commitments Organisation/Company Title 1. 2. 3. 4. Budget Aviation Holdings Pte Ltd International Air Transport Association National Council of Social Service National University of Singapore Chairman Chairman-elect, Board of Governors Member, Care & Share... -

Page 81

... Director Director Member, Advisory Board Member, Governing Board Member, Steering Committee Member Member Term Trustee, Board of Trustees Trustee Trustee Title 1. 2. 3. Economic Development Board EDB Investments Pte Ltd The Straits Trading Company Limited Director Director Director Annual... -

Page 82

.../Company Title 1 September 2012 26 July 2013 Member Member 1. Manulife Financial Corporation, Canada Director Other Principal Commitments Organisation/Company Title 1. 2. 3. 4. 5. 6. 7. 8. LinHart Group, Singapore Manulife US Real Estate Management Pte Ltd Lee Kuan Yew School of Public Policy... -

Page 83

... in the past 3 years Organisation/Company Title 1. 2. 3. Bharti Airtel Limited, India Singapore International Foundation World Bank Knowledge Advisory Commission, United States Director Member, Board of Governors Member Christina Ong AGED 68 Non-executive and independent Director Academic and... -

Page 84

... in Other Listed Companies Organisation/Company Title 1 September 2009 30 July 2015 Chairman Member 1. Microsoft Corporation Director Principal Commitments/Directorships in the past 3 years Organisation/Company Title 1. 2. Bayer AG UBS Group AG Director Director 82 Singapore Airlines -

Page 85

... Development Private Limited Epimetheus Limited Singapore Health Services Pte Ltd Singapore International Mediation Centre Singapore Business Federation Chairman and Senior Partner Chairman Chairman Director Director Director Director Director Director Member, Board of Trustees Annual Report... -

Page 86

...Cash Flows Notes to Financial Statements Additional Information Quarterly Results of the Group Five-Year Financial Summary of the Group Ten-Year Statistical Record The Group Fleet Profile Group Corporate Structure Information on Shareholdings Share Price and Turnover Notice of Annual General Meeting -

Page 87

...awards and debentures of the Company, and of related corporations: Direct interest 1.4.2015 or at date of appointment 31.3.2016 Deemed interest 1.4.2015 or at date of appointment 31.3.2016 Name of Director Interest in Singapore Airlines Limited Ordinary shares Stephen Lee Ching Yen Goh Choon Phong... -

Page 88

...2015 or at date of appointment 31.3.2016 Name of Director Conditional award of restricted shares (Note 1) Goh Choon Phong - Base Awards - Final Awards (Pending Release) Conditional award of performance shares (Note 2) Goh Choon Phong - Base Awards Award of time-based restricted shares Goh Choon... -

Page 89

...sum of SIA share dividend yields declared with ex-dividend dates occurring during the vesting period). Except as disclosed in this statement, no other Director who held office at the end of the financial year had interests in shares, share options, awards or debentures of the Company, or of related... -

Page 90

...year under review Options lapsed Aggregate options outstanding at end of financial year under review Goh Choon Phong - 444,075 444,075 - - No options have been granted to controlling shareholders or their associates, or parent group directors or employees. The options granted by the Company... -

Page 91

... to controlling shareholders or their associates, or parent group directors or employees, under the RSP/RSP 2014 and PSP/PSP 2014. No employee has received 5% or more of the total number of options or awards granted under the ESOP, RSP and PSP, or 5% or more of the total number of shares available... -

Page 92

... financial year under review Goh Choon Phong 7. Deferred RSP/RSP 2014 27,135 - 27,135 - 106,573 106,573 Details of the deferred RSP/RSP 2014 awards of restricted shares are disclosed in Note 5 to the financial statements. The grant of deferred RSP/RSP 2014 awards granted on 4 September 2013... -

Page 93

...to Mr Goh Choon Phong pursuant to the vesting of 67,636 PSP Base Awards during the financial year. R2 # * 5 Equity Compensation Plans of Subsidiaries The particulars of the equity compensation plans of subsidiaries of the Company are as follows: (i) SIA Engineering Company Limited ("SIAEC") The... -

Page 94

... submissions to the Directors of the Company for adoption; audit scopes, plans and reports (including Key Audit Matters) of the external and internal auditors; effectiveness of material controls, including financial, compliance, information technology and risk management controls; interested person... -

Page 95

... of shareholders obtained at the Annual General Meeting held on 30 July 2015, KPMG LLP was appointed as auditors of the Company in place of Ernst & Young LLP for the financial year ended 31 March 2016 and to hold office until the conclusion of the next Annual General Meeting of the Company. The... -

Page 96

... the financial statements of Singapore Airlines Limited (the Company) and its subsidiaries (the Group) which comprise the consolidated statement of financial position of the Group and the statement of financial position of the Company as at 31 March 2016, the consolidated profit and loss account... -

Page 97

... service provider in China and Singapore Airlines stations in London, Mumbai and Singapore to test the effectiveness of key controls in the passenger revenue accounting process at those locations. Findings Cautious estimates have been made regarding the timing of revenue recognition for tickets... -

Page 98

...cash is received as part of ticket sales made by Singapore Airlines for flights flown by KrisFlyer members, or alternatively from programme partners that purchase miles from Singapore Airlines to issue to their own customers. The fair value of miles issued to KrisFlyer members when flights are flown... -

