Office Depot 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

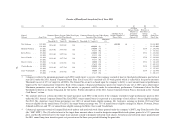

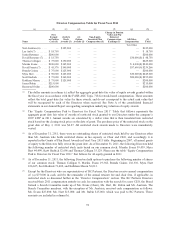

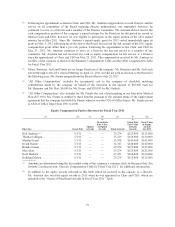

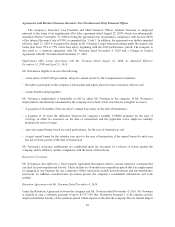

Director Compensation Table for Fiscal Year 2011

(a) (b) (c) (d) (e) (f) (g) (h)

Name

Fees

Earned

or Paid in

Cash ($)

(1)(2)(3)

Stock

Awards ($)

(4)

Option

Awards ($)

Non-Equity

Incentive Plan

Compensation ($)

Change in Pension

Value and NQ

Deferred

Compensation

Earnings ($)

All Other

Compensation

(5)

Total

Total Other

Neil Austrian (6) .... — $125,000 — — — — $125,000

Lee Ault (7) ........ $ 18,750 — — — — — $ 18,750

Justin Bateman ...... $200,000 — — — — — $200,000

David Bernauer (7) . . . $ 18,750 — — — — $30,000 (8) $ 48,750

Thomas Colligan .... $ 75,000 $150,000 — — — — $225,000

Marsha Evans ....... $100,000 $145,000 — — — $ 4,000 (8) $249,000

David Fuente (7) .... $ 41,576 $140,000 — — — $57,690 (9) $239,266

Brenda Gaines ...... $ 75,000 $125,000 — — — — $200,000

Myra Hart .......... $ 90,000 $125,000 — — — $30,000 (8) $245,000

Scott Hedrick ....... $ 75,000 $160,000 — — — $20,000 (8) $255,000

Kathleen Mason ..... $ 75,000 $125,000 — — — — $200,000

James Rubin ........ $215,000 — — — — — $215,000

Raymond Svider ..... $200,000 — — — — — $200,000

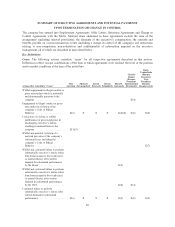

(1) The dollar amounts in column (c) reflect the aggregate grant date fair value of equity awards granted within

the fiscal year in accordance with the FASB ASC Topic 718 for stock-based compensation. These amounts

reflect the total grant date fair value for these awards, and do not correspond to the actual cash value that

will be recognized by each of the Directors when received. See Note A of the consolidated financial

statements in our Annual Report on regarding assumption underlying valuation of equity awards.

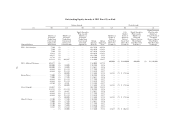

(2) The “Equity Compensation Paid to Directors for Fiscal Year 2011” Table that follows represents the

aggregate grant date fair value of awards of restricted stock granted to our Directors under the company’s

2007 LTIP in 2011. Annual awards are calculated by a dollar value that is then translated into restricted

stock based on the closing stock price on the date of grant. The per share price of the restricted stock on the

grant date of May 3, 2011 was $4.27. All restricted stock awards made to Directors were immediately

vested.

(3) As of December 31, 2011, there were no outstanding shares of restricted stock held by any Directors other

than Mr. Austrian who holds restricted shares in his capacity as Chair and CEO, and accordingly it is

reported in the Grants of Plan Based Awards in Fiscal Year 2011 table. Beginning in 2007, all annual grants

of equity to the Directors fully vest at the grant date. As of December 31, 2011, the following Directors held

the following number of restricted stock units based on our common stock: Marsha Evans 59,439, Myra

Hart 44,499, Scott Hedrick 52,696 and Thomas Colligan 35,129. Please see the table “Equity Compensation

Paid to Directors for Fiscal Year 2011” that follows for all equity granted in 2011.

(4) As of December 31, 2011, the following Directors held options to purchase the following number of shares

of our common stock: Thomas Colligan 0, Marsha Evans 19,368, Brenda Gaines 116,310, Myra Hart

106,625, Scott Hedrick 71,402, and Kathleen Mason 56,013.

(5) Except for the Directors who are representatives of BC Partners, the Directors receive annual compensation

of: (a) $75,000 in cash, and (b) the remainder of the annual retainer fee and chair fees, if applicable, in

restricted stock as discussed further in the “Director Compensation” section. The BC Partners Directors

received their 2011 compensation entirely in cash. In connection with the search for a new CEO, the Board

formed a Search Committee made up of Ms. Evans (Chair), Ms. Hart, Mr. Rubin and Mr. Austrian. The

Search Committee members, with the exception of Mr. Austrian, received cash compensation as follows:

Ms. Evans $25,000; Ms. Hart $15,000; and Mr. Rubin $15,000, which was paid to BC Partners. These

amounts are included in column (b).

78