Office Depot 2011 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

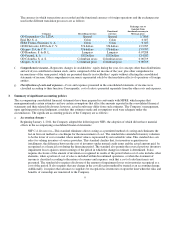

Office Depot de México, S. A. de C. V. and Subsidiaries

(A 50% Owned Subsidiary of Grupo Gigante, S. A. B. de C. V.

and a 50% Owned Affiliate of Office Depot Delaware Overseas Finance 1, LLC)

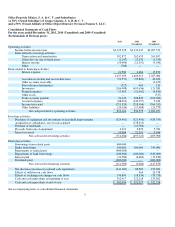

Notes to Consolidated Financial Statements

As of December 31, 2011 and 2010 (Unaudited) and for the years ended December 31, 2011, 2010 (Unaudited) and 2009

(Unaudited)

(In thousands of Mexican pesos, unless stated otherwise)

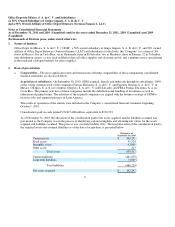

Office Depot de México, S. A. de C. V. (“ODM”, a 50% owned subsidiary of Grupo Gigante, S. A. B. de C. V. and 50% owned

affiliate of Office Depot Delaware Overseas Finance 1, LLC) and subsidiaries (collectively, the “Company”) is a chain of 201

stores in Mexico, five in Costa Rica, six in Guatemala, three in El Salvador, two in Honduras, three in Panama, 12 in Colombia,

nine distribution centers, a cross dock in Mexico that sell office supplies and electronic goods, and a printing service specializing

in the retail and catalogue business for office supplies.

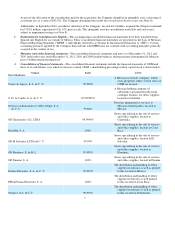

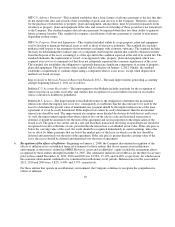

Acquisition of subsidiaries: On September 30, 2010, ODM acquired, directly and indirectly through its subsidiaries, 100%

of the voting common stock of the companies Formas Eficientes, S. A. de C. V. and Papelera General, S. A. de C. V. in

Mexico, Ofixpres, S. A. S. in Colombia, Ofixpres, S. A. de C. V. in El Salvador; and FESA Formas Eficientes, S. A. in

Costa Rica. The primary activities of these companies include the distribution and handling of inventories as well as

fabrication of printed forms. The activities of the acquired companies are aligned with the business strategy of ODM to

increase sales and augment presence in Latin America

The results of operations of the entities were included in the Company’s consolidated financial statements beginning

October 1, 2010.

Consideration paid, in cash, totaled U.S.$15,408 million, equivalent to $192,293.