Page 99

... to be made of future revenues, operating costs, capital expenditure and discount rates for each CGU. How the matter was addressed in our audit We compared the estimates of useful lives and residual values to the Singapore Airlines' fleet plan, recent aircraft transactions and contractual rights... -

Page 100

...on the key terms of these agreements has been developed. We determined that appropriate assessments of the useful lives of major inspections, and of the proportion of the power-by-hour payments that have the effect of extending the useful lives of the engines, have been made. 98 Singapore Airlines -

Page 101

... of each offer and the associated shareholder and regulatory approvals required. Findings We found that the assessment of the date Singapore Airlines obtained control of Tiger Airways, and the assessment that the 2015 acquisition was not part of the 2014 acquisition plans, were supported by the... -

Page 102

FINANCIAL Independent Auditors' Report To the members of Singapore Airlines Limited Carrying amount of investment in Virgin Australia Holdings Limited Refer to note 2(e) 'Subsidiary, associated and joint venture companies' for the relevant accounting policy and a discussion of significant ... -

Page 103

...the Group and the statement of financial position and statement of changes in equity of the Company for the year ended 31 March 2015 were audited by another auditor who expressed an unmodified opinion on those statements on 14 May 2015. Responsibilities of management and directors for the financial... -

Page 104

... have been properly kept in accordance with the provisions of the Act. The engagement partner on the audit resulting in this independent auditors' report is Tham Sai Choy. KPMG LLP Public Accountants and Chartered Accountants Dated this 12th day of May 2016 Singapore 102 Singapore Airlines -

Page 105

... Profit and Loss Account For The Financial Year Ended 31 March 2016 (in $ million) Notes The Group FY2015/16 FY2014/15 Revenue Expenditure Staff costs Fuel costs Depreciation Impairment of property, plant and equipment Amortisation of intangible assets Aircraft maintenance and overhaul costs... -

Page 106

... to profit or loss: Currency translation differences Net fair value changes on available-for-sale financial assets Adjustment on acquisition of an associated company Net fair value changes on cash flow hedges (Loss)/Surplus on dilution of interest in an associated company due to share options... -

Page 107

Statements of Financial Position As At 31 March 2016 (in $ million) The Group Notes 2016 2015 The Company 2016 2015 Equity attributable to owners of the parent Share capital Treasury shares Other reserves Non-controlling interests Total equity Deferred account Deferred taxation Long-term ... -

Page 108

FINANCIAL Statements of Changes in Equity For The Financial Year Ended 31 March 2016 (in $ million) The Group Notes Share capital Treasury shares Capital reserve Balance at 1 April 2015 Comprehensive income Currency translation differences Net fair value changes on available-for-sale assets ... -

Page 109

... Parent Share-based Foreign currency compensation translation reserve reserve Fair value reserve General reserve Total Non-controlling interests Total equity (135....4) 378.2 (3.7) (6.2) 1.5 12.4 - (85.4) 20.1 (359.0) (420.3) (3.1) (458.5) (461.6) (881.9) 13,132.9 Annual Report FY2015/16 107 -

Page 110

... Financial Year Ended 31 March 2016 (in $ million) The Group Notes Share capital Treasury shares Capital reserve Balance at 1 April 2014 Comprehensive income Currency translation differences Net fair value changes on available-for-sale assets Adjustment on acquisition of an associated company... -

Page 111

...of the Parent Share-based Foreign currency compensation translation reserve reserve Fair value reserve General reserve Total Non-controlling interests Total equity (101.5) (32....9 466.5 81.3 17.2 9.2 - (107.0) 28.6 (553.2) (523.9) 36.0 100.5 136.5 (387.4) 12,930.1 Annual Report FY2015/16 109 -

Page 112

FINANCIAL Statements of Changes in Equity For The Financial Year Ended 31 March 2016 (in $ million) The Company Notes Share capital Treasury shares Share-based Capital compensation reserve reserve Fair value reserve General reserve Total Balance at 1 April 2015 Comprehensive income Net fair value ... -

Page 113

Statements of Changes in Equity For The Financial Year Ended 31 March 2016 (in $ million) The Company Notes Share capital Treasury shares Share-based Capital compensation reserve reserve Fair value reserve General reserve Total Balance at 1 April 2014 Comprehensive income Net fair value changes on ... -

Page 114

... on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of profits of joint venture companies Share of losses of associated companies Exceptional items Operating cash flow before working capital changes Decrease in trade and other... -

Page 115

...of an associated company Net cash used in investing activities Cash flow from financing activities Dividends paid Dividends paid by subsidiary companies to non-controlling interests Acquisition of non-controlling interests without a change in control Issuance of share capital by a subsidiary company... -

Page 116

... (Private) Limited, incorporated in the Republic of Singapore. The registered office of the Company is at Airline House, 25 Airline Road, Singapore 819829. The financial statements of the Group as at and for the year ended 31 March 2016 comprise the Company and its subsidiary companies (together... -

Page 117

... to the International Financial Reporting Standards ("IFRS") from the financial year ending 31 December 2018 onwards. Singapore-incorporated companies listed on SGX will have to assess the impact of IFRS 1: First-time adoption of IFRS when transitioning to the new reporting framework. The Group is... -

Page 118

... values at the acquisition date. Acquisition-related costs, other than those associated with the issue of debt or equity securities, are recognised as expenses in the periods in which the costs are incurred and the services are received. When the Group acquires a business, it assesses the financial... -

