Office Depot 2011 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NIF C-5, Advance Payments

—

This standard establishes that a basic feature of advance payments is the fact that they

do not transfer the risks and rewards of the ownership of goods and services to the Company. Therefore, advances

for the purchase of inventories or property, plant and equipment, among others, must be presented separately from

inventory or property, plant and equipment if the risks and rewards of ownership of those goods have not transferred

to the Company. The standard requires that advance payments be impaired when they lose their ability to generate

future economic benefits. This standard also requires classification of advance payments as current or noncurrent,

depending on their nature.

NIF C-6, Property, Plant and Equipment—This standard included within its scope property, plant and equipment

used to develop or maintain biological assets as well as those of extractive industries. The standard also includes

guidance with respect to the treatment of non-monetary exchanges with economic substance. The standard includes

the basis for determining the residual value of a component, that being the amount that could be obtained currently

from the disposal of the asset, assuming it is of the age and in the condition expected at the end of its useful life. The

standard eliminates the requirement to record, at an appraised value, property, plant and equipment which was

acquired at no cost or at a minimal cost that does not adequately represent the economic significance of the asset.

The standard also establishes the obligation to separately depreciate significant components of an item of property,

plant and equipment. This provision of the standard will be effective on January 1, 2012. Finally, the standard

establishes a requirement to continue depreciating a component when it is not in use, except when depreciation

methods are based on usage.

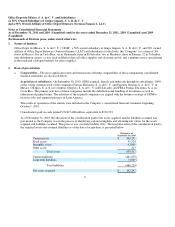

Improvements to Mexican Financial Reporting Standards 2011—The main improvements generating accounting

changes beginning January 1, 2011 are as follows:

Bulletin C-3, Accounts Receivable—The improvement to this Bulletin includes standards for the recognition of

interest income on accounts receivable, and clarifies that recognition of accrued interest income on receivables

whose collection is doubtful is prohibited.

Bulletin D-5, Leases—The improvement to this Bulletin removes the obligation to determine the incremental

interest rate when the implicit rate is too low; consequently, it establishes that the discount rate to be used by the

lessor to determine the present value of minimum lease payment should be the implicit interest rate of the lease

agreement, if it can be easily determined. If the implicit rate cannot be easily determined, then the incremental

interest rate should be used. The improvement also requires more detailed disclosures by both lessors and lessees.

As well, the improvement requires that when a gain or loss on the sale in a sale and leaseback transaction is

deferred, it should be amortized over the term of the agreement and not in proportion to the depreciation of the

leased asset. The gain or loss on the sale in a sale and leaseback transaction involving an operating lease should be

recognized in results at the time of sale, provided that the transaction is established at fair value. If the sale price is

below the carrying value of the asset, the result should be recognized immediately in current earnings, unless the

loss is offset by future payments that are below the market price of the lease, in which case the loss should be

deferred and amortized over the term of the agreement. If the sale price is greater than the carrying value of the

asset, the excess should be deferred and amortized over the term of agreement.

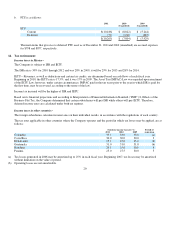

For those entities that operate in an inflationary environment, the Company continues to recognize the comprehensive

effects of inflation.

10

b.

R

ecognition of the effects of inflation

—

Beginning on January 1, 2008, the Company discontinued recognition of the

effects of inflation in its consolidated financial statements for those entities that do not operate in an inflationary

environment, as that term is defined in MFRS. However, assets and stockholders’ equity include the restatement effects

recognized by those entities through December 31, 2007. The cumulative inflation rate in Mexico for the three fiscal years

prior to those ended December 31, 2011, 2010 and 2009 was 12.26%, 15.19% and 14.48%, respectively, for which reason

the economic environment continued to be considered non-inflationary in all periods. Inflation rates for the years ended

2011, 2010 and 2009 were 3.82%, 4.40% and 3.57%, res

p

ectivel

y

.