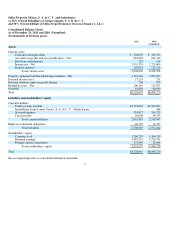

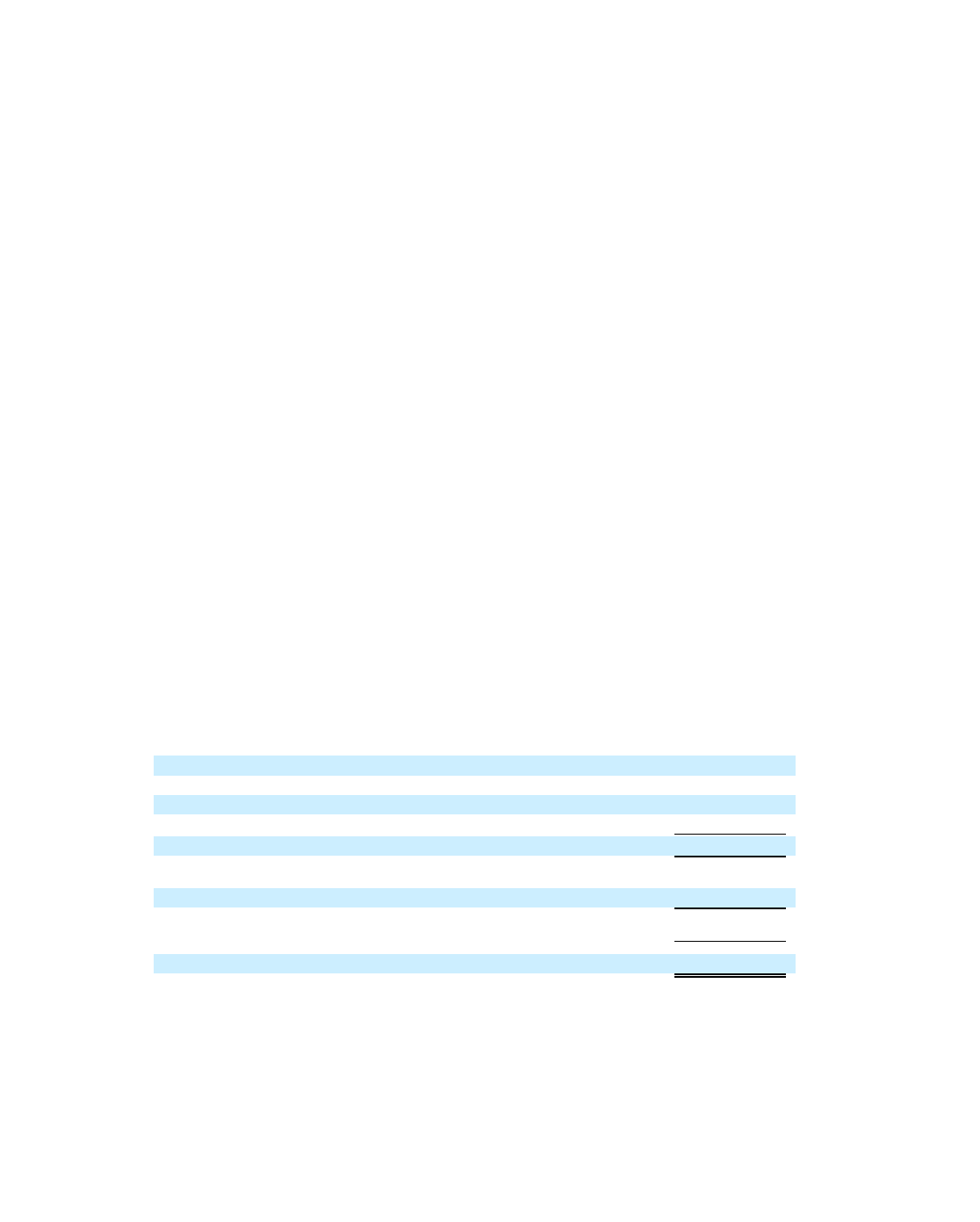

As of December 31, 2010, the allocation of the consideration paid to the assets acquired and the liabilities assumed was

provisional as the Company was in the process of identifying certain intangibles and obtaining fair values for the assets

acquired and liabilities assumed. This process was concluded in May 2011. The final allocation of the consideration paid to

the acquired assets and assumed liabilities as of the date of acquisition, is presented below.

6

1. Nature of business

2. Basis of presentation

a. Comparability

—

The most significant events and transactions affecting comparability of the accompanying consolidated

financial statements are discussed below:

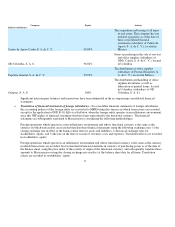

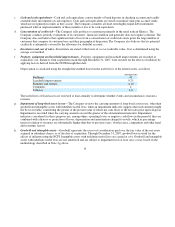

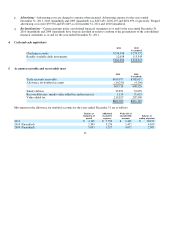

Balance as of

Se

p

tember 30, 2010

Current assets

$509,271

Fixed assets

55,224

Intan

g

ible assets

93,805

Other assets

217

Total assets

658,517

Current liabilities

(461,679)

Lon

g

-term liabilities

(4,545)

Total liabilities

(466,224)

Net assets ac

q

uired

$192,293