Page 119

... financial statements. The Group accounts for its investments in associated and joint venture companies using the equity method from the date on which it becomes an associated or joint venture company. On acquisition of the investment, any excess of the cost of the investment over the Group's share... -

Page 120

... in profit or loss. The most recently available audited financial statements of the associated and joint venture companies are used by the Group in applying the equity method. Where the dates of the audited financial statements used are not co-terminous with those of the Group, the share of results... -

Page 121

... to the Group's share of engine development payments made in connection with its participation in aircraft engine development projects with other companies. Amortisation of such intangibles begins only when the aircraft engines are available for sale. These deferred engine development costs are... -

Page 122

... taken to the profit and loss account. For the purpose of the consolidated financial statements, the net assets of the foreign subsidiary, associated and joint venture companies are translated into SGD at the exchange rates ruling at the end of the reporting period. The financial results of foreign... -

Page 123

... working condition for its intended use. The cost of aircraft is stated net of manufacturers' credit. Aircraft and related equipment acquired on an exchange basis are stated at amounts paid plus the fair value of the fixed asset traded-in. Expenditure for heavy maintenance visits on aircraft, engine... -

Page 124

...financial position as deferred gain on sale and leaseback transactions, included under deferred account and amortised over the minimum lease terms. If the sales proceeds are below fair values, the loss is recognised in the profit and loss account except that, if the loss is compensated for by future... -

Page 125

... the profit and loss account. All regular way purchases and sales of financial assets are recognised or derecognised on the trade date, i.e., the date that the Group commits to purchase or sell the asset. Regular way purchases or sales are purchases or sales of financial assets that require delivery... -

Page 126

... within 12 months after the end of the reporting period. (ii) Loans and receivables Non-derivative financial assets with fixed or determinable payments that are not quoted in an active market are classified as loans and receivables. Such assets are carried at amortised cost using the effective... -

Page 127

... risk of changes in value, and are used by the Group in the management of its short-term commitments. The accounting policy for this category of financial assets is stated in Note 2(l), under loans and receivables. (p) Impairment of non-financial assets The Group assesses at each reporting date... -

Page 128

... future cash flows discounted at the current market rate of return for a similar financial asset. Such impairment losses are not reversed in subsequent periods. (iii) Available-for-sale financial assets Significant or prolonged decline in the fair value below cost, significant financial difficulties... -

Page 129

... Group has not designated any financial liabilities upon initial recognition as carried at fair value through profit or loss. (ii) Other financial liabilities After initial recognition, other financial liabilities are subsequently measured at amortised cost using the effective interest rate method... -

Page 130

... the Financial Statements 31 March 2016 2 Summary of Significant Accounting Policies (continued) (u) Trade and other creditors Trade and other creditors and amounts owing to subsidiary and associated companies are initially recognised at fair value and subsequently measured at amortised cost using... -

Page 131

..., affects neither the accounting profit nor taxable profit or loss; and In respect of taxable temporary differences associated with investments in subsidiary, associated and joint venture companies, where the timing of the reversal of the temporary differences can be controlled and it is probable... -

Page 132

... is principally earned from the carriage of passengers, cargo and mail, engineering services, training of pilots, air charters and tour wholesaling and related activities. Revenue for the Group excludes dividends from subsidiary companies and intra-group transactions. Passenger and cargo sales are... -

Page 133

... of share options to senior executives and other employees. The exercise price approximates the market value of the shares at the date of grant. The Company has also implemented the Singapore Airlines Limited Restricted Share Plan and Performance Share Plan, and its subsidiaries the SIA Engineering... -

Page 134

...be paid directly to the Group. The fair value of plan assets is based on market price information. When no market price is available, the fair value of plan assets is estimated by discounting expected future cash flows using a discount rate that reflects both the risk associated with the plan assets... -

Page 135

... its risks associated with foreign currency, interest rate and jet fuel price fluctuations. Such derivative financial instruments are initially recognised at fair value on the date on which a derivative contract is entered into; any attributable transaction costs are recognised in profit or loss as... -

Page 136

...factors used to identify the reportable segments and the measurement basis of segment information. The significant business segments of the Group are airline operations, engineering services and cargo operations. (ii) Geographical segment The analysis of revenue by area of original sale from airline... -

Page 137

... revenue when the transportation is provided. The value of unused tickets is included as sales in advance of carriage on the statement of financial position and recognised as revenue at the end of two years. This is estimated based on historical trends and experiences of the Group whereby ticket... -

Page 138

... The airline operations segment provides passenger air transportation. The engineering services segment is in the business of providing airframe maintenance and overhaul services, line maintenance, technical ground handling services and fleet management. It also manufactures aircraft cabin equipment... -

Page 139

.../16 Total Revenue External revenue Inter-segment revenue Results Segment result Finance charges Interest income Surplus/(Loss) on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of (losses)/profits of joint venture companies Share... -

Page 140

.../15 Total revenue External revenue Inter-segment revenue Results Segment result Finance charges Interest income Surplus/(Loss) on disposal of aircraft, spares and spare engines Dividends from long-term investments Other non-operating items Share of (losses)/profits of joint venture companies Share... -

Page 141

...) Business segments (continued) Airline operations 2016 Engineering services 2016 Cargo operations 2016 Others 2016 Total of segments Elimination* Consolidated 2016 2016 2016 Other information as at 31 March Segment assets Investments in associated and joint venture companies Loan receivable... -

