Office Depot 2011 Annual Report Download - page 137

Download and view the complete annual report

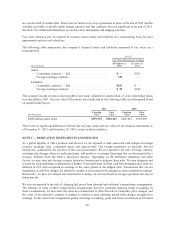

Please find page 137 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On June 17, 2011, a derivative lawsuit was filed against certain current and former executive officers and the

company, generally alleging that the officers breached their fiduciary duties. The allegations in this lawsuit

primarily relate to the company’s previous financial disclosures and reports regarding the certain tax losses

described below. The derivative lawsuit was filed in the United States District Court for the Southern District of

Florida captioned as Long v. Steve Odland, Michael D. Newman and Neil R. Austrian, defendants, and Office

Depot, Inc., nominal defendant. The Special Litigation Committee (“SLC”), which was appointed by the

company’s Board of Directors to review the allegations, issued its report on January 9, 2012. As set forth in the

report, the SLC determined that the claims alleged in the Complaint should be dismissed. Accordingly, the

company intends to file a motion to dismiss the Complaint at the appropriate time.

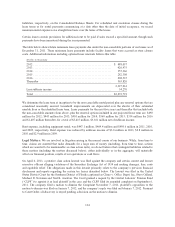

The allegations made in the above lawsuits primarily relate to the company’s previous financial disclosures and

reports regarding certain tax losses. On March 31, 2011, Office Depot announced that the Internal Revenue

Service had denied the company’s claim to carry back certain tax losses to prior tax years under economic

stimulus-based tax legislation enacted in 2009. As a result, on April 6, 2011, the company restated its financial

results to revise the accounting treatment regarding its original tax position. The periods covered by the

restatement were the fiscal year ended December 25, 2010 and each of the quarters ended June 26, 2010 and

September 25, 2010.

In addition, in the ordinary course of business, our sales to and transactions with government customers may be

subject to investigations, audits and review by governmental authorities and regulatory agencies, with which we

cooperate. Many of these investigations, audits and reviews are resolved without incident. While claims in these

matters may at times assert large demands, we do not believe that contingent liabilities related to these matters,

either individually or in the aggregate, will materially affect our financial position, results of our operations or

cash flows. Among such matters, during the first quarter of 2011, we were notified that the United States

Department of Justice (“DOJ”) commenced an investigation into certain pricing practices related to an expired

agreement that was in place between January 2, 2006 and January 1, 2011, pursuant to which state, local and

non-profit agencies could purchase office supplies. We are cooperating with the DOJ on this investigation.

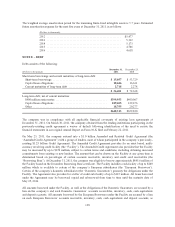

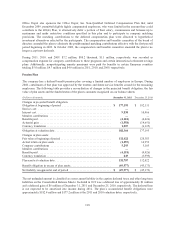

Other: — The company has received a proposed tax and penalty assessment from the U.S. Internal Revenue

Service totaling approximately $126 million. The company disagrees with this assessment. See Note F.

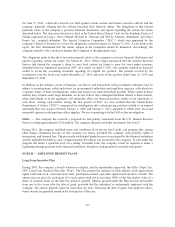

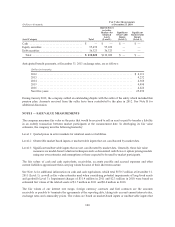

During 2011, the company modified terms and conditions of its private label credit card program that, among

other things, eliminated recourse to the company for losses, provided the company with portfolio rights at

termination, and lowered fees. The previously-established funded reserve was retained by the financial institution

and the unfunded bad debt accrual of approximately $8 million was reversed by the company. If sales under the

program fall under a specified level on a rolling 12-month basis, the company would be required to make a

liquidating damage payment to the financial institution, though no such payment is currently anticipated.

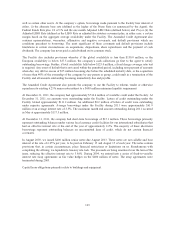

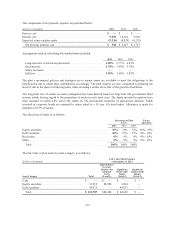

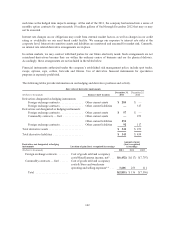

NOTE H — EMPLOYEE BENEFIT PLANS

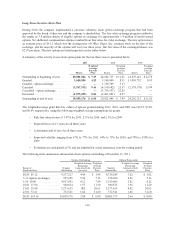

Long-Term Incentive Plan

During 2007, the company’s board of directors adopted, and the shareholders approved, the Office Depot, Inc.

2007 Long-Term Incentive Plan (the “Plan”). The Plan permits the issuance of stock options, stock appreciation

rights, restricted stock, restricted stock units, performance-based, and other equity-based incentive awards. The

option exercise price for each grant of a stock option shall not be less than 100% of the fair market value of a

share of common stock on the date the option is granted. Options granted under the Plan become exercisable

from one to five years after the date of grant, provided that the individual is continuously employed with the

company. All options granted expire no more than ten years following the date of grant. Our employee share-

based awards are generally issued in the first quarter of the year.

135