Office Depot 2011 Annual Report Download - page 131

Download and view the complete annual report

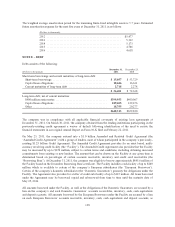

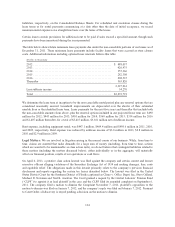

Please find page 131 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.well as certain other assets. At the company’s option, borrowings made pursuant to the Facility bear interest at

either, (i) the alternate base rate (defined as the higher of the Prime Rate (as announced by the Agent), the

Federal Funds Rate plus 1/2 of 1% and the one month Adjusted LIBO Rate (defined below) and 1%) or (ii) the

Adjusted LIBO Rate (defined as the LIBO Rate as adjusted for statutory revenues) plus, in either case, a certain

margin based on the aggregate average availability under the Facility. The Amended Credit Agreement also

contains representations, warranties, affirmative and negative covenants, and default provisions which are

conditions precedent to borrowing. The most significant of these covenants and default provisions include

limitations in certain circumstances on acquisitions, dispositions, share repurchases and the payment of cash

dividends. The company has never paid a cash dividend on its common stock.

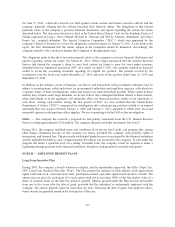

The Facility also includes provisions whereby if the global availability is less than $150.0 million, or the

European availability is below $37.5 million, the company’s cash collections go first to the agent to satisfy

outstanding borrowings. Further, if total availability falls below $125.0 million, a fixed charge coverage ratio test

is required. Any event of default that is not cured within the permitted period, including non-payment of amounts

when due, any debt in excess of $25 million becoming due before the scheduled maturity date, or the acquisition

of more than 40% of the ownership of the company by any person or group, could result in a termination of the

Facility and all amounts outstanding becoming immediately due and payable.

The Amended Credit Agreement also permits the company to use the Facility to redeem, tender or otherwise

repurchase its existing 6.25% senior notes subject to a $600 million minimum liquidity requirement.

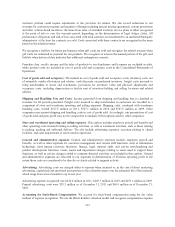

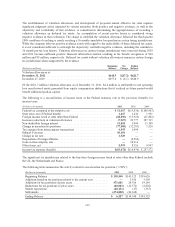

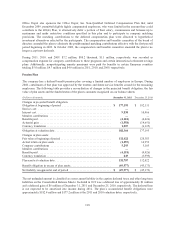

At December 31, 2011, the company had approximately $734.4 million of available credit under the Facility. At

December 31, 2011, no amounts were outstanding under the Facility. Letters of credit outstanding under the

Facility totaled approximately $111.2 million. An additional $0.2 million of letters of credit were outstanding

under separate agreements. Average borrowings under the Facility during 2011 were approximately $61.9

million at an average interest rate of 3.5%. The maximum month end amount outstanding during 2011 occurred

in May at approximately $117.5 million.

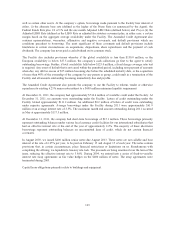

At December 31, 2011, the company had short-term borrowings of $15.1 million. These borrowings primarily

represent outstanding balances under various local currency credit facilities for our international subsidiaries that

had an effective interest rate at the end of the year of approximately 2.2%. The majority of these short-term

borrowings represent outstanding balances on uncommitted lines of credit, which do not contain financial

covenants.

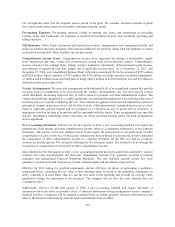

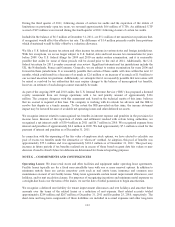

In August 2003, we issued $400 million senior notes due August 2013. These notes are not callable and bear

interest at the rate of 6.25% per year, to be paid on February 15 and August 15 of each year. The notes contain

provisions that, in certain circumstances, place financial restrictions or limitations on us. Simultaneous with

completing the offering, we liquidated a treasury rate lock. The proceeds are being amortized over the term of the

issue, reducing the effective interest rate to 5.86%. During 2004, we entered into a series of fixed-to-variable

interest rate swap agreements as fair value hedges on the $400 million of notes. The swap agreements were

terminated during 2005.

Capital lease obligations primarily relate to buildings and equipment.

129