Page 142

...) Business segments (continued) Airline operations 2015 Engineering services 2015 Cargo operations 2015 Others 2015 Total of segments Elimination* 2015 2015 Consolidated 2015 Other information as at 31 March Segment assets Investments in associated and joint venture companies Long-term... -

Page 143

... total staff costs of the Group for FY2015/16 and FY2014/15, additional disclosures of the defined benefit plans are not shown. Share-based compensation arrangements As at 31 March 2016, the Group has the following share-based payment arrangements: (a) Share option plans (equity-settled) Singapore... -

Page 144

... Statements 31 March 2016 5 Staff Costs (in $ million) (continued) Share-based compensation arrangements (continued) (b) Share-based incentive plans (equity-settled) (continued) The RSP/RSP 2014 awards fully-paid ordinary shares of the Company, conditional on position and individual performance... -

Page 145

...for these options is 1.46 years (FY2014/15: 2.21 years). Movement of share awards during the financial year Number of Restricted Shares Date of grant Balance at 01.04.2015/ date of grant Adjustment* Vested Balance at 31.03.2016 RSP/RSP 2014 01.07.2011 10.07.2012 15.07.2013 03.07.2014 03.07.2015 15... -

Page 146

.../15 RSP PSP Valuation Method Expected dividend paid yield (%) Expected volatility (%) Risk-free interest rate (%) Expected term (years) Share price at date of grant ($) Estimated fair value ($) Monte Carlo Simulation Management's forecast in line with dividend policy 14.11 - 18.34 0.89 - 1.61... -

Page 147

... (in $ million) Operating profit for the financial year was arrived at after charging/(crediting): The Group FY2015/16 FY2014/15 Compensation for changes in aircraft delivery slots Interest income from short-term investments Dividend income from short-term investments Income from operating lease of... -

Page 148

... long-term investment of an equity stake of 16% in China Cargo Airlines to fully write down its carrying value, due to negative shareholders' equity, and continued operating losses incurred. The Company recorded an additional gain of $7.3 million on the sale of Virgin Atlantic Limited arising from... -

Page 149

... of defined benefit plans (0.4) 37.8 (0.3) 37.1 - (159.2) 2.1 (157.1) The Group has tax losses (of which no deferred tax asset has been recognised) of approximately $155.3 million (2015: $163.3 million) that are available for offset against future taxable profits of the companies. This is due... -

Page 150

... they are anti-dilutive for the current and previous year presented. The average market value of the Company's shares for purposes of calculating the dilutive effect of share options was based on quoted market prices for the period during which the options were outstanding. 148 Singapore Airlines -

Page 151

...the financial year ended 31 March 2016. During the financial year, total dividends of $43.6 million (FY2014/15: $72.0 million) were paid to non-controlling interests. 14 Share Capital (in $ million) The Group and the Company Number of shares Amount 2016 2015 2016 2015 Issued and fully paid share... -

Page 152

... the amount available for the distribution of cash dividends by the Company. 16 Other Reserves (in $ million) The Group 31 March 2016 2015 The Company 31 March 2016 2015 Capital reserve Foreign currency translation reserve Share-based compensation reserve Fair value reserve General reserve (129... -

Page 153

... value changes of available-for-sale financial assets: The Group 31 March 2016 2015 The Company 31 March 2016 2015 Balance at 1 April Net gain on fair value changes Balance at 31 March Gain on fair value changes Adjustment on acquisition of an associated company Recognised in the profit and loss... -

Page 154

... 23.8 - (612.6) (581.8) Total fair value reserve (e) General reserve General reserve comprises mainly retained earnings of the Group and the Company. Movements in the Group's and the Company's general reserves are set out in the Statement of Changes in Equity respectively. 152 Singapore Airlines -

Page 155

17 Deferred Account (in $ million) The Group 31 March 2016 2015 The Company 31 March 2016 2015 Deferred gain/(loss) on sale and leaseback transactions - operating leases - finance leases Deferred credit Presented as: - Non-current assets - Non-current liabilities 5.8 2.7 8.5 210.8 219.3 (6.0) 225... -

Page 156

... Company Statement of financial position 31 March 2016 2015 The deferred taxation arises as a result of: Deferred tax liabilities Differences in depreciation Revaluation to fair value - fuel hedging contracts - currency hedging contracts - interest rate cap contracts - available-for-sale financial... -

Page 157

...) for the Company. $300 million fixed rate notes due 2024 ("Series 003 Notes") bear fixed interest at 3.75% per annum and are repayable on 8 April 2024. The fair value of notes payable amounted to $313.3 million as at 31 March 2016 (2015: $309.1 million) for the Company. Annual Report FY2015/16... -

Page 158

... within 12 months after the reporting date. The other short-term loans of $181.6 million (2015: $83.7 million) are European Export Credit Agency ("ECA") aircraft financing loans denominated in SGD taken by a subsidiary company. These are in the form of credit support, where a bank or other financial... -

Page 159

...-term liabilities and $50.8 million (2015: nil) under trade and other creditors. The fair value of the purchase option price payable amounted to $83.8 million (2015: $85.3 million) as at 31 March 2016. Future minimum lease payments under these finance leases are as follows: The Group 31 March 2016... -

