Office Depot 2011 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

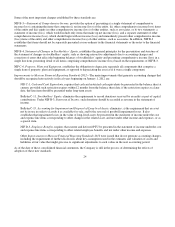

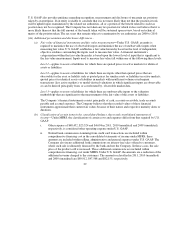

Some of the most important changes established by these standards are:

NIF B-3—Statement of Comprehensive Income, provides the option of presenting a) a single statement of comprehensive

income (loss) containing the items that comprise (i) net income (loss) of the entity, (ii) other comprehensive income (loss) items

of the entity and (iii) equity in other comprehensive income (loss) of other entities, such as associates, or b) two statements: a

statement of income (loss), which would include only items that make up net income (loss), and a separate statement of other

comprehensive income (loss), which should begin with net income (loss) and immediately present other comprehensive income

(loss) items of the entity and other comprehensive income (loss) of other entities, such as associates. In addition, NIF B-3

establishes that items should not be separately presented as non-ordinary in the financial statements or the notes to the financial

statements.

NIF B-4, Statement of Changes in Stockholders’ Equity, establishes the general principles for the presentation and structure of

the statement of changes in stockholders’ equity, such as showing retroactive adjustments due to accounting changes and

correction of errors that affect the beginning balances of stockholders’ equity and presenting comprehensive income (loss) in a

single line item, presenting detail of all items comprising comprehensive income (loss) based on the requirements of NIF B-3.

NIF C-6, Property, Plant and Equipment, establishes the obligation to depreciate separately all components that comprise a

single item of property, plant and equipment, as opposed to depreciating the asset as if it were a single component.

Improvements to Mexican Financial Reporting Standards 2012—The main improvements that generate accounting changes that

should be recognized retroactively in fiscal years beginning on January 1, 2012 are:

NIF C-1, Cash and Cash Equivalents, requires that cash and restricted cash equivalents be presented in the balance sheet at

current, provided such restriction expires within 12 months from the balance sheet date; if the restriction expires at a later

date, this line item should be presented under long-term assets.

Bulletin C-11, Stockholders’ Equity, eliminates the requirement to record donations received by an entity as part of capital

contributions. Under NIF B-3, Statement of Income, such donations should be recorded as revenue in the statement of

income.

Bulletin C-15, Accounting for Impairment and Disposal of Long-lived Assets, eliminates: a) the requirement that an asset

not be in use in order to classify it as available-for-sale, and b) the reversal of goodwill impairment losses. It also

establishes that impairment losses in the value of long-lived assets be presented in the statement of income under the cost

and expense line items corresponding to other changes in the related asset, and not under other income and expenses, or as

a special item.

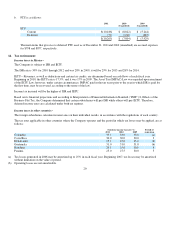

NIF D-3, Employee Benefits, requires that current and deferred PTU be presented in the statement of income under the cost

and expense line items corresponding to other related employee benefits and not under other income and expenses.

Other Improvements to Mexican Financial Reporting Standards 2012 were issued that do not generate accounting changes,

including the requirement of further disclosures about key assumptions used in the estimates and valuation of assets and

liabilities at fair value that might give rise to significant adjustments to such values in the next accounting period.

As of the date of these consolidated financial statements, the Company is still in the process of determining the effects of

adoption of these new standards.

24