Office Depot 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

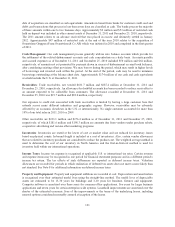

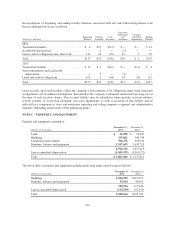

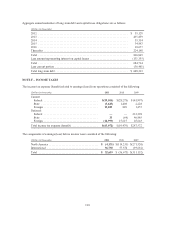

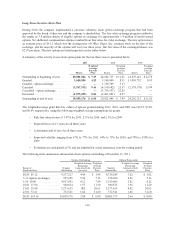

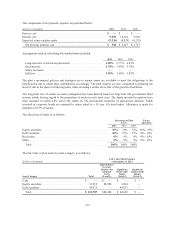

The components of deferred income tax assets and liabilities consisted of the following:

(Dollars in thousands)

December 31,

2011

December 25,

2010

U.S. and foreign net operating loss carryforwards .................. $ 379,610 $ 344,878

Deferred rent credit .......................................... 101,679 107,673

Vacation pay and other accrued compensation ..................... 78,797 71,496

Accruals for facility closings .................................. 32,800 41,896

Inventory .................................................. 13,562 17,165

Self-insurance accruals ....................................... 20,640 20,622

Deferred revenue ............................................ 5,893 10,764

State credit carryforwards, net of Federal benefit ................... 13,643 12,739

Allowance for bad debts ...................................... 2,911 9,005

Accrued rebates ............................................. 7,978 14,591

Other items, net ............................................. 46,713 65,768

Gross deferred tax assets .................................... 704,226 716,597

Valuation allowance ......................................... (621,719) (648,869)

Deferred tax assets ........................................ 82,507 67,728

Internal software ............................................ 4,216 1,003

Basis difference in fixed assets ................................. 32,055 53,391

Deferred Subpart F income .................................... 10,791 —

Deferred tax liabilities ...................................... 47,062 54,394

Net deferred tax assets ....................................... $ 35,445 $ 13,334

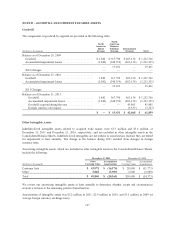

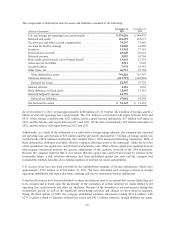

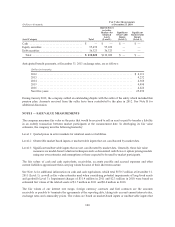

As of December 31, 2011, we had approximately $280 million of U.S. Federal, $822 million of foreign, and $1.2

billion of state net operating loss carryforwards. The U.S. Federal carryforward will expire between 2030 and

2031. Of the foreign carryforwards, $623 million can be carried forward indefinitely, $17 million will expire in

2012, and the balance will expire between 2013 and 2031. Of the state carryforwards, $29 million will expire in

2012, and the balance will expire between 2013 and 2031.

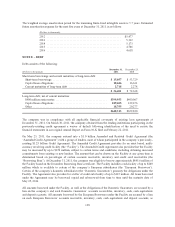

Additionally, as a result of the settlement of an audit with a foreign taxing authority, the company has conceded

net operating loss carryfowards of $56 million and the previously disclosed $1.73 billion of foreign capital loss

carryforwards ($454 million tax-effected) that resulted from a 2010 internal restructuring transaction. Both of

these deferred tax attributes were fully offset by valuation allowance prior to the settlement. Under the tax laws

of the jurisdiction, the capital loss carryforward was limited to only offset a future capital gain resulting from an

intercompany transaction between the specific subsidiaries of the company involved in the 2010 transaction.

Because the company believed that it was remote that the capital loss carryforward would be realized in the

foreseeable future, a full valuation allowance had been established against the asset and the company had

excluded the attribute from the above tabular rendition of deferred tax assets and liabilities.

U.S. income taxes have not been provided on the undistributed earnings of foreign subsidiaries, which were

approximately $793 million as of December 31, 2011. We have reinvested such earnings overseas in foreign

operations indefinitely and expect that future earnings will also be reinvested overseas indefinitely.

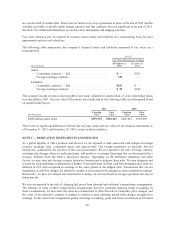

Valuation allowances have been established to reduce our deferred asset to an amount that is more likely than not

to be realized and is based upon the uncertainty of the realization of certain deferred tax assets related to net

operating loss carryforwards and other tax attributes. Because of the downturn in our performance during this

recessionary period, as well as the significant restructuring activities and charges we have taken in response,

during the third quarter of 2009, the company established valuation allowances totaling $321.6 million, with

$279.1 million related to domestic deferred tax assets and $42.5 million related to foreign deferred tax assets.

131