Page 160

... the lease terms. An analysis of the provisions is as follows: The Group Return costs for leased aircraft Onerous leases Others Total Balance at 1 April 2014 Acquisition of a subsidiary company Provision during the year Provision utilised during the year Balance at 31 March 2015 Current Non-current... -

Page 161

20 Provisions (in $ million) (continued) The Company Return costs for leased aircraft Others Total Balance at 1 April 2014 Provision during the year Provision utilised during the year Balance at 31 March 2015 Current Non-current 596.6 263.9 (50.9) 809.6 138.0 671.6 809.6 809.6 206.0 (48.7) (142... -

Page 162

... Notes to the Financial Statements 31 March 2016 21 Property, Plant and Equipment (in $ million) The Group Aircraft spares Aircraft spare engines Aircraft Cost At 1 April 2014 Additions Acquisition of a subsidiary company Transfers Reclassification to assets held for sale Disposals Exchange... -

Page 163

Freehold land Freehold buildings Leasehold land and buildings Plant and equipment Office and computer equipment Advance and progress payments Total 15.7 15.7 15.7 147.4 147.4 147.4 621.9 0.5 0.1....8 276.2 234.2 34.2 36.1 3,045.9 3,167.9 13,523.2 14,143.5 Annual Report FY2015/16 161 -

Page 164

FINANCIAL Notes to the Financial Statements 31 March 2016 21 Property, Plant and Equipment (in $ million) (continued) The Company Aircraft spares Aircraft spare engines Aircraft Cost At 1 April 2014 Additions Transfers Disposals At 31 March 2015 Additions Transfers Disposals At 31 March 2016 ... -

Page 165

Freehold land Freehold buildings Leasehold land and buildings Plant and equipment Office and computer equipment Advance and progress payments Total 15.7 - - - 15.7 - - - 15.7 147.4 - - - 147.4... 19.8 17.9 216.5 182.1 19.4 20.3 1,910.3 2,442.3 9,906.4 10,241.2 Annual Report FY2015/16 163 -

Page 166

... As of 31 March 2016, seven aircraft were classified as held for sale as a subsidiary company had decided to sell these aircraft (2015: two aircraft). The sale is expected to be completed within one year. During the financial year, the Group recognised a loss on planned disposal of aircraft of $38... -

Page 167

... (in $ million) The Group Deferred Computer engine Advance and software development progress and others cost payments Goodwill Brand Trademarks Total Cost At 1 April 2014 Additions Acquisition of a subsidiary company Disposals Transfers Exchange differences At 31 March 2015 Additions Disposals... -

Page 168

...-term growth rate used to extrapolate the cash flow projections beyond the five-year period is 2.5% (2015: 2.5%). The calculation of value-in-use for the CGU is most sensitive to the following assumptions: Pre-tax discount rates - Discount rates represent the current market assessment of the risks... -

Page 169

... has been performed. The recoverable amount of the CGU (the aircraft engine development project) has been determined based on value-in-use calculations using cash flow projections from business plan approved by Management for the next 46 years (2015: 47 years). The pre-tax discount rate applied to... -

Page 170

... Company 31 March 2016 2015 Investment in subsidiary companies Accumulated impairment loss Long-term loans to a subsidiary company 3,331.6 (52.7) 3,278.9 1,182.0 4,460.9 2,846.3 (52.7) 2,793.6 571.1 3,364.7 During the financial year: 1. The Company announced a Voluntary Conditional General Offer... -

Page 171

... of the Group The subsidiary companies at 31 March are: Country of incorporation and place of business Percentage of equity held by the Group 2016 2015 Principal activities SIA Engineering Company Limited* Aircraft Maintenance Services Australia Pty Ltd(1)** NexGen Network (1) Holding Pte Ltd... -

Page 172

....0 Held by SIA Engineering Company The company is considered a subsidiary of the Group by virtue of the management control over financial and operating policies of the company Held by Singapore Airlines Cargo Pte Ltd Held by SilkAir (Singapore) Private Limited Held by the Company (56%) and SilkAir... -

Page 173

... Group: SIA Engineering Company Group of Companies 2016 2015 Proportion of ownership interest held by NCI Profit allocated to NCI during the reporting period Accumulated NCI at the end of reporting period Dividends paid to NCI 22.4% 43.9 359.8 40.7 22.4% 43.3 321.9 71.1 During the financial year... -

Page 174

... to the Financial Statements 31 March 2016 23 Subsidiary Companies (in $ million) (continued) (d) Summarised statement of comprehensive income SIA Engineering Company Group of Companies FY2015/16 FY2014/15 Tiger Airways Group of Companies FY2015/16 FY2014/15 # Revenue Profit/(Loss) before income... -

Page 175

... the financial year ended 31 March 2015. If the acquisition had taken place on 1 April 2014, the Group's revenue would have been $15,886.1 million and the Group's net profit attributable to owners of the Parent would remain the same, as there is no change in the net equity interest. Annual Report... -

Page 176

... paid the Final Offer Price of $0.45 per share, and issued a letter of grant in relation to the options to subscribe for the Company's shares, within ten days of their valid acceptances being received. As a result of the Offer, the Group granted 44,412,941 equity-settled share-based payment options... -

Page 177

...an associated company of the Group, provides flight training services on full-flight simulators for all in-production Airbus aircraft types. The Company injected $33.0 million in TATA SIA Airlines Limited ("TATA-SIA"). There was no change in the Group's 49% equity stake in TATA-SIA after the capital... -

