Office Depot 2011 Annual Report Download - page 86

Download and view the complete annual report

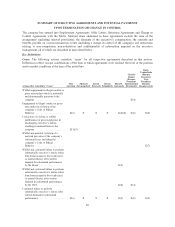

Please find page 86 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interim Agreement and Non-Qualified Stock Option Award Agreement with Mr. Neil Austrian as Interim Chair

and CEO during Fiscal Year 2011

In connection with his appointment as Interim Chair and CEO, the company entered into the Interim Agreement

and a Non-Qualified Stock Option Award Agreement (the “2010 Option Agreement”), each dated November 2,

2010, with Mr. Austrian to reflect the unique nature of the newly created interim position until a permanent chief

executive officer was hired by the company.

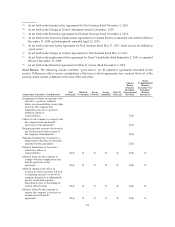

Under the Interim Agreement, Mr. Austrian was eligible to receive a monthly salary of $200,000. Mr. Austrian

was also granted a non-qualified stock option to purchase 400,000 shares of common stock of the company (the

“2010 Options”) under the Non-Qualified Stock Option Award Agreement dated November 2, 2010 (the “2010

Option Agreement”) pursuant to and subject to the terms of the company’s 2007 Long-Term Incentive Plan (the

“2007 LTIP”). The 2010 Options were granted with an exercise price of $4.43, and with such other customary

terms as determined by the Compensation Committee under the 2007 LTIP and as set forth in the 2010 Option

Agreement. The 2010 Options vested with respect to one third (1/3) of the shares on the grant date of

November 2, 2010, and had been scheduled to vest 1/3 on each of the first and second anniversaries of the grant

date (each a “Scheduled Vesting Date”), subject to Mr. Austrian, on each Scheduled Vesting Date, continuing to

serve as, (i) CEO through the date of commencement of employment of a successor CEO of the company

(“Successor CEO Event”), and as (ii) a member of the Board of the Directors of the company, from and after the

employment of such Successor CEO. As discussed below the Agreement modified the terms of the 2010 Options.

Under the Interim Agreement, if Mr. Austrian continued to be employed as interim CEO through the Successor

CEO Event, then as of such date, the 2010 Options would vest (to the extent not previously vested) with respect

to 50% of the shares subject to the 2010 Options, and the then remaining unvested shares covered by the 2010

Options would vest, subject to Mr. Austrian’s continued services as a member of the Board of Directors on the

first anniversary of the Successor CEO Event. In addition, the 2010 Options, unless previously forfeited by

Mr. Austrian pursuant to a Forfeiture Event (defined below), would become 100% vested upon the occurrence of

any of the following events:

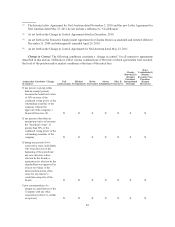

• if prior to the occurrence of a Successor CEO Event, (A) Mr. Austrian’s employment as CEO of the company

terminates for any reason other than because of his resignation or for termination by the company for good

cause or (B) Mr. Austrian has not been re-elected to the Board, despite having offered himself as a candidate

for re-election to the Board;

• following the occurrence of a Successor CEO Event, if Mr. Austrian dies, ceases performing services as a

Director upon becoming Disabled (as defined in the 2010 Option Agreement), or has not been re-elected to the

Board, despite having offered himself as a candidate for re-election to the Board (other than following the

occurrence of a Director Good Cause Event (defined below)); or

• immediately prior to the date of any “Change in Control” of the company (as defined in the 2007 LTIP).

The 2010 Options would expire on November 2, 2017, subject to earlier expiration due to certain termination

events as described in Section 2(b) of the 2010 Option Agreement.

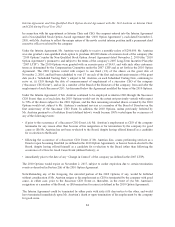

Notwithstanding any of the foregoing, the unvested portion of the 2010 Options, if any, would be forfeited

without consideration if Mr. Austrian resigns or his employment as CEO is terminated by the company with good

cause, in either case, prior to the Successor CEO Event or, thereafter, in the event of (A) Mr. Austrian’s

resignation as a member of the Board, or (B) termination for cause (as defined in the 2010 Option Agreement).

The Interim Agreement could be terminated by either party with sixty (60) days notice to the other, and would

have terminated immediately upon Mr. Austrian’s death or upon termination of his employment by the company

for good cause.

84