Office Depot 2011 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2011 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

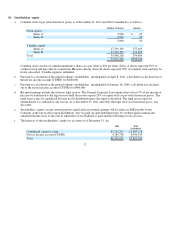

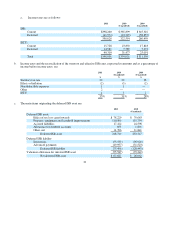

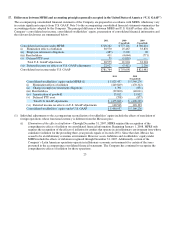

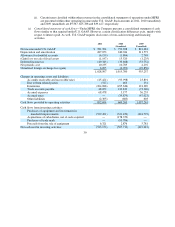

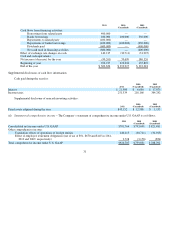

The amount in accumulated other comprehensive income expected to be recognized as component of net periodic

benefit cost over the following fiscal year is $519.

Weighted-average assumptions used to determine benefit obligations and net periodic benefit cost as of and for the

year ended December 31, 2011 and 2010:

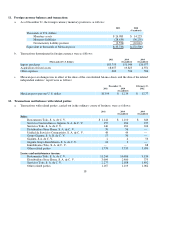

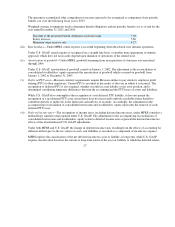

Under U.S. GAAP, rental expense is recognized on a straight-line basis, or another more appropriate systematic

approach, which does not necessarily depend upon initiation of operations of the related store.

Under U.S. GAAP, amortization of goodwill ceased on January 1, 2002. The adjustment to the reconciliation of

consolidated stockholders’ equity represents the amortization of goodwill which occurred on goodwill from

January 1, 2002 to December 31, 2005.

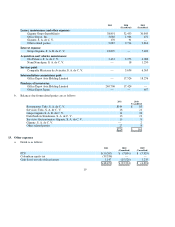

While U.S. GAAP also contemplates the recognition of a net deferred PTU liability, it does not permit the

recognition of a net deferred PTU asset, given that it does not necessarily embody a probable future benefit to

contribute directly or indirectly to the future net cash inflows of an entity. Accordingly, the adjustment in the

accompanying reconciliation of consolidated net income and stockholders’ equity represents the removal of such

deferred PTU asset.

Under both MFRS and U.S. GAAP, the change in deferred income taxes resulting from the effects of accounting for

inflation with respect to the tax values of assets and liabilities is recorded as a component of income tax expense.

MFRS requires the classification of the net deferred income tax asset or liability as long-term, while U.S. GAAP

requires classification based on the current or long-term nature of the asset or liability to which the deferred relates.

27

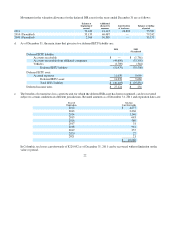

Discount of the

p

ro

j

ected benefit obli

g

ation at

p

resent value

7.98

Salar

y

increase

5.86

Minimum wa

g

e increase rate

4.27

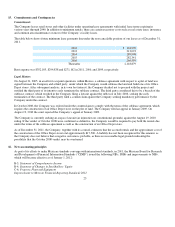

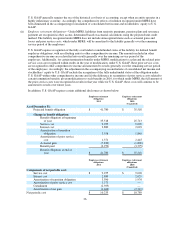

(iii)

R

ent holidays

—

Under MFRS, rental ex

p

ense is recorded be

g

innin

g

when the related store initiates o

p

erations.

(iv)

A

mortization of goodwill—Under MFRS, goodwill stemming from an acquisition of a business was amortized

throu

g

h 2004.

(v)

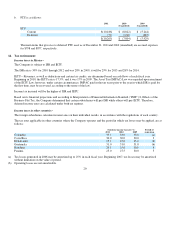

D

eferred PTU asset

—

Mexican statutory requirements require Mexican entities to pay statutory employee profit

sharing (PTU) to their employees. Current PTU is recorded in the results of the year in which it is incurred. The

recognition of deferred PTU is also required, whether it results in a net liability or net asset position, and is

determined considerin

g

tem

p

orar

y

differences between the accountin

g

and the PTU bases of assets and liabilities.

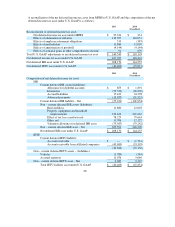

(vi)

D

eferred income taxes

—

The recognition of income taxes, including deferred income taxes, under MFRS considers a

methodology similar to that required under U.S. GAAP. The adjustments to the accompanying reconciliations of

consolidated net income and stockholders’ equity relate to deferred income taxes represent the deferred income tax

effects of the aforementioned U.S. GAAP ad

j

ustments.