Page 178

... associated companies at 31 March are: Country of incorporation and place of business Percentage of equity held by the Group 2016 2015 Principal activities Airbus Asia Training Centre Pte Ltd+++(a) RCMS Properties Private Limited+++^ Tata SIA Airlines Limited(b) Virgin Australia Holdings Limited... -

Page 179

...) Country of incorporation and place of business Percentage of equity held by the Group 2016 2015 Principal activities Jamco Singapore Pte Ltd(1)(f)@ Manufacturing aircraft cabin equipment and refurbishment of aircraft galleys Singapore 15.5 15.5 (1) (2) Held by SIA Engineering Company Held... -

Page 180

... material associated companies based on their respective (consolidated) financial statements prepared in accordance with FRS, modified for fair value adjustments on acquisitions and differences in the Group's accounting policies. Summarised statement of financial position VAH 31 March 2016 2015 2016... -

Page 181

... of equity held by the Group 2016 2015 International Engine Component Overhaul Pte Ltd (1) Singapore Aero Engine Services Pte Ltd (1) NokScoot Airlines Co., Ltd (2) (1) (2) Repair and overhaul of aero engine components and parts Repair and overhaul of aircraft engines Air transportation Singapore... -

Page 182

...) The carrying amounts of the investments are as follows: The Group 31 March 2016 2015 Singapore Aero Engine Services Pte Ltd ("SAESL") Other joint venture companies 136.0 20.3 156.3 126.1 41.8 167.9 The activities of SAESL are strategic to the Group's activities. Dividends of approximately $33... -

Page 183

... A reconciliation of the summarised financial information to the carrying amount of SAESL is as follows: The Group 31 March 2016 2015 Group's share of net assets 136.0 126.1 Aggregate information about the Group's investment in the other joint venture companies that are not individually material... -

Page 184

... held for sale During the financial year, the Group entered into a conditional sale and purchase agreement with Rolls-Royce Overseas Holdings Limited and Hong Kong Aircraft Engineering Company Limited to divest its 10% stake in Hong Kong Aero Engine Services Limited ("HAESL"). The Group remeasured... -

Page 185

... owing by subsidiary, associated and joint venture companies are unsecured, trade-related, non-interest bearing and are repayable on demand. The amounts are neither overdue nor impaired. The interest on a short-term loan to an associated company was computed using Bank Bill Swap Bid Rate plus an... -

Page 186

... 2016, the composition of trade debtors held in foreign currencies by the Group is as follows: USD - 16.7% (2015: 26.5%), AUD - 13.7% (2015: 4.5%), EUR - 5.4% (2015: 4.6%), GBP - 4.1% (2015: 5.0%) and JPY - 2.0% (2015: 2.6%). There was no loan to Directors of the Company. 184 Singapore Airlines -

Page 187

....8 15.5 23.3 38.8 8.5 35.0 43.5 8.4 9.5 17.9 31 Investments (in $ million) The Group 31 March 2016 2015 The Company 31 March 2016 2015 Available-for-sale investments Quoted Government securities Equity investments Non-equity investments 16.4 33.5 176.5 226.4 8.0 37.7 118.3 164.0 0.5 - 159... -

Page 188

... 1.00%) per annum for USD funds. As at 31 March 2016, 33.9% of the funds from subsidiary companies are denominated in USD (2015: USD - 36.3%). Amounts owing to subsidiary and associated companies are unsecured, trade-related, non-interest bearing and are repayable on demand. 186 Singapore Airlines -

Page 189

... acquisition of aircraft fleet and related equipment. In addition, the Group's share of associated companies' and joint venture companies' commitments for capital expenditure totalled $4,421.6 million (2015: $4,368.8 million) and $6.2 million (2015: $24.2 million) respectively. Annual Report FY2015... -

Page 190

... an option to purchase the related aircraft. Sub-leasing is allowed under all the lease arrangements, subject to certain terms and conditions stated in the agreements. Future minimum lease payments under non-cancellable operating leases are as follows: The Group 31 March 2016 2015 The Company 31... -

Page 191

... agreements for office and computer equipment, leasehold land and buildings. These noncancellable leases have lease terms of between one to 50 years. Future minimum lease payments under non-cancellable operating leases are as follows: The Group 31 March 2016 2015 The Company 31 March 2016 2015 Not... -

Page 192

... the Company were among several airlines that received notice of investigations by competition authorities in the United States, European Union, Australia, Canada, New Zealand, South Africa, South Korea and Switzerland as to whether surcharges, rates or other competitive aspects of air cargo service... -

Page 193

...January 2014, a shipper from South Korea which purportedly contracted with SIA Cargo's customers served a claim against SIA Cargo and other airlines. SIA Cargo is defending this proceeding. Without admitting any liabilities, SIA Cargo and the Company have settled with plaintiffs in the United States... -

Page 194

... of fair value, are as follows: • • Loan receivable from an associated company, trade debtors, amounts owing by subsidiary companies, deposits and other debtors, and cash and bank balances are classified as loans and receivables financial assets; and Quoted non-equity investments are... -

Page 195

... Derivatives liabilities at financial used for amortised assets hedging cost Fair value 31 March 2016 The Company AvailableLoans for-sale and financial receivables assets Total Level 1 Level 2 Level 3 Financial assets measured at fair value Long-term investments Investments Derivative assets... -

Page 196

... Derivatives liabilities at financial used for amortised assets hedging cost Derivatives at fair value through profit or loss Fair value 31 March 2015 The Group Total Level 1 Level 2 Level 3 Financial assets measured at fair value Long-term investments Investments Derivative assets - - - - 304... -

Page 197

... Derivatives liabilities at financial used for amortised assets hedging cost Fair value 31 March 2015 The Company AvailableLoans for-sale and financial receivables assets Total Level 1 Level 2 Level 3 Financial assets measured at fair value Long-term investments Investments Derivative assets... -

Page 198

...Classification and fair values of financial instruments (continued) Derivative financial instruments included in the statements of financial position are as follows: The Group 31 March 2016 2015 The Company 31 March 2016 2015 Derivative assets Currency hedging contracts Fuel hedging contracts Cross... -

Page 199

...currency swap contracts is determined based on referenced market prices for existing cash flow profiles pre-agreed with counterparties at trade inception. The fair value of quoted investments is generally determined by reference to stock exchange quoted market bid prices at the close of the business... -

Page 200

... Notes to the Financial Statements 31 March 2016 37 Financial Instruments (in $ million) (continued) Master netting or similar agreements The Group enters into derivative transactions under International Swaps and Derivatives Association ("ISDA") master netting agreements. In general, under such... -

Page 201

... revenue in various currencies. The Group's airline operations carry certain financial and commodity risks, including the effects of changes in jet fuel prices, foreign currency exchange rates, interest rates and the market value of its investments. The Group's overall risk management approach... -

Page 202

... Notes to the Financial Statements 31 March 2016 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (a) Jet fuel price risk The Group's earnings are affected by changes in the price of jet fuel. The Group's strategy for managing the risk on fuel price, as defined by... -

Page 203

...) in short-term deposits to hedge against foreign currency risk for a portion of the forecast USD capital expenditure in the next 12 months. A fair value loss of $22.5 million (2015: gain of $22.3 million) is included in the fair value reserve in respect of these contracts. During the financial year... -

Page 204

... to the Financial Statements 31 March 2016 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (b) Foreign currency risk (continued) Sensitivity analysis: The Group 31 March 2016 Effect on equity R1 Effect on profit before taxation R2 Effect on equity R1 2015 Effect on... -

Page 205

38 Financial Risk Management Objectives and Policies (in $ million) (continued) (c) Interest rate risk The Group's earnings are also affected by changes in interest rates due to the impact such changes have on interest income and expense from short-term deposits and other interest-bearing financial... -

Page 206

... to the Financial Statements 31 March 2016 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (c) Interest rate risk (continued) Sensitivity analysis: The Group 31 March 2016 Effect on equity R1 Effect on profit before taxation R2 Effect on equity R1 2015 Effect on... -

Page 207

... 1 year 1-2 years 2-3 years 3-4 years 4 - 5 More than years 5 years 31 March 2016 Total The Group Notes payable Loans Finance lease commitments Maintenance reserve Purchase option payable to lessor Trade and other creditors Derivative financial instruments: Currency hedging contracts Fuel hedging... -

Page 208

... 38 Financial Risk Management Objectives and Policies (in $ million) (continued) (e) Liquidity risk (continued) 31 March 2015 Within 1 year 1-2 years 2-3 years 3-4 years 4 - 5 More than years 5 years Total The Group Notes payable Loans Finance lease commitments Maintenance reserve Purchase option... -

Page 209

..., country and credit rating of its counterparties. The table below shows an analysis of credit risk exposures of balances that exceed 5% of the financial assets of the Group and the Company as at 31 March: The Group Outstanding Percentage of total balance financial assets 2016 2015 2016 2015 The... -

Page 210

...the financial year ended 31 March 2016, no significant changes were made in the objectives, policies or processes relating to the management of the Company's capital structure. The Group 31 March 2016 2015 The Company 31 March 2016 2015 Notes payable Finance lease commitments Loans Total debt Share... -

Page 211

...options outstanding at end of financial year under review Goh Choon Phong Mak Swee Wah Ng Chin Hwee 444,075 362,750 214,025 444,075 342,750 214,025 - 20,000 - Conditional awards granted to Director and key executives of the Company pursuant to the Restricted Share Plan and the Performance Share... -

Page 212

... as at 1 April 2015 Awards released during the financial year Balance as at 31 March 2016 Aggregate ordinary shares released to participant since commencement of time-based RSP to end of financial year under review Goh Choon Phong Mak Swee Wah Ng Chin Hwee Deferred RSP/PSP 2014 Awards 27,135 27... -

Page 213

... Profit and Loss Account Aircraft maintenance and overhaul costs Material costs Other operating expenses The Group As previously reported 668.6 176.7 502.7 646.6 59.4 642.0 The Company 31 March 2015 As previously As restated reported As restated Statements of Financial Position Long-term... -

Page 214

... Services Private Limited - Taj Madras Flight Kitchen Pvt Limited - Taj SATS Air Catering Ltd - TKF Corporation Singapore Technologies Engineering Limited Group - Unicorn International Pte Ltd Singapore Telecommunications Limited Group - Optus Networks Pty Ltd - Singapore Telecommunications Limited... -

Page 215

... Results of the Group 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total Total revenue 2015/16 2014/15 Total expenditure 2015/16 2014/15 Operating profit 2015/16 2014/15 Profit before taxation 2015/16 2014/15 Profit attributable to owners of the Parent 2015/16 2014/15 Earnings per share... -

Page 216

...-Year Financial Summary of the Group 2015/16 2014/15 2013/14 2012/13 2011/12 Profit and loss account ($ million) Total revenue Total expenditure Operating profit Finance charges Interest income Surplus/(Loss) on disposal of aircraft, spares and spare engines Dividend from long-term investments... -

Page 217

... Dividends Gross dividends (cents per share) Dividend cover (times) Profitability ratios (%) Return on equity holders' funds R4 Return on total assets R5 Return on turnover R6 Productivity and employee data Value added ($ million) Value added per employee ($) R7 Revenue per employee ($) R7 Average... -

Page 218

... 2015/16 Singapore Airlines Financial Total revenue Total expenditure Operating profit/(loss) Profit/(Loss) before taxation Profit/(Loss) after taxation Capital disbursements R1 Passenger - yield - unit cost - breakeven load factor Operating passenger fleet Aircraft Average age Passenger production... -

Page 219

... intangible assets, investments in subsidiary, associated companies and joint venture companies, and additional long-term equity investments. Seat capacity per employee is available seat capacity divided by Singapore Airlines' average staff strength. Passenger load carried per employee is defined as... -

Page 220

... Singapore Airlines Group operating fleet consisted of 173 aircraft - 164 passenger aircraft and 9 freighters. Average age in years (y) and months (m) Aircraft type Owned Finance Lease Operating Lease Total Expiry of operating lease 2016/17 2017/18 On firm order On option Singapore Airlines... -

Page 221

...March 2016 SINGAPORE AIRLINES LIMITED 77.6% SIA Engineering Company Limited SilkAir (Singapore) Private Limited Singapore Aviation and General Insurance Company (Pte) Limited Scoot Pte. Ltd. 100% Tradewinds Tours 100% & Travel Private Limited 100% 100% 49% 25% NokScoot Airlines Co., Ltd Air... -

Page 222

....00 Twenty largest shareholders Name Number of shares %* 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Temasek Holdings (Private) Limited DBS Nominees (Private) Limited Citibank Nominees Singapore Pte Ltd HSBC (Singapore) Nominees Pte Ltd DBSN Services Pte Ltd United Overseas Bank Nominees... -

Page 223

... its subsidiary and associated company have a direct or deemed interest. Shareholdings held by the public Based on the information available to the Company as at 2 June 2016, 44.51% of the issued ordinary shares of the Company are held by the public and, therefore, Rule 723 of the Listing Manual... -

Page 224

... Share Price ($) 2015/16 2014/15 High Low Closing Market Value Ratios R1 12.24 9.57 11.42 12.91 9.57 11.95 Price/Earnings Price/Book value Price/Cash earnings R2 16.55 1.04 5.54 38.06 1.12 7.24 R1 R2 Based on closing price on 31 March and Group numbers. Cash earnings is defined as profit... -

Page 225

...Orchard Road, Singapore 238879 on Friday, 29 July 2016 at 10.00 a.m. to transact the following business: Ordinary Business 1. To receive and adopt the Directors' Statement and Audited Financial Statements for the year ended 31 March 2016 and the Auditors' Report thereon. To declare a final dividend... -

Page 226

... from time to time; (2) the aggregate number of ordinary shares under awards to be granted pursuant to the SIA Performance Share Plan 2014 and the SIA Restricted Share Plan 2014 respectively during the period (the "Relevant Year") commencing from this Annual General Meeting and ending on the date of... -

Page 227

... the next Annual General Meeting of the Company is required by law to be held; and (iii) the date on which purchases and acquisitions of Shares pursuant to the Share Buy Back Mandate are carried out to the full extent mandated; (c) in this Resolution: "Average Closing Price" means the average of the... -

Page 228

... (Pte) Limited are credited with ordinary shares of the Company as at 5.00 p.m. on 4 August 2016 will be entitled to the final dividend. The final dividend, if so approved by shareholders, will be paid on 17 August 2016. By Order of the Board Brenton Wu Company Secretary 30 June 2016 Singapore... -

Page 229

... the SIA Performance Share Plan 2014 and the SIA Restricted Share Plan 2014 respectively. Ordinary Resolution No. 9, if passed, will renew the mandate to allow the Company, its subsidiaries and associated companies that are entities at risk (as that term is used in Chapter 9 of the Listing Manual of... -

Page 230

... a proxy or proxies must be deposited at the office of the Company's Share Registrar, M & C Services Private Limited, 112 Robinson Road #05-01, Singapore 068902 not less than 48 hours before the time fixed for holding the Annual General Meeting. Personal data privacy: By submitting an instrument... -

Page 231

... (until 10 June 2015) Png Kim Chiang President & Chief Executive Officer SIA Engineering Company Limited 17 August 2016 Payment of Final Dividend for the FY2015/16 (subject to shareholders' approval at AGM) Board Compensation and Industrial Relations Committee CHAIRMAN MEMBERS Lau Hwa Peng... -

Page 232

SINGAPORE AIRLINES MCI (P) 100/05/2016 IS20160000549 Singapore Company Registration Number: 197200078R Airline House, 25 Airline Road, Singapore 819829 COMPANY SECRETARY Brenton Wu Tel: +65 6541 5314 Fax: +65 6546 7469 Email: [email protected] INVESTOR RELATIONS Tel: +65 6541 4885 ...